In this study guide about Integrated Card Swipe functionality, you will learn to enter payments and deposits using a card reader, run the Fee Audit and Food Service Deposit reports, and use the Payments Reporter to view transactions that were processed using Campus Payments.

Enter Fee Payments (Detailed Version)

Credit/debit card payments can be recorded for a student, person or an entire household.

Student Fees

A credit/debit card payment can be applied to one or multiple fees on the student's Fees tool. This topic shows how to make a payment using a card reader and by entering the payment manually.

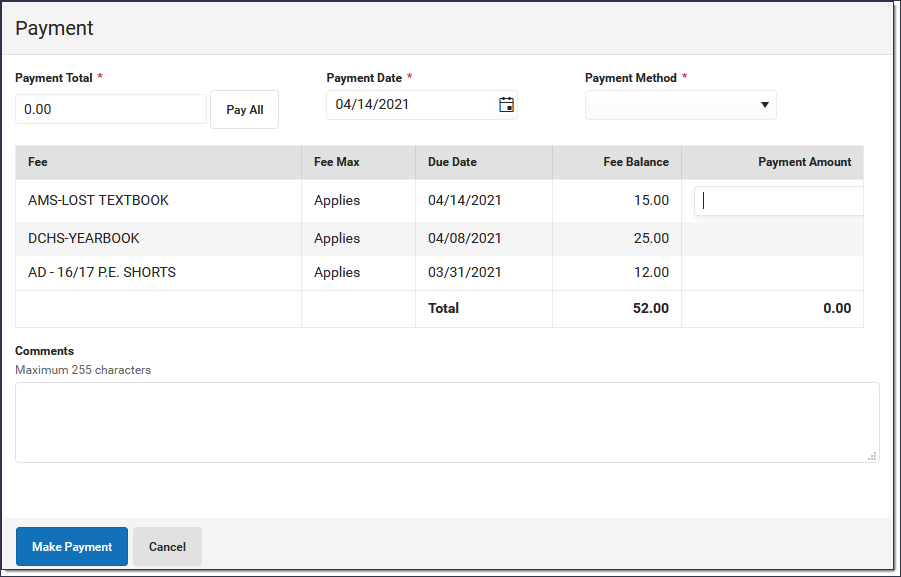

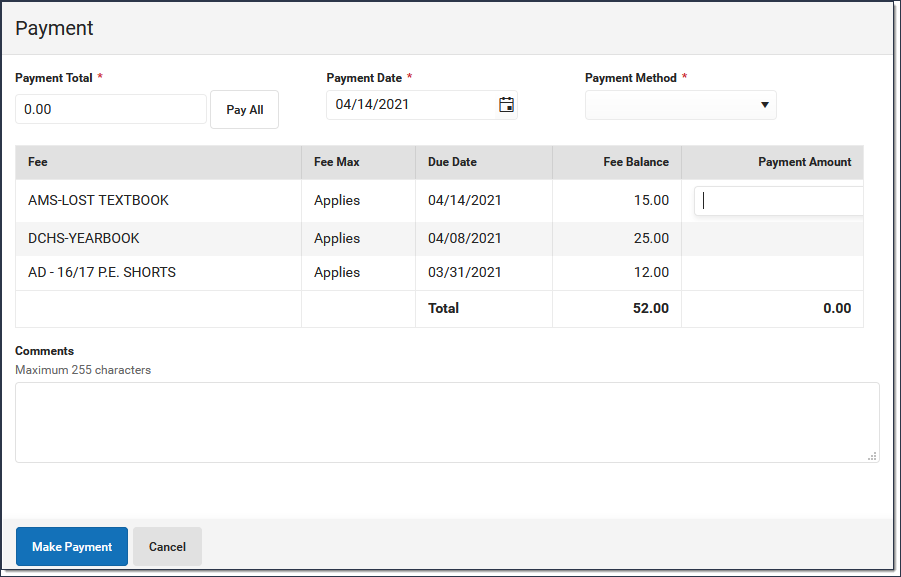

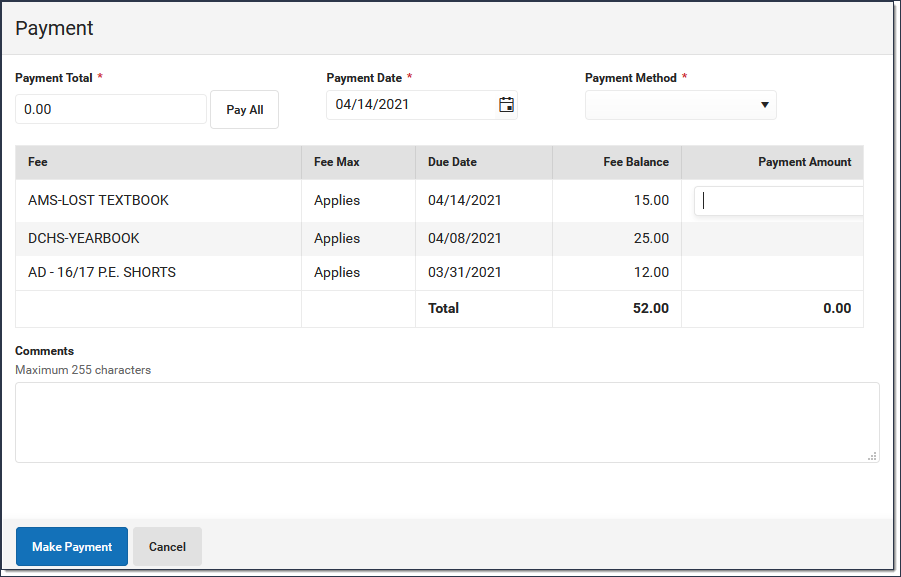

Fees can be paid one at a time or you can pay multiple fees with a single payment.

Example of Paying Multiple Fees with One Payment

Example of Paying Multiple Fees with One Payment

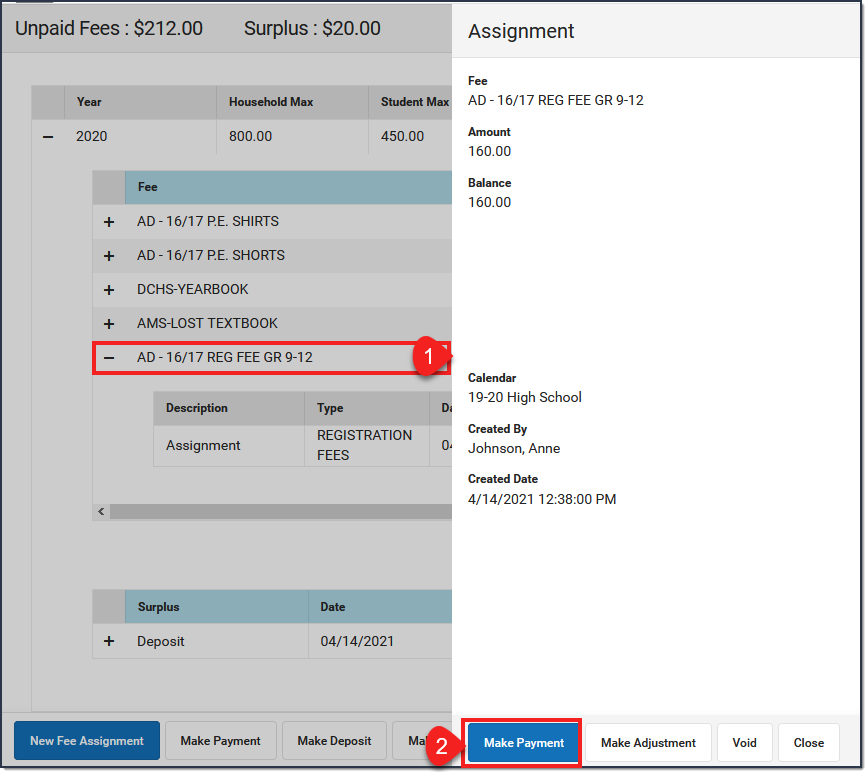

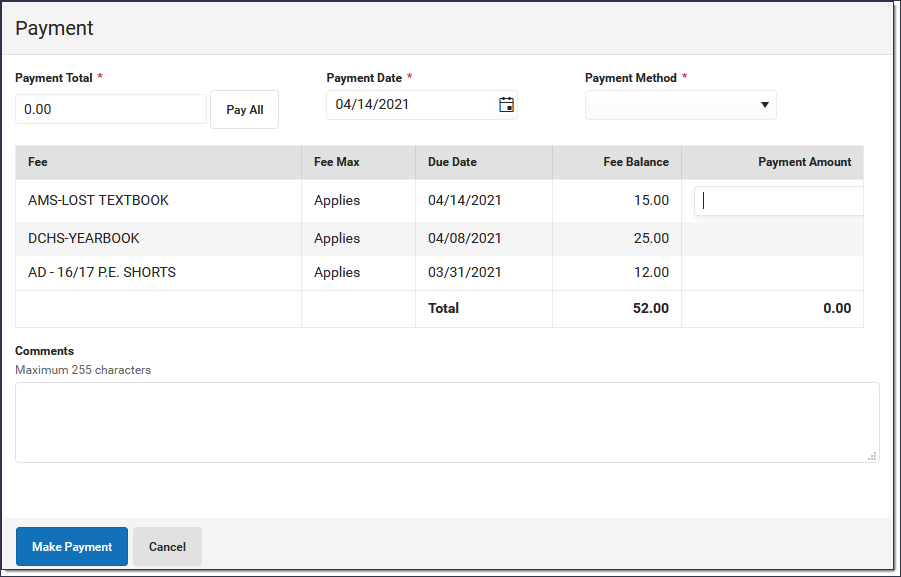

Make a Payment

- Click the Make Payment button at the bottom of the screen.

Result: The Payment panel displays all fees from all years for which a payment is needed.

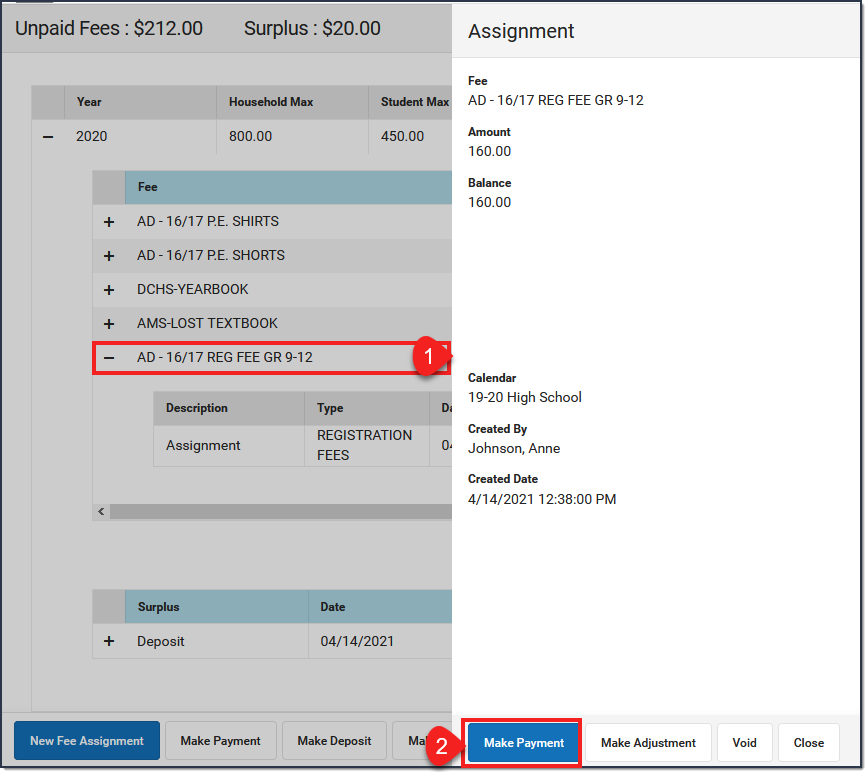

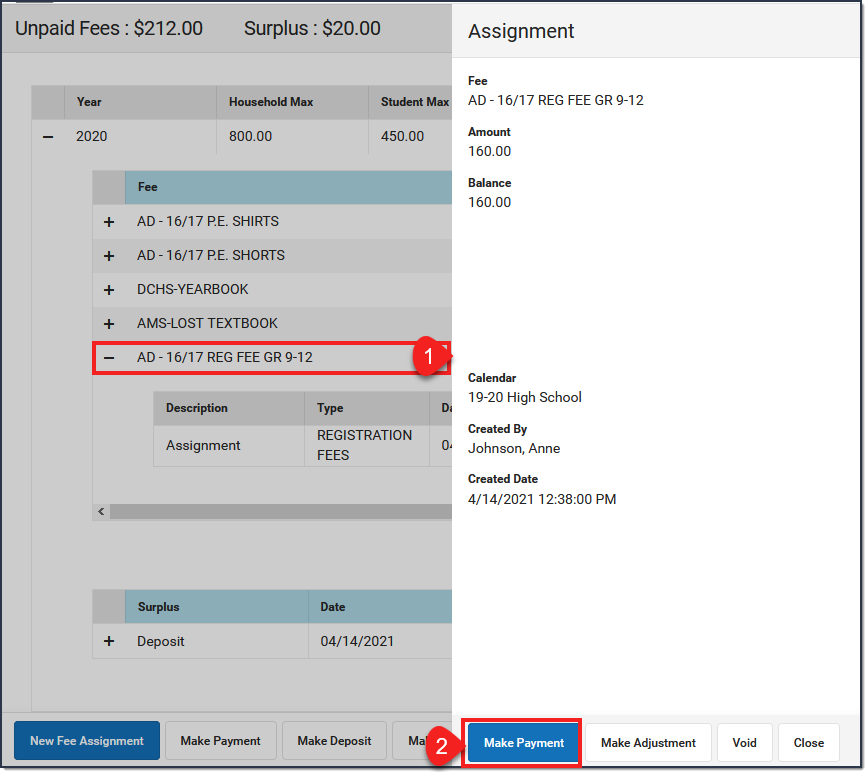

You can also access the Payment panel by clicking an individual fee then clicking the Make Payment button on the Assignment panel.

You can also access the Payment panel by clicking an individual fee then clicking the Make Payment button on the Assignment panel.

- Enter a Payment Date in mmddyyyy format.

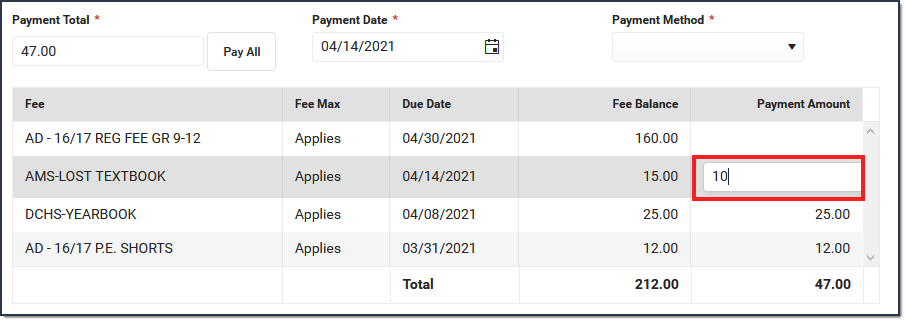

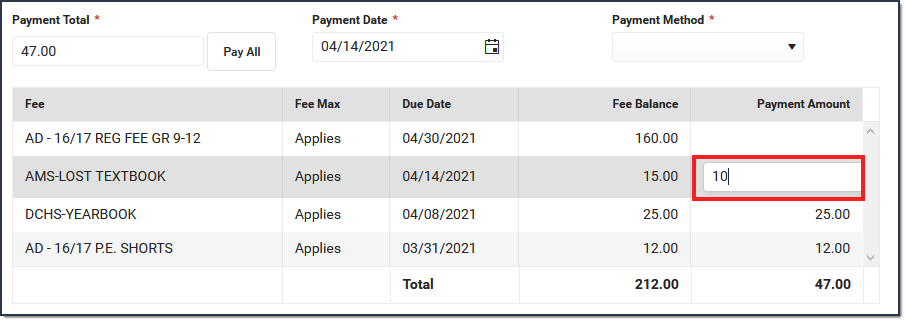

- Enter the amount of the payment using one of the following options.

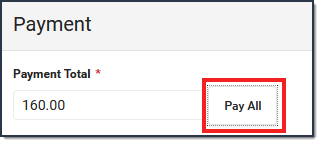

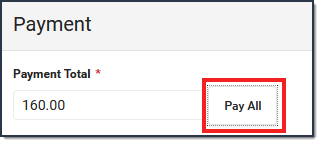

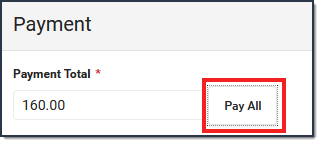

Option Description Pay All Click Pay All to populate this field with the total amount remaining to be paid.

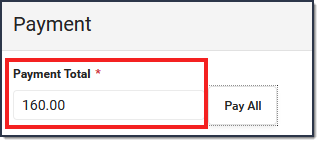

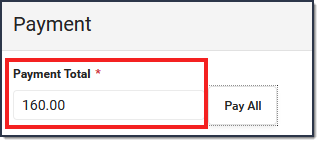

Payment Total The Payment Total field at the top of the panel allows you to enter the amount to be paid. If the total amount exceeds the Fee Assignment amount, the remaining amount is deposited as a surplus.

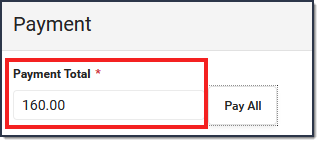

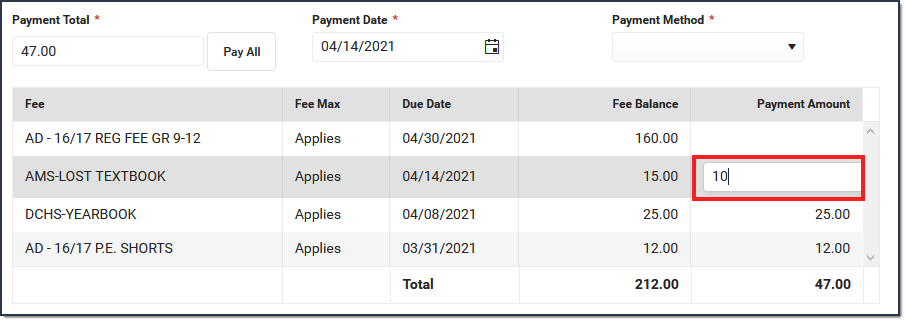

Payment Amount The Payment Amount column allows you allows you to manually enter a unique value for each line. Campus automatically updates the Payment Total to match the values you enter.

Enter any Comments associated with the payment.

Select one of the following Payment Methods and complete the payment.

Payment Method Description Cash Click the Make Payment button.

Result

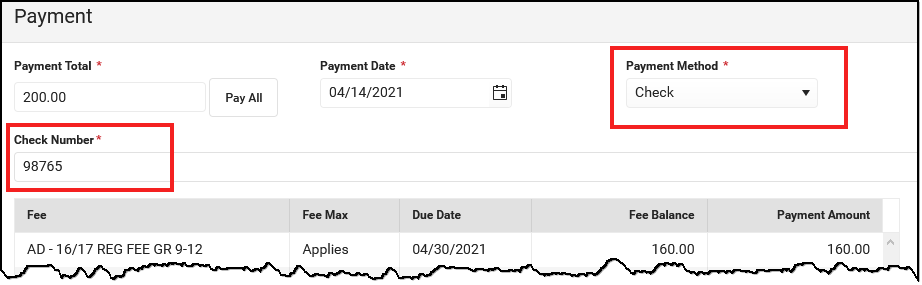

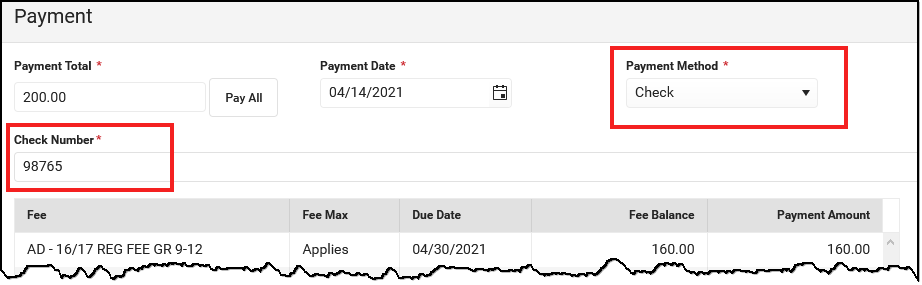

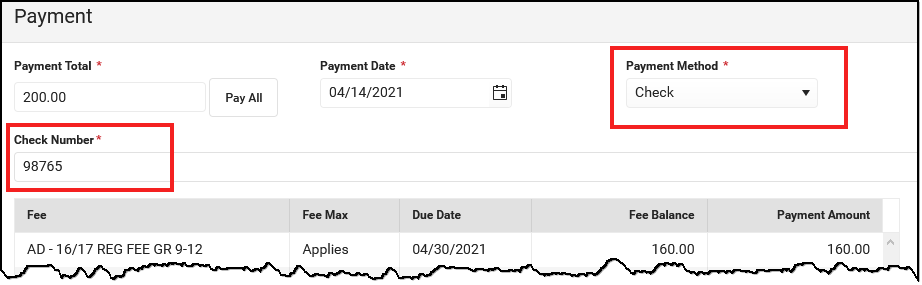

If more than the amount of the fee selected is paid, the extra amount becomes a Surplus. Campus saves the surplus amount and it can be applied to other fees.Check The Check # field displays when you select this option. Enter the Check # then click the Make Payment button.

Result

The payment displays below the fee(s) with the type and date of the payment, the amount paid in the Credit column.If more than the amount of the fee selected is paid, the extra amount becomes a Surplus. Campus saves the surplus amount and it can be applied to other fees.

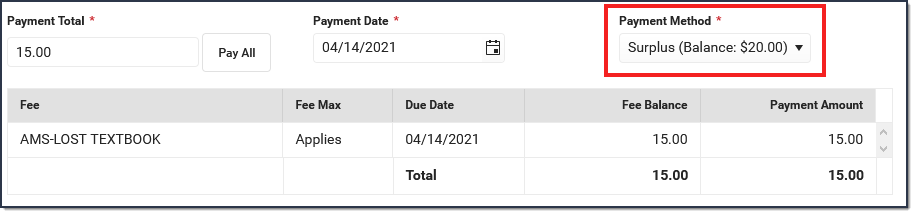

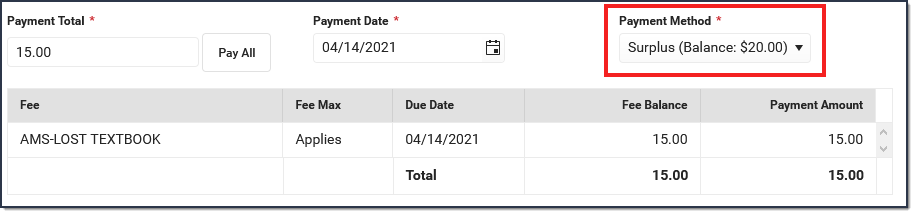

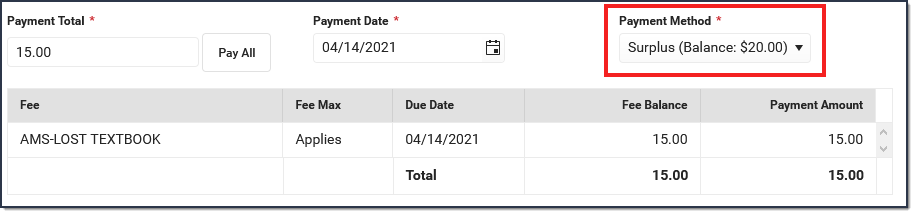

Surplus (Balance: $XX.XX) This option only displays if a surplus is available on the account.

Click the Make Payment button.

Result

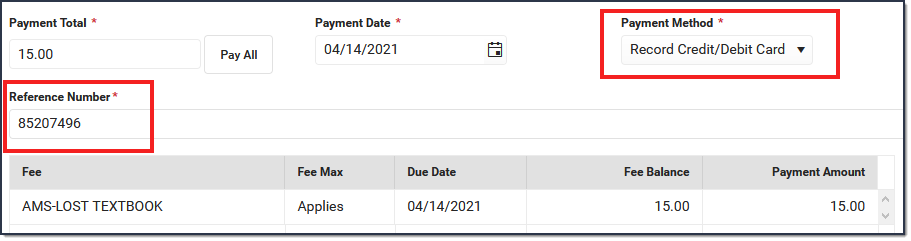

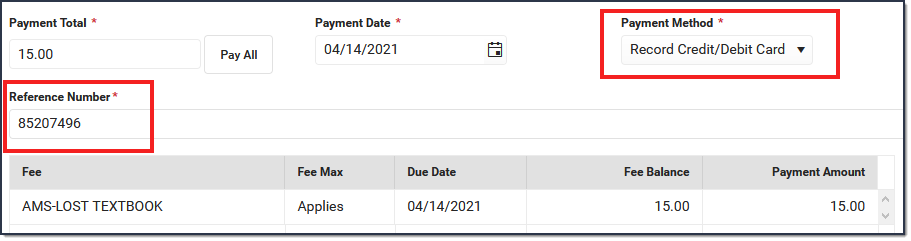

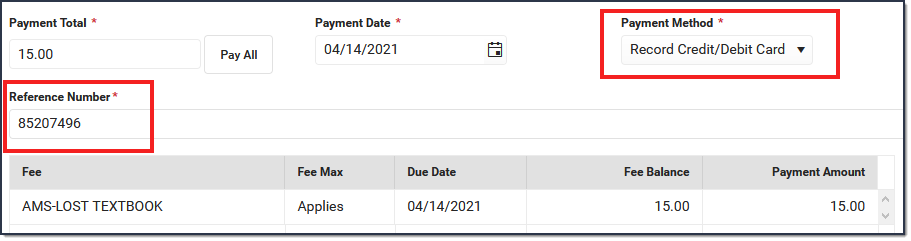

The Surplus Balance is reduced by the amount used to pay the fee. The payment displays below the fee(s) with the type and date of the payment, the amount paid in the Credit column.Record Credit/Debit Card If your district does NOT use Online Payments or a Desktop Card Reader, enter the Reference Number then click the Make Payment button.

Result

The payment displays below the fee(s) with the type and date of the payment, the amount paid in the Credit column. If more than the amount of the fee selected is paid, the extra amount becomes a Surplus Campus saves the surplus amount and it can be applied to other fees.Process Credit/Debit Card

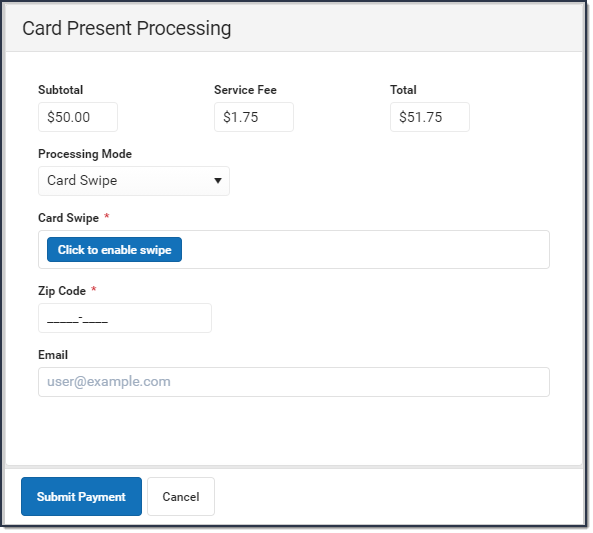

(Card Swipe)Complete these steps if you are using a Desktop Card Reader.

- Click the Make Payment button.

Result

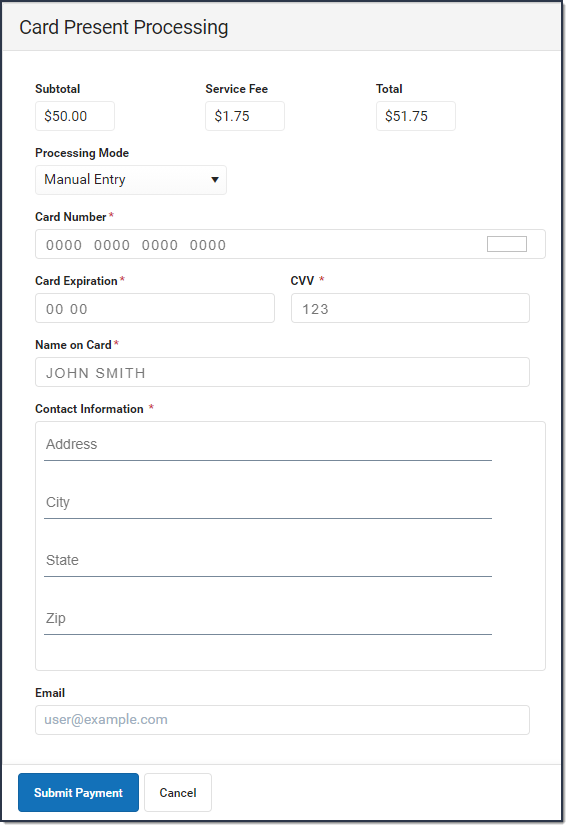

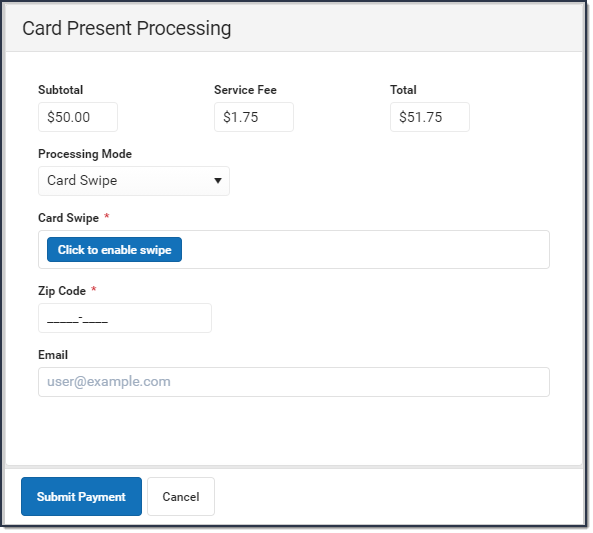

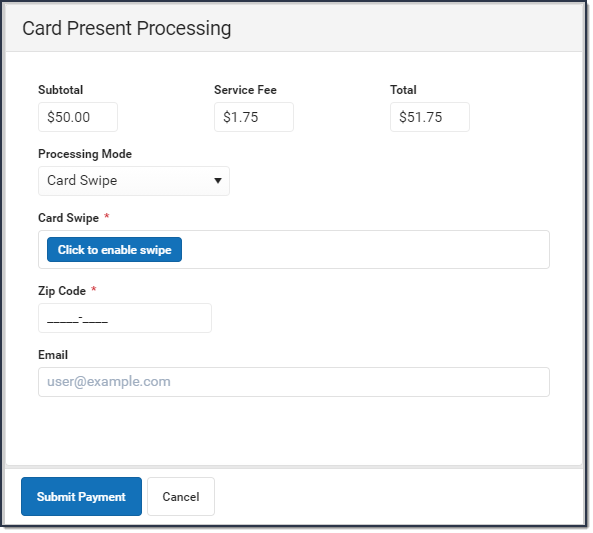

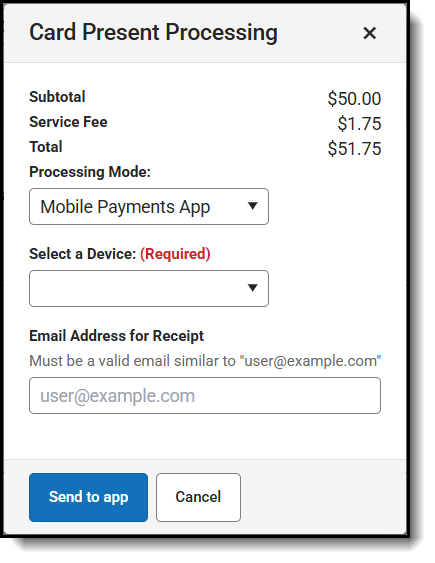

The Card Present Processing window displays.

Click the Click to enable swipe in the Card Swipe field then swipe the card through the card reader.

Result

A progress bar appears in the Card Swipe field. When the process completes, the message changes to Success.Enter an Email address. (Optional)

If Email Settings are set up, Campus will send the receipt to the Email address entered here. This email is not included in the Sent Message Log.

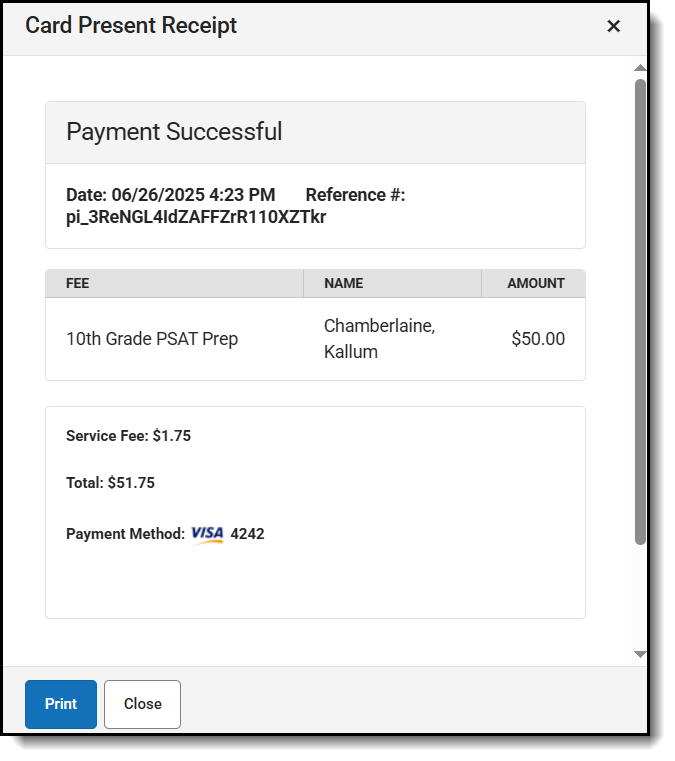

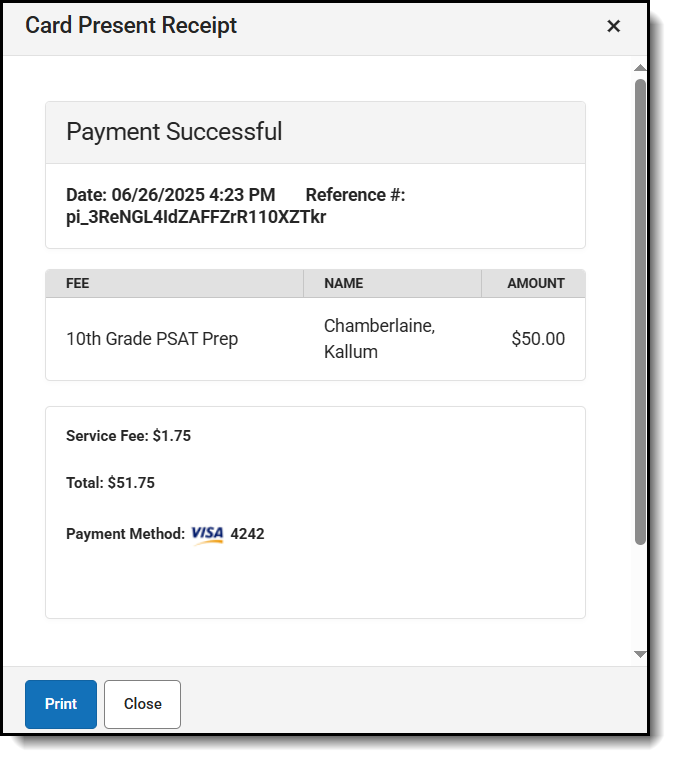

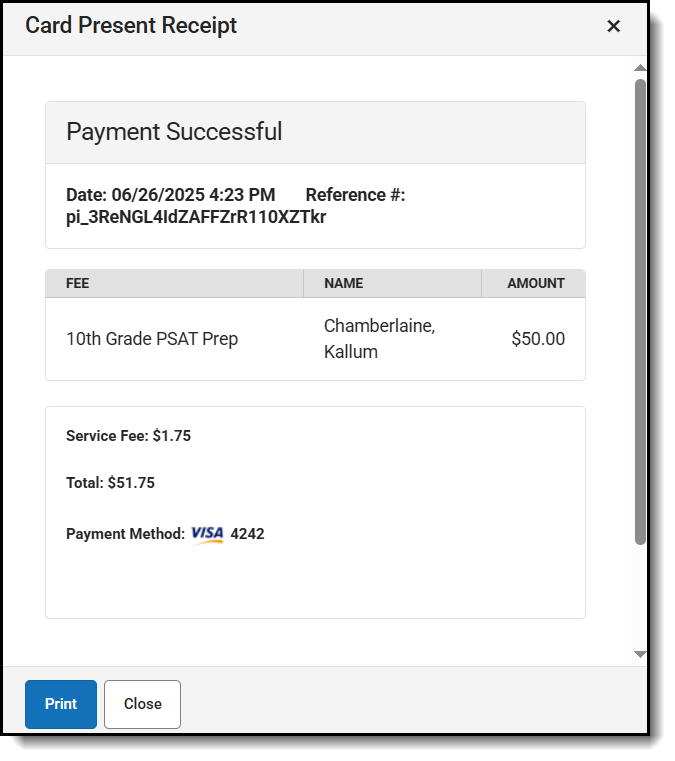

- Click the Submit Payment button.

Result

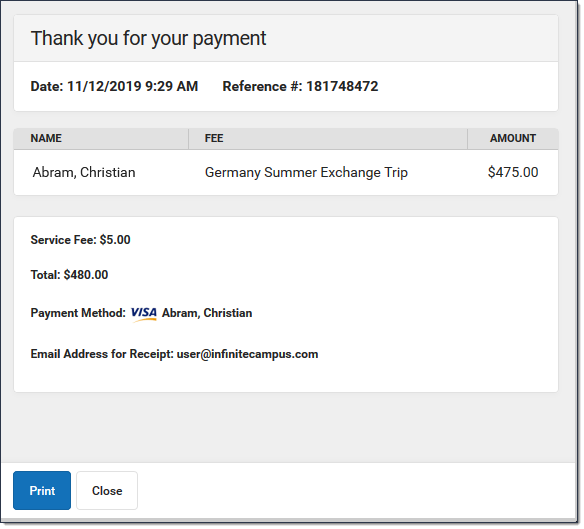

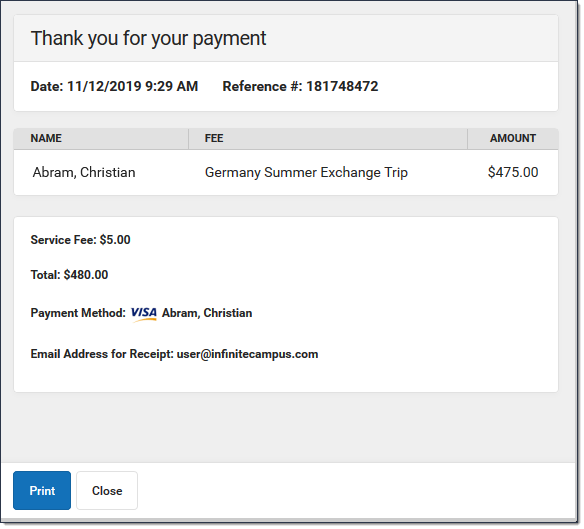

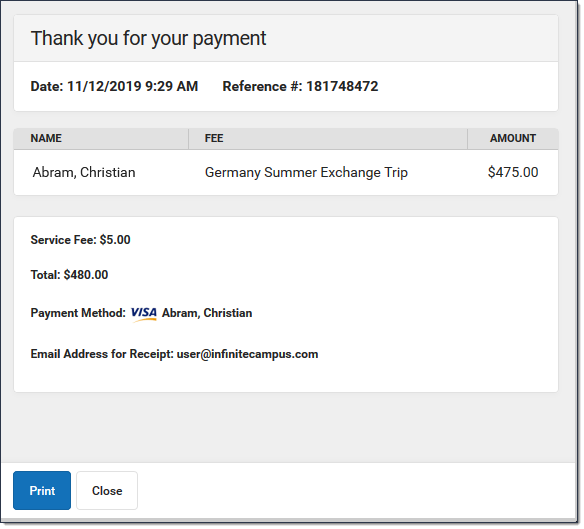

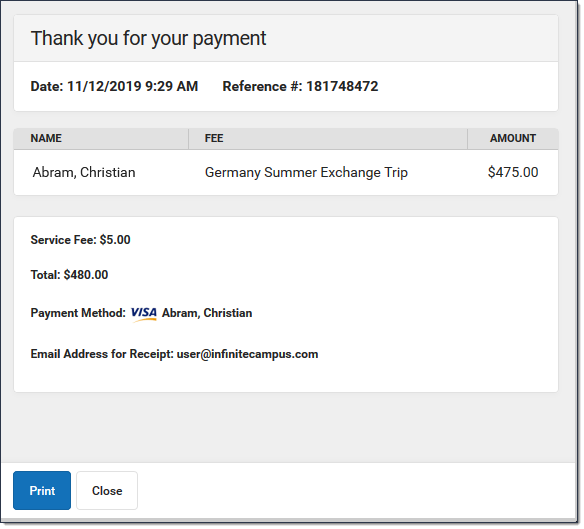

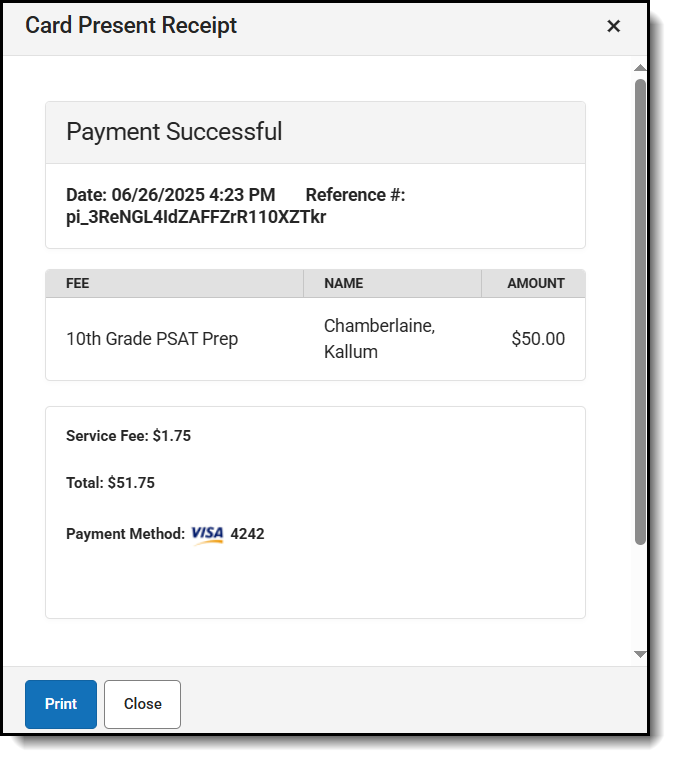

If the transaction is successful, the receipt displays and you can print the receipt from your browser. A receipt is emailed if an email address was entered in the Email field.

- Click the Close button.

Result

The payment displays below the fee(s) with the type and date of the payment, the amount paid in the Credit column and Balances and Totals updated accordingly.

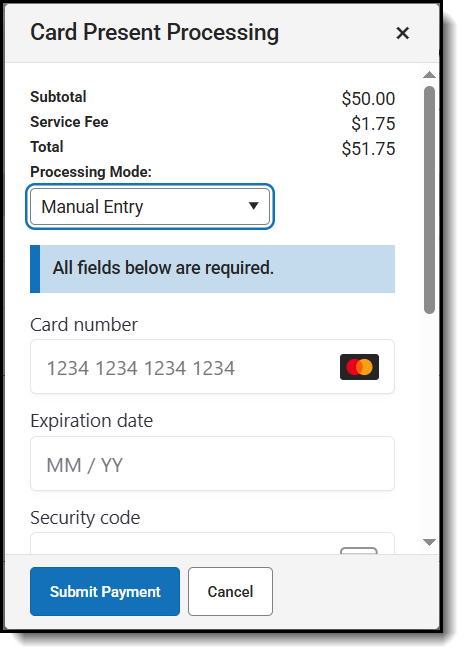

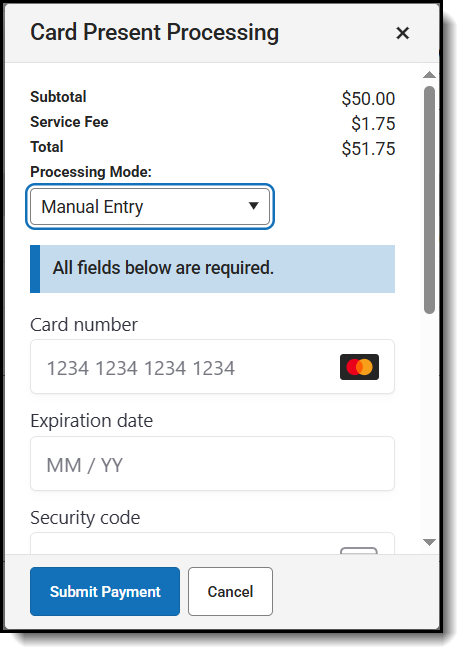

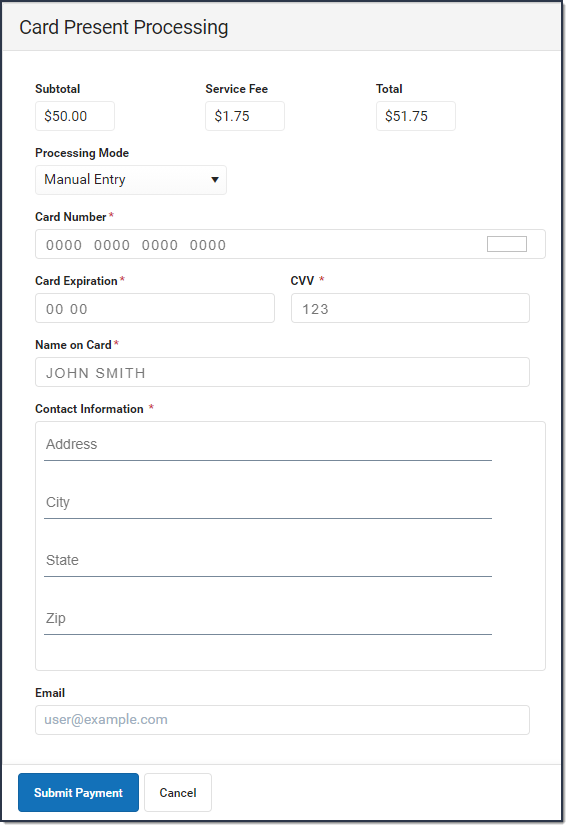

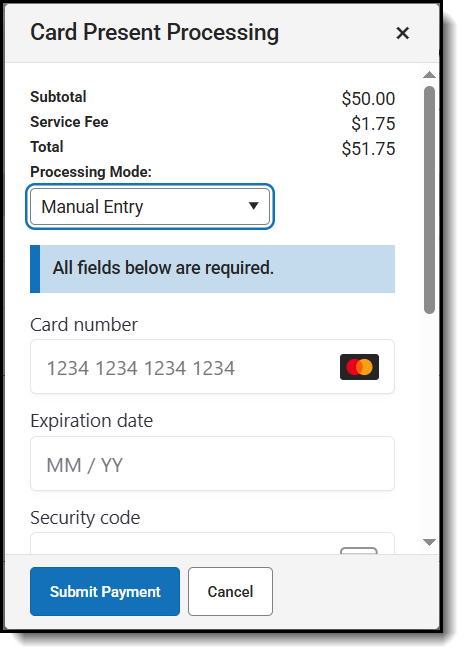

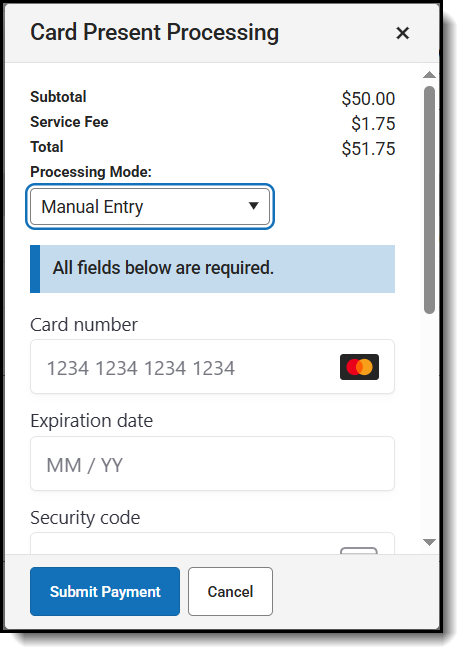

Process Credit/Debit Card (Manual Entry) Complete these steps if you do not have a Desktop Card Reader.

- Click the Make Payment button.

Result

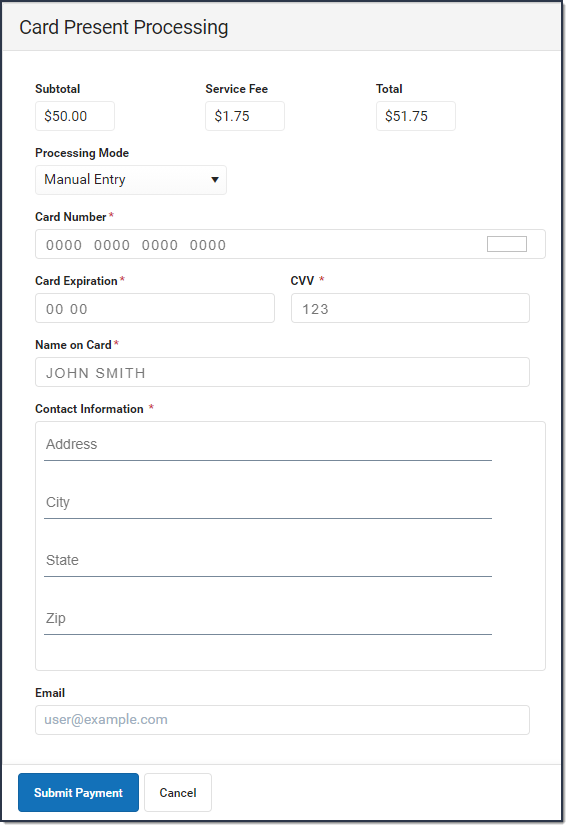

The Card Present Processing window displays.

- Select Manual Entry in the Processing Mode dropdown list.

- Fill out the following fields.

- Card Number

- Card Expiration

- Name on Card

- Address

- Zip Code

- Click the Submit Payment button.

Result

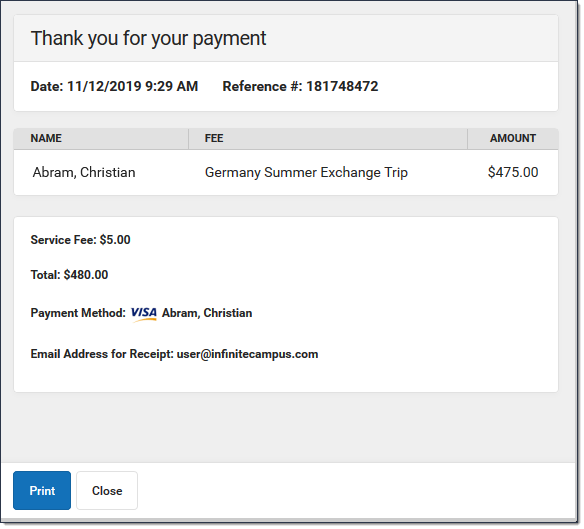

If the transaction is successful, the receipt displays and you can print the receipt from your browser. A receipt is emailed if an email address was entered in the Email field. This email is not included in the Sent Message Log.

- Click the Close button.

Result

The payment displays below the fee(s) with the type and date of the payment, the amount paid in the Credit column and Balances and Totals updated accordingly.

- Click the Make Payment button.

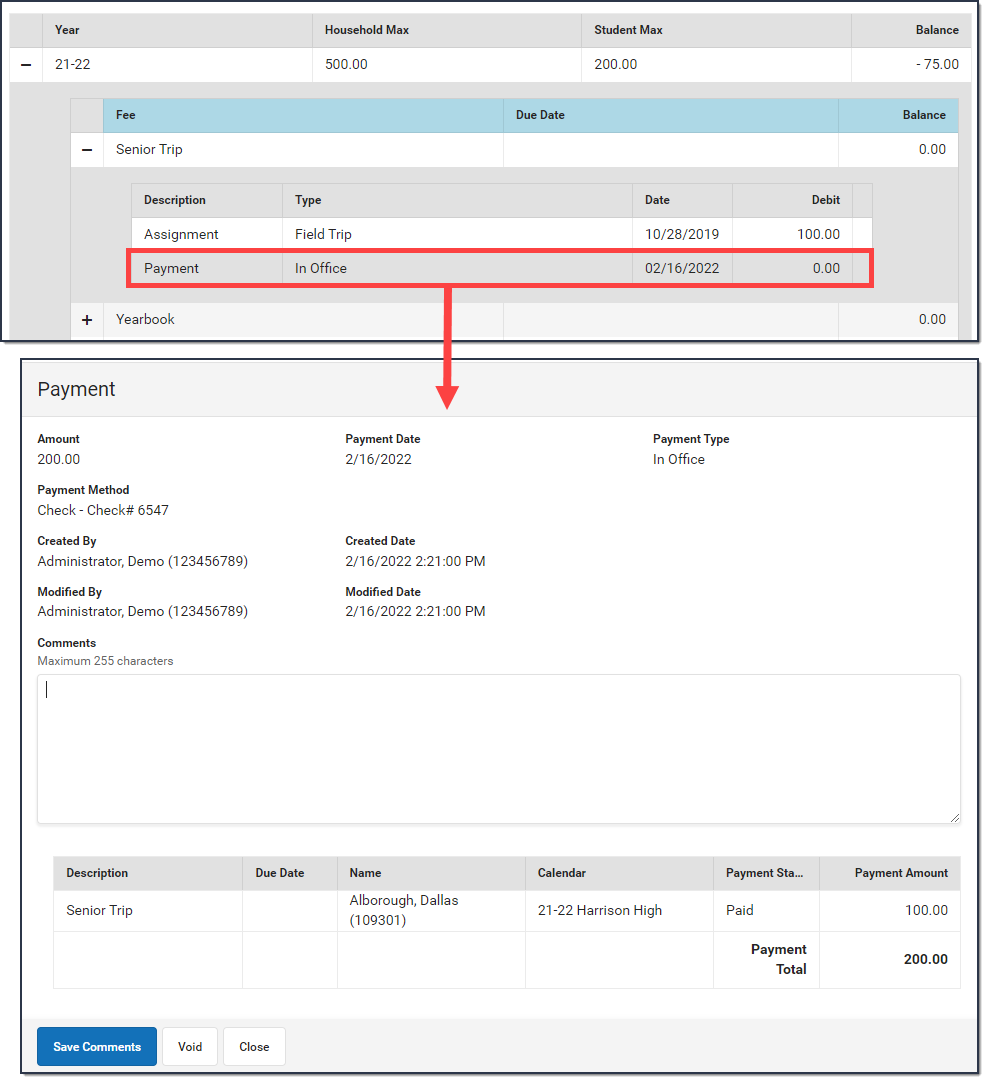

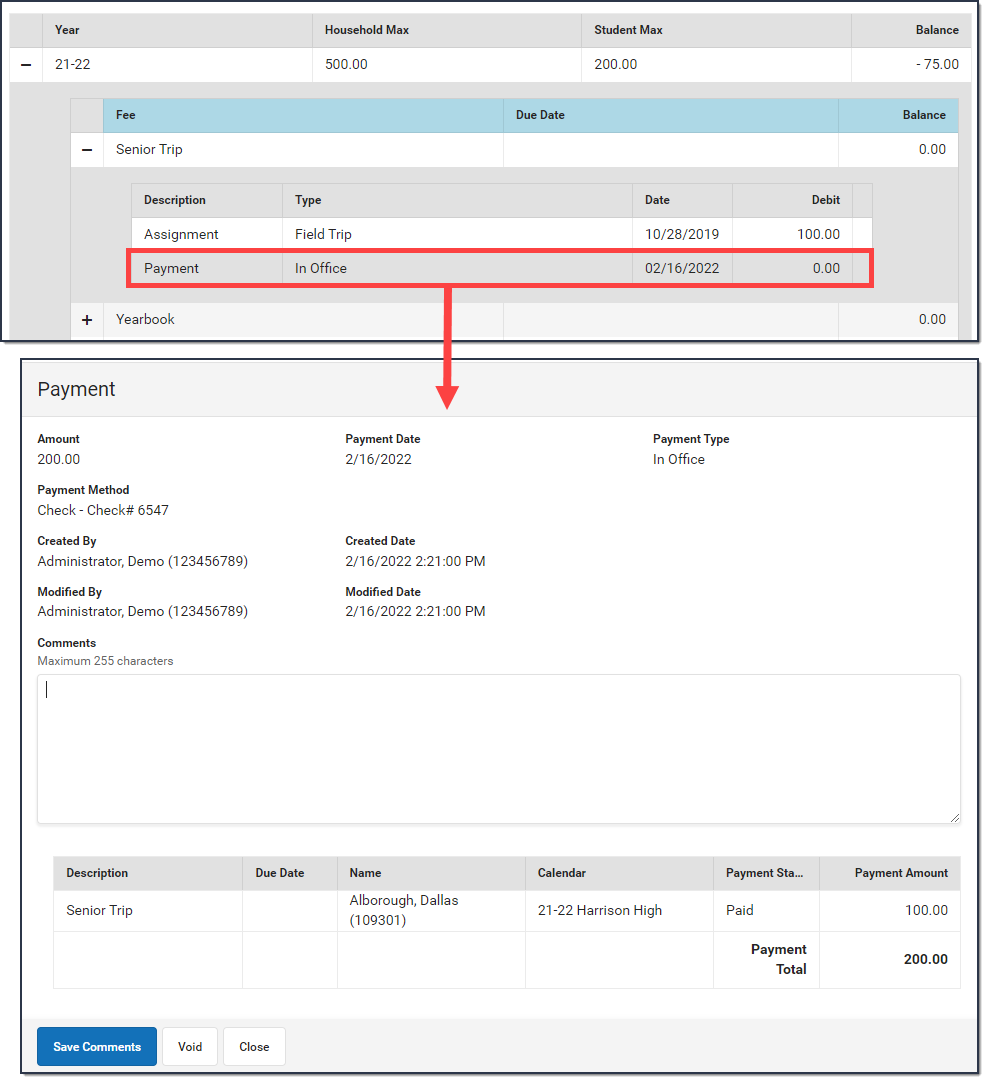

Payment Panel

Only Comments can be added or modified in this panel.

After a payment is made, you can click the payment to display the Payment panel. This panel includes the Payment Date, the total Amount, the Payment Method, and any Comments attached to the payment. The calendar in which the payment was made and the name of the user(s) who created the payment also display.

Below the Comments section, the panel displays all fees paid with that payment, the due dates of each fee, and the amount paid for each fee.

Person Fees

This topic shows how to make payments for fees using a card reader and by entering the payment manually from the Fees tool in Census >Person.

Household Fees

A credit/debit card payment can be applied to one or multiple fees on the household's Fees tool. The desktop card reader allows you to swipe a credit/debit card or enter the card holder's information manually.

Fees assigned to a household can be viewed and managed from the fees tool in Census > Households.

Enter Fee Payments (Summarized Version)

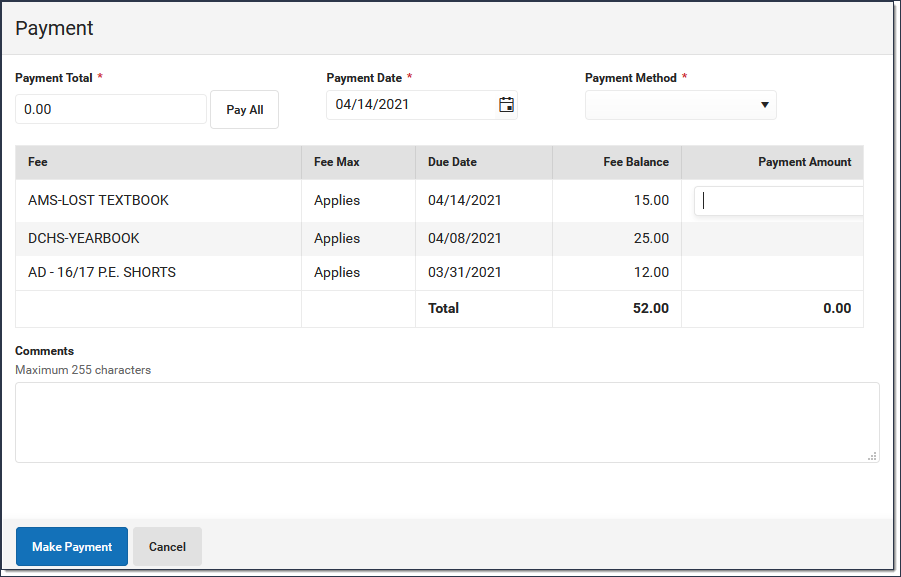

Fees can be paid one at a time or you can pay multiple fees with a single payment.

Example of Paying Multiple Fees with One Payment

Example of Paying Multiple Fees with One Payment

Make a Payment

- Click the Make Payment button at the bottom of the screen.

Result: The Payment panel displays all fees from all years for which a payment is needed.

You can also access the Payment panel by clicking an individual fee then clicking the Make Payment button on the Assignment panel.

You can also access the Payment panel by clicking an individual fee then clicking the Make Payment button on the Assignment panel.

- Enter a Payment Date in mmddyyyy format.

- Enter the amount of the payment using one of the following options.

Option Description Pay All Click Pay All to populate this field with the total amount remaining to be paid.

Payment Total The Payment Total field at the top of the panel allows you to enter the amount to be paid. If the total amount exceeds the Fee Assignment amount, the remaining amount is deposited as a surplus.

Payment Amount The Payment Amount column allows you allows you to manually enter a unique value for each line. Campus automatically updates the Payment Total to match the values you enter.

Enter any Comments associated with the payment.

Select one of the following Payment Methods and complete the payment.

Payment Method Description Cash Click the Make Payment button.

Result

If more than the amount of the fee selected is paid, the extra amount becomes a Surplus. Campus saves the surplus amount and it can be applied to other fees.Check The Check # field displays when you select this option. Enter the Check # then click the Make Payment button.

Result

The payment displays below the fee(s) with the type and date of the payment, the amount paid in the Credit column.If more than the amount of the fee selected is paid, the extra amount becomes a Surplus. Campus saves the surplus amount and it can be applied to other fees.

Surplus (Balance: $XX.XX) This option only displays if a surplus is available on the account.

Click the Make Payment button.

Result

The Surplus Balance is reduced by the amount used to pay the fee. The payment displays below the fee(s) with the type and date of the payment, the amount paid in the Credit column.Record Credit/Debit Card If your district does NOT use Online Payments or a Desktop Card Reader, enter the Reference Number then click the Make Payment button.

Result

The payment displays below the fee(s) with the type and date of the payment, the amount paid in the Credit column. If more than the amount of the fee selected is paid, the extra amount becomes a Surplus Campus saves the surplus amount and it can be applied to other fees.Process Credit/Debit Card

(Card Swipe)Complete these steps if you are using a Desktop Card Reader.

- Click the Make Payment button.

Result

The Card Present Processing window displays.

Click the Click to enable swipe in the Card Swipe field then swipe the card through the card reader.

Result

A progress bar appears in the Card Swipe field. When the process completes, the message changes to Success.Enter an Email address. (Optional)

If Email Settings are set up, Campus will send the receipt to the Email address entered here. This email is not included in the Sent Message Log.

- Click the Submit Payment button.

Result

If the transaction is successful, the receipt displays and you can print the receipt from your browser. A receipt is emailed if an email address was entered in the Email field.

- Click the Close button.

Result

The payment displays below the fee(s) with the type and date of the payment, the amount paid in the Credit column and Balances and Totals updated accordingly.

Process Credit/Debit Card (Manual Entry) Complete these steps if you do not have a Desktop Card Reader.

- Click the Make Payment button.

Result

The Card Present Processing window displays.

- Select Manual Entry in the Processing Mode dropdown list.

- Fill out the following fields.

- Card Number

- Card Expiration

- Name on Card

- Address

- Zip Code

- Click the Submit Payment button.

Result

If the transaction is successful, the receipt displays and you can print the receipt from your browser. A receipt is emailed if an email address was entered in the Email field. This email is not included in the Sent Message Log.

- Click the Close button.

Result

The payment displays below the fee(s) with the type and date of the payment, the amount paid in the Credit column and Balances and Totals updated accordingly.

- Click the Make Payment button.

Payment Panel

Only Comments can be added or modified in this panel.

After a payment is made, you can click the payment to display the Payment panel. This panel includes the Payment Date, the total Amount, the Payment Method, and any Comments attached to the payment. The calendar in which the payment was made and the name of the user(s) who created the payment also display.

Below the Comments section, the panel displays all fees paid with that payment, the due dates of each fee, and the amount paid for each fee.

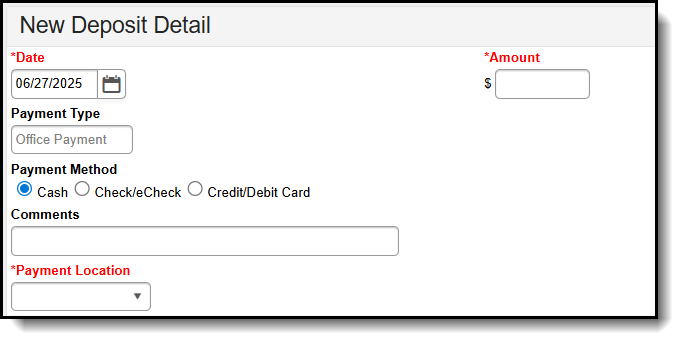

Enter Food Service Deposits

Deposits made to food service accounts can be entered for an individual or a household using the FS Deposit tool.

Deposit for an Individual

The FS (Food Service) Deposit tool allows district staff to enter new deposits using a desktop card reader. The credit/debit card can be swiped or the cardholder's information can be entered manually. In general, the FS Deposit tool is used for a district or school staff member whose account is not attached to a household record in Campus.

Tool Search: Food Service Deposit

This functionality is only available in districts that have purchased Campus Point-of-Sale as add-on functionality.

The Food Service Deposit tool allows a district to enter new deposits, void existing deposits and review account balances for a patron with a POS account. In general, this tool is used for a district or school staff member whose account is not attached to a household record in Campus.

Deposits for student patrons should be handled through the Household Food Service Deposit tool, which allows a deposit to be dispersed among various members of a household.

View Existing Deposits

The Food Service Deposit tool is designed for making and tracking individual deposits to food service accounts. Deposits made through the Household Food Service Deposit tool will show the amount of the deposit specifically allocated to the account being viewed (e.g., if a household deposit of $100 is split between two patrons, this tool will only show the $50 applied to this account).

This tool will only display deposit transactions. For a complete summary of all account activity (e.g., deposits, purchases, adjustments), please view the Account Journal tool.

Individual Food Service Deposit Tool

Individual Food Service Deposit Tool

Field Descriptions

|

Field |

Description |

|---|---|

|

Date |

Date for which the deposit should be recorded. |

|

Amount |

The amount to be deposited. |

|

Payment Type |

This field will auto-populate with the value "Office Payment" when the deposit is made through this tool. If the deposit was made by a parent/student using the My Cart payments tool in Campus Parent or Campus Student, this field will indicate that the payment was made "Online." |

|

Payment Method |

Payment method used for the deposit. |

|

Check Number |

This field only appears when the Payment Method selected is "Check/eCheck." This field should contain the number of the check. |

|

Reference Number |

This field only appears when the Payment Method selected is "Credit/Debit Card." This field should contain the credit/debit card number. Only use this field if your district does not use Online Payments. |

|

Comments |

User-entered details on the deposit that will display in the Description column of the Deposits Detail editor of each member's individual account information. |

|

Payment Location |

The location at which the deposit was entered. This dropdown list is populated with items created on the Payment Location tool. |

|

Do Not Accept Check |

A check mark in the Do Not Accept Check box indicates a NSF(No Sufficient Funds) Block has been set for the patron, indicating that the district has had to collect money from this patron. This is a visual flag to warn staff members not to accept checks from this person. A checkmark for patrons in this area does not prevent check deposits. An alert will appear to the staff member attempting to deposit a check for a "blocked" patron, but that staff member may bypass the warning and continue depositing the check. |

Create a New Deposit

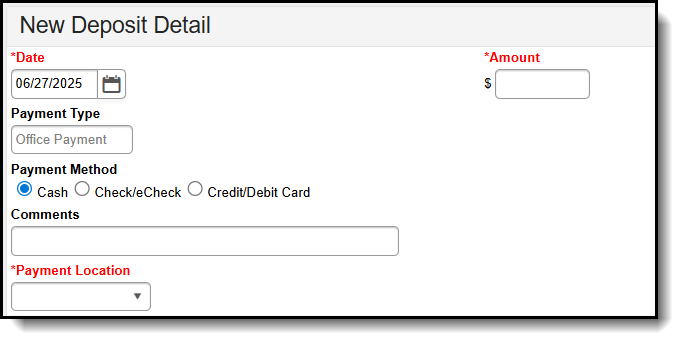

- Select the New Deposit icon. A New Deposit Detail table will appear.

- The deposit Date is auto-filled with the current date, but may be adjusted, as necessary.

- Enter the Payment Amount. This dollar amount can be entered in whole or dollar/cent values (e.g., 100 or 100.00).

- Enter any relevant Comments for this deposit.

- Select a Payment Location.

- Complete the deposit using one of the following Payment Methods.

Payment Method Description Cash Select Cash, then click the Save button.

Check/eCheck The Check # field displays when you select this option. Enter the Check # then click the Save button.

Credit/Debit Card If your district does NOT use Online Payments or a Card Reader, enter the Reference # then click the Save button.

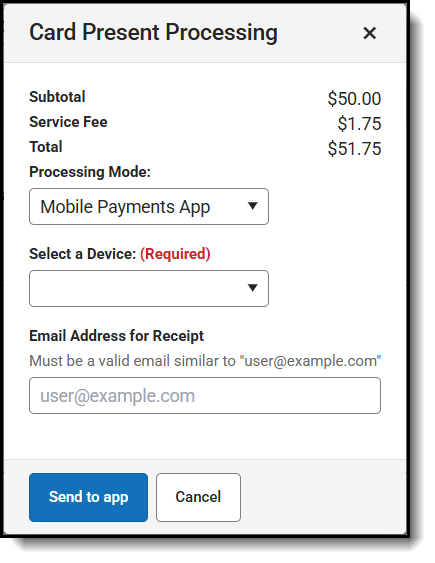

Credit/Debit Card (Mobile Payments App) Complete these steps if you are using a Card Reader.

- Click the Process button. The Card Present Processing window displays.

-

Select Mobile Payments App in the Processing Mode field.

-

Select one of the mobile devices configured for Campus Payments from the Select a Device field. For details on setting up the mobile app to take payments, see Mobile Payments Setup for Office Payments.

-

Enter an Email Address if the cardholder would like a receipt.

-

Click Send to app. It will then appear as a Pending Transaction on that mobile device. You may need to tap Refresh for the transaction to appear.

-

Tap Submit Payment.

-

Use the card reader to either tap, swipe, or read the chip in the card. When payment is complete, a confirmation message displays on the app. In Campus, a card present receipt display.

Credit/Debit Card (Manual Entry) Complete these steps if you do not have a Desktop Card Reader.

- Click the Process button.

- The Card Present Processing window displays.

- Select Manual Entry in the Processing Mode dropdown list.

- Fill out the following fields.

- Card Number

- Card Expiration

- Security Code

- Full Name

- Country or region

- Address

- Email Address for Receipt

- Click the Submit Payment button. If the transaction is successful, the receipt displays and you can print the receipt from your browser. A receipt is emailed if an email address was entered in the Email field. This email is not included in the Sent Message Log.

-

Click the Close button. The payment displays below the fee(s) with the type and date of the payment, the amount paid in the Credit column and Balances and Totals updated accordingly.

- Click the Process button. The Card Present Processing window displays.

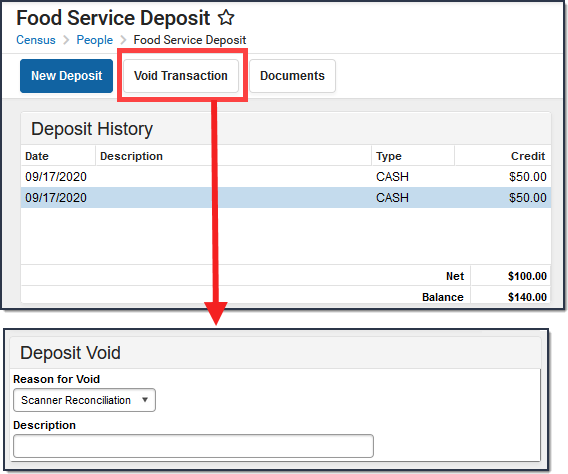

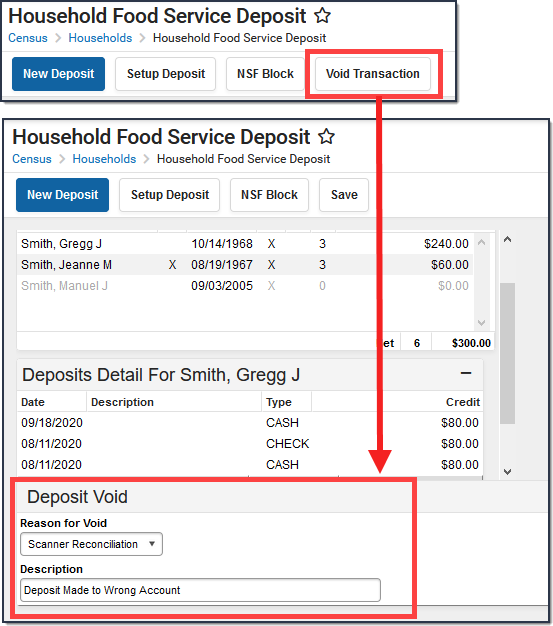

Void a Deposit

- Click the deposit that you want to void in the Deposit History editor.

- Click the Void Transaction button. The Deposit Void editor appears.

- Select the Reason for Void.

- Add comments in the Description field.

Comments display as the Description in the Deposit History editor. - Click Save.

Voiding a Transaction

Voiding a Transaction

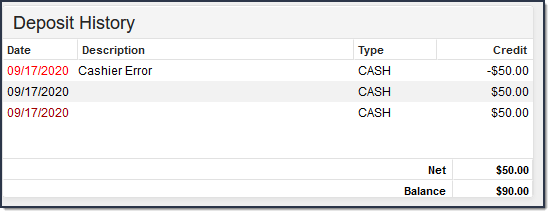

The void and original transactions will both display in red text: Example Void Deposit

Example Void Deposit

Managing Documents

To view documents, click the Documents button on the action bar. Users with the appropriate tool rights may also complete the following tasks.

- Upload Documents

- Delete Documents

- Replace Documents

- Edit a Document Name or File Description

- Download Documents

Food Service deposits for an individual patron can be managed using Food Service Deposit.

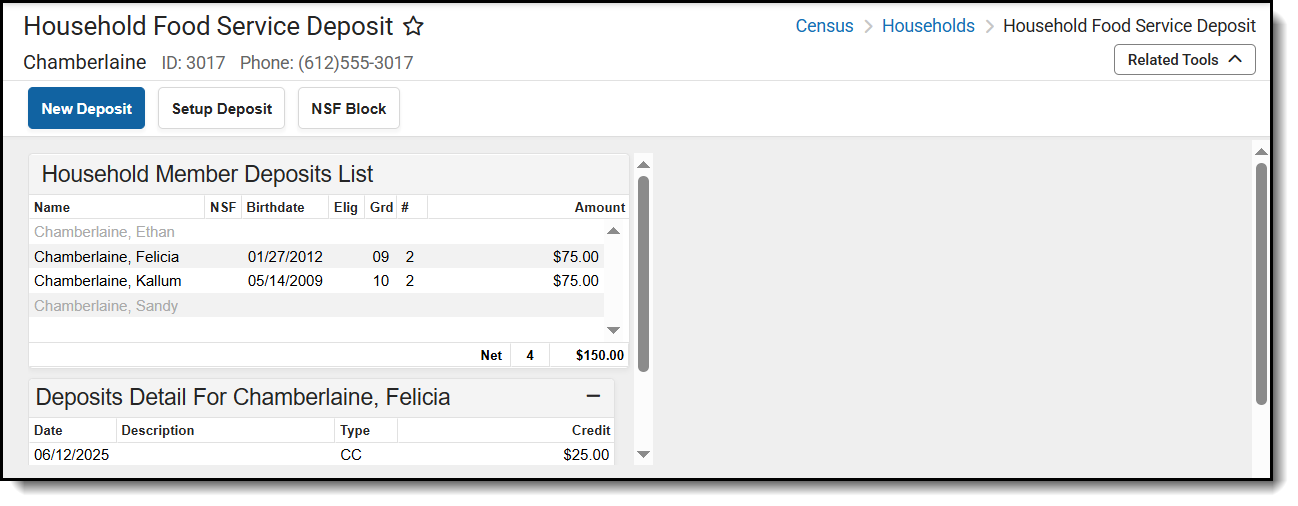

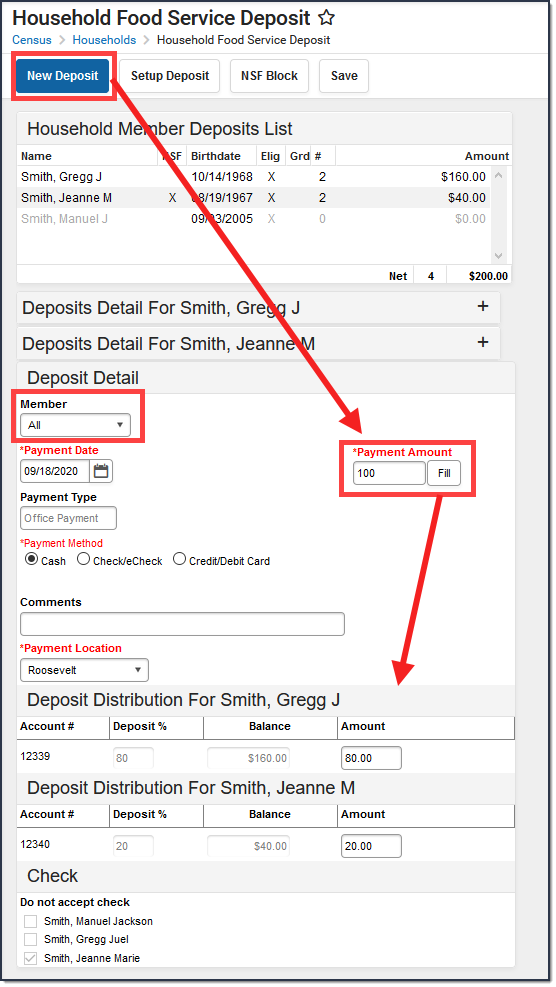

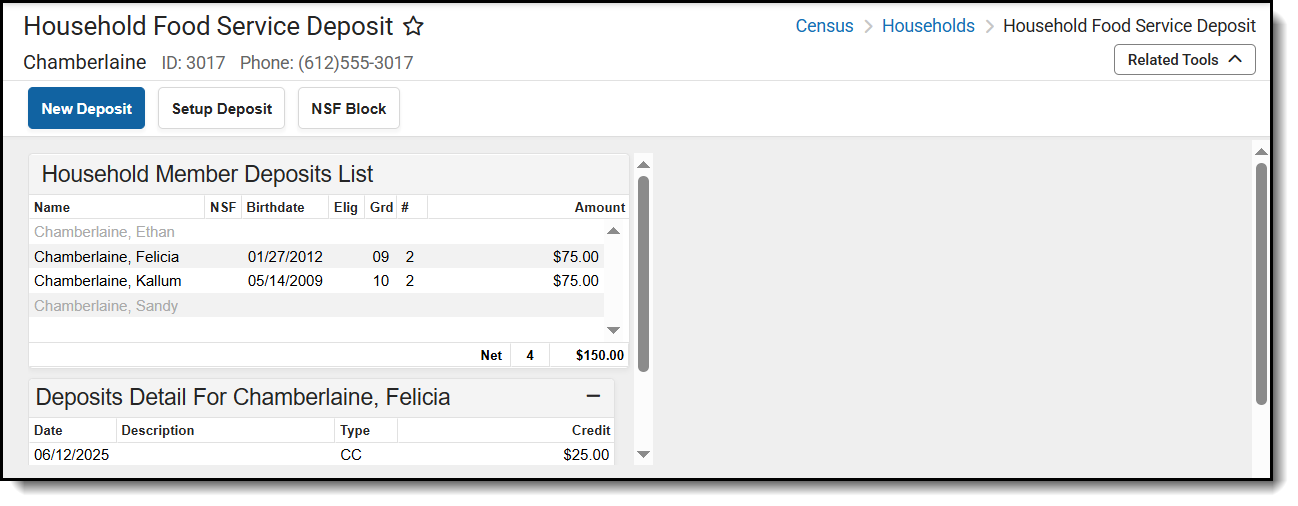

Deposit for a Household

The Household Food Service Deposit allows district staff to enter new deposits using a desktop card reader. The credit/debit card can be swiped or the cardholder's information can be entered manually. In general, Household Food Service Deposit is used for students or other individuals whose account is attached to a household record in Campus.

Tool Search: Household Food Service Deposit

This functionality is only available in districts that have purchased Campus Point-of-Sale as an add-on functionality.

The Household Food Service Deposit screen allows a district to enter new deposits, void existing deposits and review account balances for any patron in a household. In general, this tool is used to manage deposits made to student accounts.

All members of the household will be shown in the Household Member Deposits List editor. However, only the members who have Food Service accounts will appear in black text and have a Deposit Detail editor to track their deposits. Members of the household who do not have an account are shown in gray text.

When a new deposit is to be added to a household, the funds may be dispersed in a variety of manners:

- Funds may be distributed based on the setup of deposit percentages saved for the household.

- Funds may be equally distributed among patrons.

- Funds may be unequally distributed among patrons.

- All funds from the deposit may be distributed to one patron.

To view the details of an existing deposit, click on the deposit in the Deposits Detail editor. The details cannot be edited, as they are read-only.

The Do not accept check area of the Check editor displays a checkmark for household members who should not be allowed to pay with a check. Please see the Create an NSF Block article for more information.

Household Food Service Deposit Field Descriptions

Household Food Service Deposit Field Descriptions

Household Member Deposits List Editor

|

Column Header |

Definitions |

|---|---|

|

Name |

Name of household member. |

|

NSF |

An "X" in the NSF (No Sufficient Funds) column indicates the district has had to collect money from this patron. This is a visual flag to warn staff members not to accept checks from this person. |

|

Birthdate |

The birth date of the household member. |

|

Elig(ibility) |

The discounted meal status (free or reduced) of the individual. If the student does not qualify for free or reduced meal purchases, this column will be blank. If a student's eligibility should NOT be viewed by cashiers processing meal purchases the Eligibility setting of the POS Preferences should be disabled. |

|

Grd (Grade) |

Grade level of the household member. |

|

# (Number) |

Total number of deposits given for that household member. |

|

Amount |

Dollar amount of the deposit. |

|

Net |

The net total of deposits. If a deposit has been voided, this total will reflect that adjustment. |

Deposits Detail Editor

|

Column Header |

Definitions |

|---|---|

|

Date |

Date on/for which the transaction was posted. |

|

Description |

Comments on the transaction, as entered by the user. If the deposit has been made by a parent/student through use of the online payments, this field will indicate the payment method (e.g., Visa, Checking Account, Savings Account"). |

|

Type |

The type of deposit: Cash, Check or CC (Credit Card). |

|

Credit |

The amount of the deposit credited to the patron. |

|

Net |

The net total of deposits. If a deposit has been voided, this total will reflect that adjustment. |

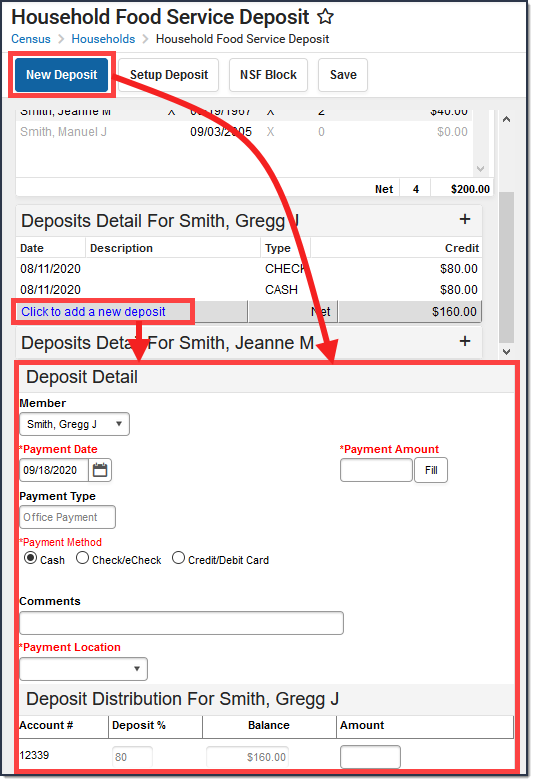

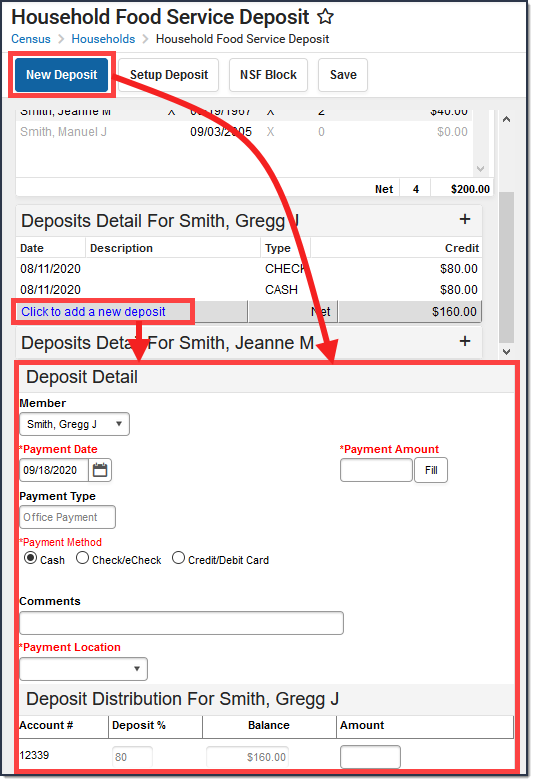

Add a Deposit for One Household Member

To specify a deposit for only one individual within the household:

- Select the Click to add a new deposit link on a patron's Deposits Detail editor, OR

- Click the New Deposit icon from the action bar and select the name of the individual patron from the Member field.

Deposit Detail Editor

Deposit Detail Editor

Deposit Detail Editor Field Descriptions

|

Fields/Items |

Definition |

|---|---|

|

Member |

The name of the household member to whom the deposit should be applied. "All" is the default selection, allowing the funds to be dispersed among the members of the household. |

|

Payment Date |

Date for which the deposit should be recorded. |

|

Payment Amount |

Total value of the deposit. |

|

Fill (Clear) |

This button allows the funds entered in the Payment Amount field to be dispersed among the members of the household listed at the bottom of this editor. If deposit percentages have been assigned, the Fill button will automatically split this amount as indicated in the Deposit % column. If no deposit percentages exist, the funds will be dispersed equally among all members of the account. After this button has been used and the funds have been distributed, the name of this button will change to "Clear" and will allow the user to clear the distribution. |

|

Payment Type |

This field will auto-populate with the value "Office Payment" when the deposit is made through this tool. If the deposit has been made by a parent/student using the My Cart tool in Campus Parent or Campus Student, this field indicates that the payment was made "Online." |

|

Payment Method |

Payment method used for the deposit: Cash, Check/eCheck or Credit/Debit Card. When "Check/eCheck" is selected, the Check Number field will appear. If "Credit/Debit Card" is selected, the Reference Number field will appear. |

|

Comments |

User-entered details on the deposit that will display in the Description column of the Deposits Detail editor of each member's individual account information. |

|

Payment Location |

Location at which the deposit was entered. |

A Deposit Distribution editor will appear for each account attached to the household:

|

Column/Field |

Definition |

|---|---|

|

Account # |

The number of the household member's food service account. |

|

Deposit % |

The percentage of each household deposit that should be distributed to the account. If a number does not appear in this column, household deposit percentages have not been established (through the Setup Deposit icon in the action bar). |

|

Balance |

The current balance of the account. |

|

Amount |

This is the amount of the total deposit listed in the Payment Amount field that will be applied to this account.

|

Make a Deposit for All Household Members

Entering a Payment Amount and clicking the Fill button will auto-divide the amount among the accounts. If deposit percentages are established, the Payment Amount will be divided accordingly. If deposit percentages are not set up, the Payment Amount is dispersed equally among accounts.

- Select the New Deposit icon from the action bar. The Deposit Detail editor will appear.

- Select "All" from the Member field. If the deposit should only be attributed to one member, select his/her name from this field instead.

- Enter or select a Payment Date.

- Enter a Payment Amount.

- Select a Payment Type.

Payment Method Description Cash Select Cash.

Check/eCheck The Check # field displays when you select this option. Enter the Check #.

Credit/Debit Card If your district does NOT use Online Payments or a Desktop Card Reader, enter the Reference #.

Credit/Debit Card (Mobile Payments App) - Click the Process button. The Card Present Processing window displays.

-

Select Mobile Payments App in the Processing Mode field.

-

Select one of the mobile devices configured for Campus Payments from the Select a Device field. For details on setting up the mobile app to take payments, see Mobile Payments Setup for Office Payments.

-

Enter an Email Address if the cardholder would like a receipt.

-

Click Send to app. It will then appear as a Pending Transaction on that mobile device. You may need to tap Refresh for the transaction to appear.

-

Tap Submit Payment.

-

Use the card reader to either tap, swipe, or read the chip in the card. When payment is complete, a confirmation message displays on the app. In Campus, a card present receipt display.

Credit/Debit Card (Manual Entry) - Click the Process button. The Card Present Processing window displays.

- Select Manual Entry in the Processing Mode dropdown list.

- Fill out the following fields.

- Card Number

- Card Expiration

- Security Code

- Full Name

- Country or region

- Address

- Email Address for Receipt

- Click the Submit Payment button. If the transaction is successful, the receipt displays and you can print the receipt from your browser. A receipt is emailed if an email address was entered in the Email field. This email is not included in the Sent Message Log.

-

Click the Close button. The payment displays below the fee(s) with the type and date of the payment, the amount paid in the Credit column and Balances and Totals updated accordingly.

- Enter additional details in the Comments field. This text will be displayed in the Description column of the Deposits Detail editor.

- Select a Payment Location to indicate where the deposit was entered.

- Verify the Amount. If necessary, this field can be manually edited.

- Click the Fill button to disperse the Payment Amount among the accounts. The dispersal amount will automatically appear in the Amount field of each member's account Deposit Distribution editor.

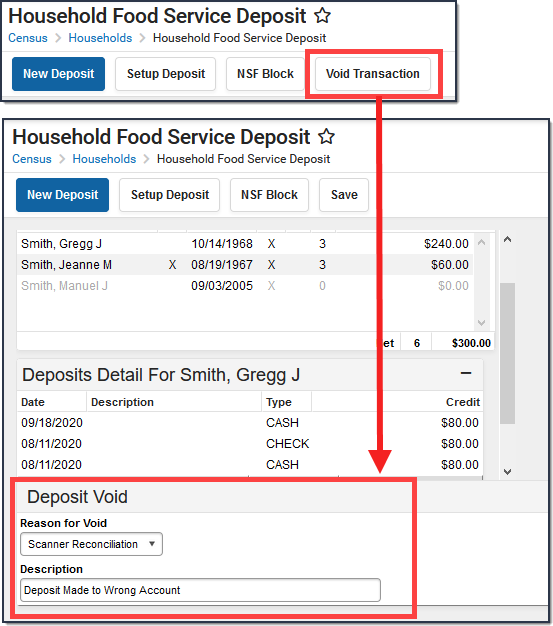

Void a Household Food Service Deposit Transaction

- Expand the Deposits Detail editor of the proper patron within the household.

- Select the deposit transaction to void.

- Click the VoidTransaction icon in the action bar. The Deposit Void editor will appear.

- Select a Reason for voiding the deposit.

- If desired, enter a Description for the void. Text entered in this area will show up in the Description column of the Deposits Detail editor.

- Click Save to void the transaction.

- Click Yes on the pop-up window to finalize the void.

Upon reopening the Deposits Detail editor for the patron, the Date of the reversed transaction will appear in bright red text, indicating that it was voided. The Date of the original transaction will appear in dark red text.

Voiding a TransactionVideo

Voiding a TransactionVideoDeposits and related preferences for patrons in a household can be managed using Household Food Service Deposit.

Reports

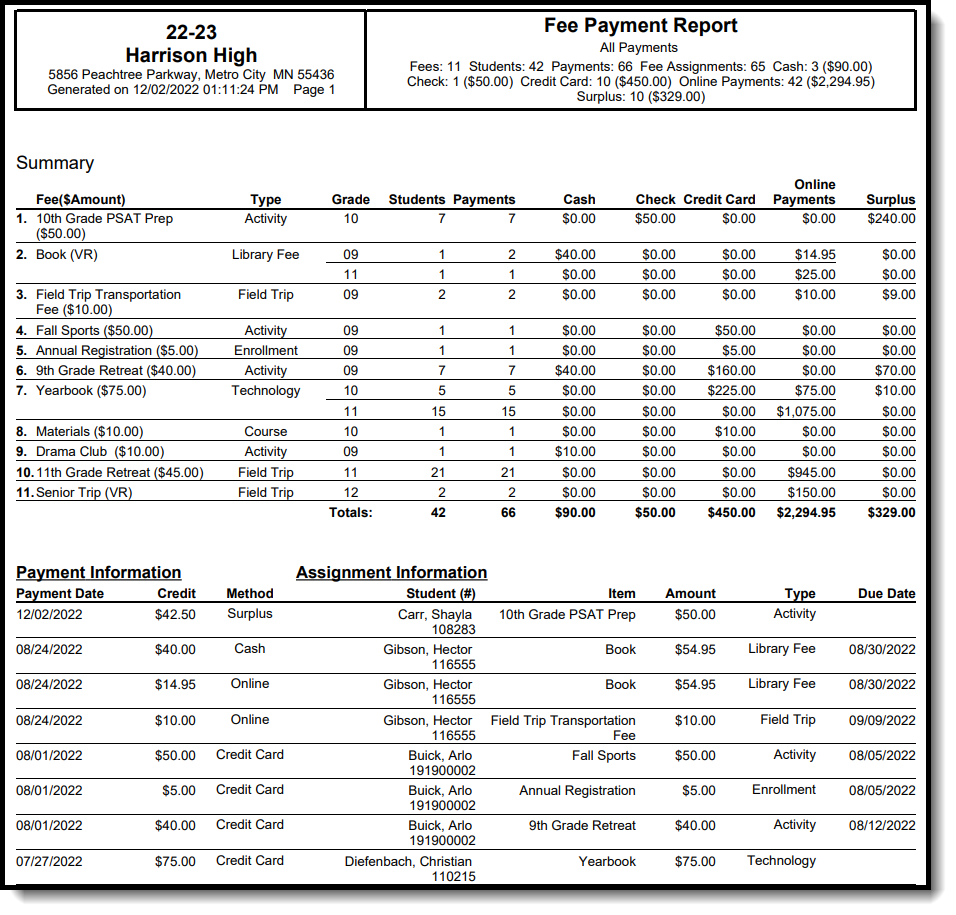

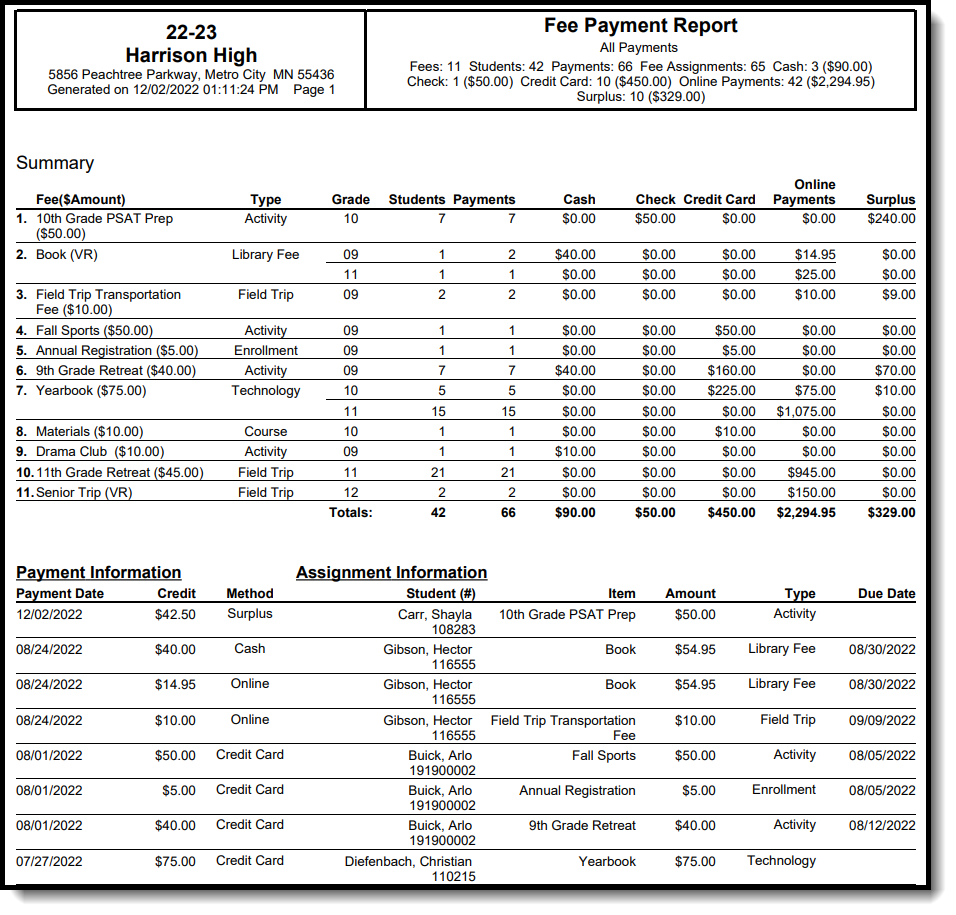

Fee Audit Report

The Payments mode of the Fee Audit Report provides information about payments made to fee assignments, including payments made using the integrated card swipe.

DocumentationTool Search: Fee Audit Report

The Fee Audit Report in Payments mode collects information about payments made to fee assignments based on the options selected in the wizard.

The Fee Audit Report can be generated in other modes as well:

The Fee Audit Report can be generated in other modes as well:

Payments Mode Report Logic

The following logic applies to the calculations used when reporting fee totals in the Payments Mode.

- Any voided payments that are returned (canceled) are not included in report totals.

- Any voided payments that are converted into a deposits are included in report totals.

- Adjustments are not considered payments and are not included in report totals.

- Over-payments (deposits) are included in report totals.

- Deposits made when the student is not affiliated with any fee assignments and has a zero balance or a surplus balance are included in report totals.

- Payments made out of surplus balances are included in report totals.

-

When optional fees are paid, the payment is assigned to the student's primary calendar of enrollment. If there is more than one primary enrollment, Campus uses the oldest active calendar of enrollment.

When a payment is made for multiple fees and one of those fees is voided after the payment is made:

- Generating the report for All Payments (Excluding Voids) does not include the voided payment. All other non-voided fees from the payment do still display.

- Generating the report for Voided Fee Payments displays only the voided payment. All other non-voided fees made in that same payment do not display.

Fee Definitions

For the purpose of this report, the following definitions apply.

Term

Definition

Payment

Includes any money made toward a fee assignment (full or partial), any overpayment and any payment voids that create a deposit or a simple deposit.

Amount

Total money of payment made toward a fee assignment, minus the total voided payments.

Fees

Total number of fees paid by the fee payment.

Fee Assignment

Total number of money paid toward a fee assignment.

Students

Total number of students who received a fee payment.

Payments Mode Report Editor

The following options are available on the Payments Mode Report Editor.

Field Description Fees Selection The Select District Fees section is populated with all fees entered for the district. Multiple fees can be selected. If a School is set in the Campus Toolbar, only fees for that school will appear. Calendar Selection Calendar Options are dependent on the Year and School selected in the Campus Toolbar. If a school is selected, only calendars for that school will appear in the Select Calendars list. If a school is not selected in a school bar, calendars from all schools will display for selection. Calendars are listed in descending year order. Student Selection When selecting the Students for which the audit report should be run, users can select a previously created Ad hoc Filter (created in the Ad hoc Reporting Filter Designer) or a specific Grade level. Available grade levels are based on the school selected in the Campus toolbar. Transaction Selection Users can select which Transactions to include in the report. Entering a date range will limit the results to records created on or between those dates. - Leaving both date fields blank will include all payments.

- Entering only a start date will include all payments on or after that date.

- Entering only an end date will include all payments on or before that. date.

See the Transaction Selection table for descriptions of the available options.

Sort By Options Sort By options control in what order information will appear on the audit report. Fee Assignment Due Date will be selected by default, which will sort results by the due date of the fee assignment. Fee and Student options will sort results alphabetically by Fee name or Student name. Show Fee Comments When set to Yes, comments that were added when the Fees were paid are included on the report. Report Format The report can be generated in CSV or PDF format. Transaction Selection

Options

Description

All Fee Payments (Excluding voids)

Selecting this option will include all fee payments made for the indicated students and calendar(s) in the entered date range, but not include voided payments.

Voided Fee Payments

Selecting this option will include all fee payments that have been voided for the indicated students and calendar(s) in the entered date range.

Sort By Options

The Fee Audit report in payment mode can be sorted in the following ways:

- Payment Date - payments are listed in date order, with the most recent payments first.

- Payment Amount - payments are listed in amount order, with the highest payment amounts first.

- Payment Type - payments are listed in the following order: Cash, then Check, then Credit Card, then Online payments.

- Student Name - students are listed in alphabetical last name order.

- Fee - fees that were payed are listed in alphabetical order.

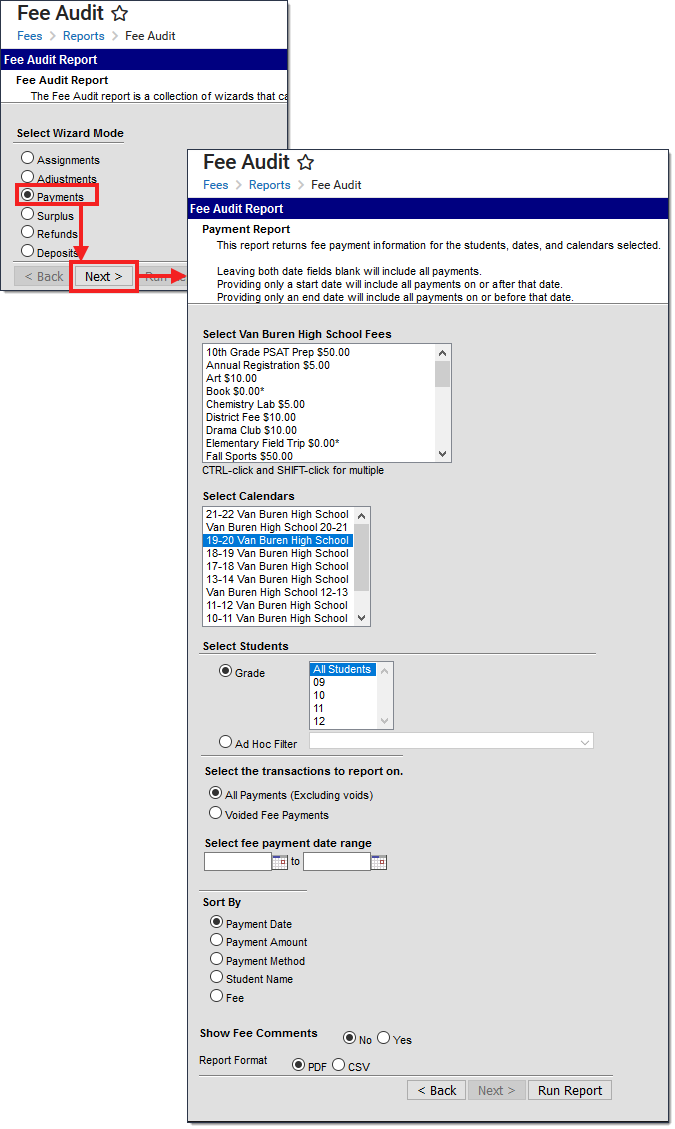

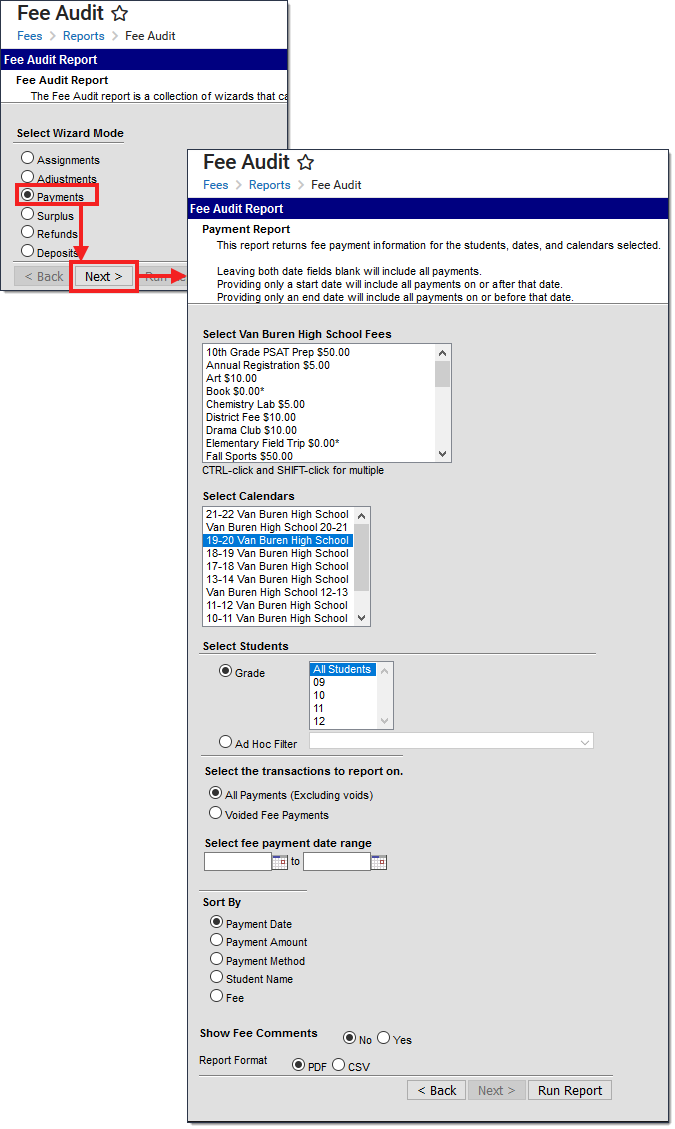

Generating the Fee Audit Report in Payments Mode

Mode Selection

- Select Payments as the Mode for which the report.

- Click Next to proceed to the next screen.

Report Options

- Indicate which Fee(s) should appear in the report.

- Select which Calendar(s) should appear in the report.

- Indicate which students should appear in the report by selecting an Ad hoc Filter or a Grade Level.

- Indicate which type of Transaction(s) should appear in the report.

- Select the desired Sort Option.

- Select whether you want to Show Fee Comments.

- Select the Report Format.

- Click Run Report to generate the audit report in PDF format.

Sav

This video covers all of the modes of the Fee Audit Report.

VideoReports for different fee transactions can be generated from the Fees Audit Report.

K28Nni3OFood Service Deposit Report

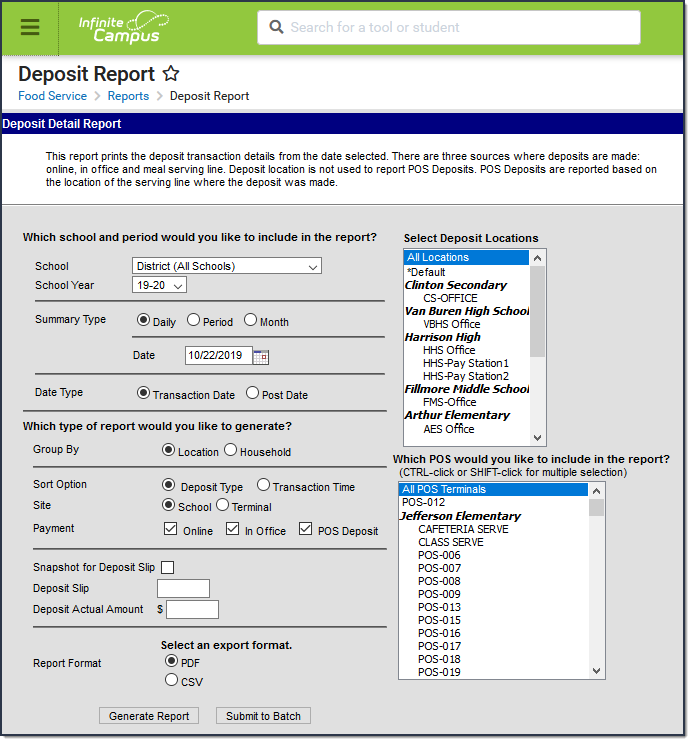

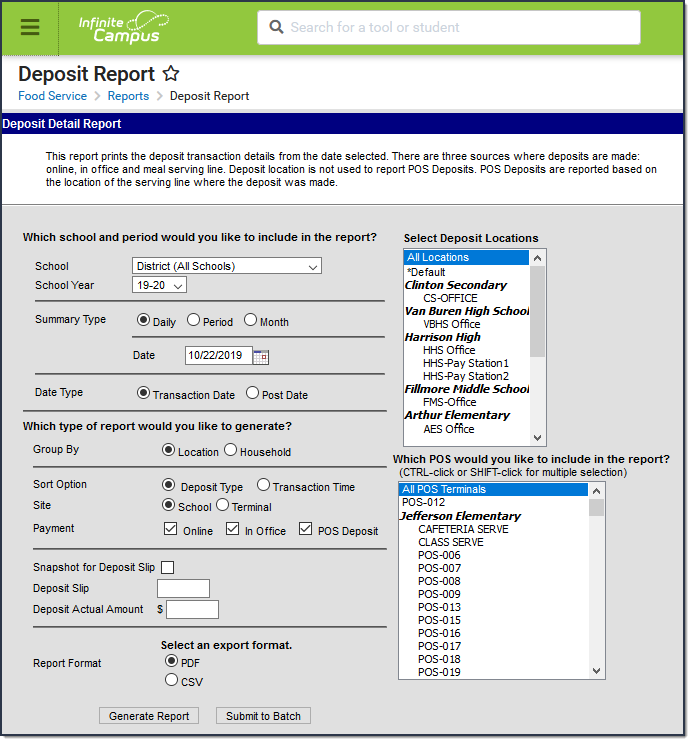

The Deposit Report generates a list of check, cash, and credit card deposits made through the FS Deposit for an individual or a household. The report also provides information about deposits made directly at a Point of Sale Terminal or online by a parent or guardian.

DocumentationThis functionality is only available to districts that have purchased Campus Point of Sale as add-on functionality.

Classic View: Point of Sale > Reports > Deposit Report

Search Terms: Deposit Report

What do I need to know? The report editor fields have a significant impact on report results. See the following topics for detailed information about each field.

Deposit Report Editor

Deposit Report Editor

Field Descriptions (Deposit Report)

The following sections explain how the report editor fields impact report results.

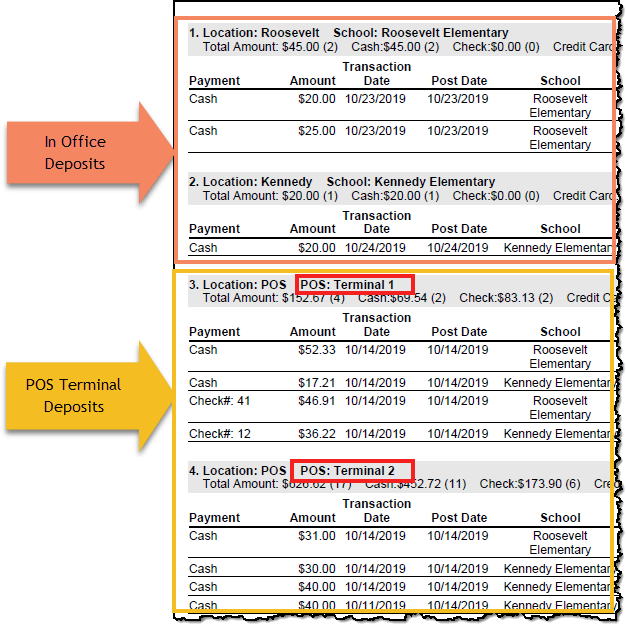

School and Period Options

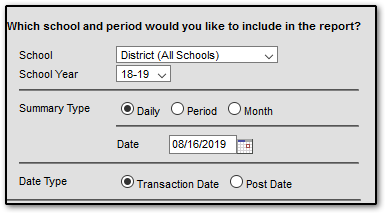

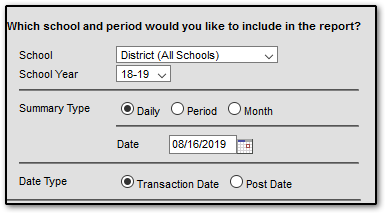

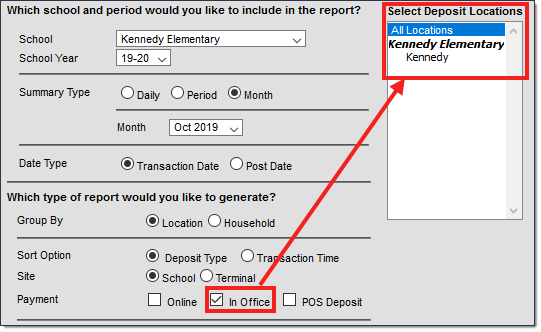

Parameters define the scope of the report, per the Which school and period would you like to include in the report? section.

Selecting Parameters

Selecting Parameters

Field

Description

School

The school (or all schools in the district) for which the report results should be generated. The default value for this field is the school currently selected in the Campus toolbar.

When you select a specific school, Campus limits the Deposit Locations for In Office Payments and the POS Terminals for POS Deposits to the locations and terminals available at the selected school.

When you select the Online payment option on the editor, the Deposit Report includes Online Payments for ALL schools regardless of the School selected in the School field.

School Year

The school year for which the report results should be generated. The default value for this field is the Year currently selected in the Campus toolbar.

Summary Type

These options allow the user to specify the date parameter(s) of the transactions returned in the report results:

- Daily - Deposits occurring on a specified date. When this option is selected, a Date field will appear.

- Period - Deposits occurring within a date range will be returned by the report. When this option is selected, a Start Date and an End Date field will appear.

- Month - Deposits occurring within the selected month will be returned by the report. When this option is selected, a Month field will appear.

Date Type

These options allow the user to choose the sorting method of deposit transactions in the report results:

- Transaction Date - When this option is selected, the deposit transactions will be sorted by the date on which they occurred.

Post Date- When this option is selected, the deposit transactions will be sorted by the date on which they posted to the Campus server.

The Transaction Date and Post Date are often the same; however, differences occur if the network is interrupted before all transactions can be posted. In this event, the transaction messages are stored in a queue until the network is reconnected and the messages can be processed.

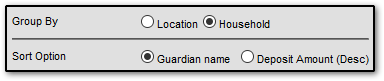

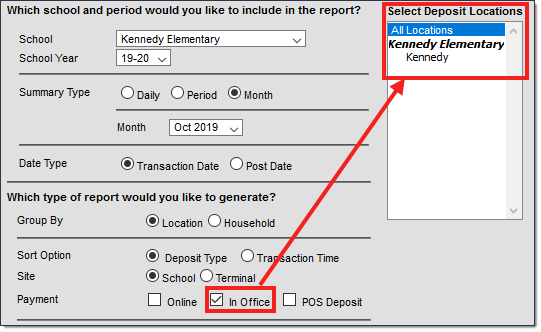

Grouping and Sorting Options

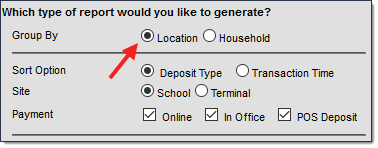

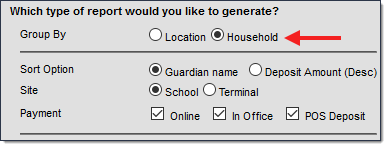

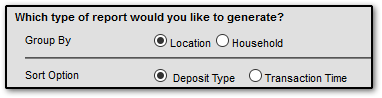

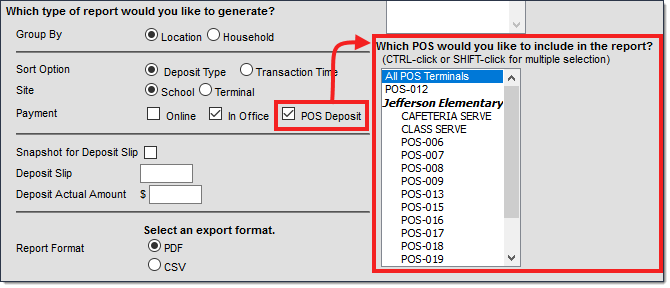

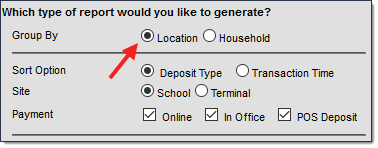

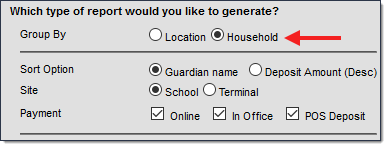

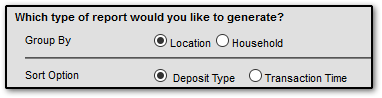

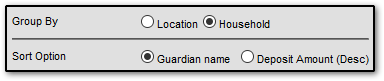

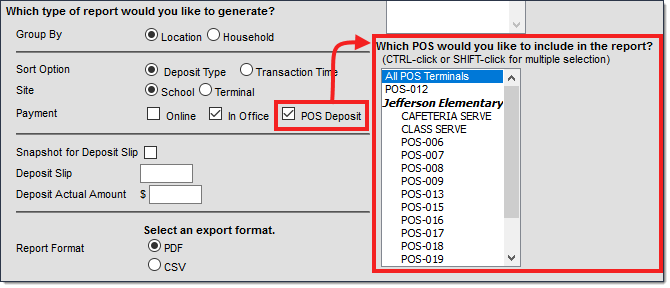

Grouping and sorting options define how the deposits display on the report, per the Which type of report would you like to generate? section.

Field Description Group By The option you select here determines how deposits are grouped on the report.

- When Location is selected, transactions are grouped by the location at which they were made.

- When Household is selected, transactions are grouped by the household who made the deposit.

Option Transactions are grouped by... Location the location at which they were made. Household the household to which they were made. Sort Option Depending on the option selected in the Group By area, different fields for sorting the report results display in the Sort Option field.

When... These options appear as the available sorting methods... Location is chosen in the Group By area - Deposit Type - When this option is selected, the deposit transactions are sorted by the type of deposit (i.e., cash, check, credit card).

- Transaction Time - When this option is selected, the deposit transactions are sorted by the day on which they occurred.

Household is chosen in the Group By area - Guardian Name - When this options is selected, the deposit transactions are sorted by the guardian of the household for which they were made.

- Deposit Amount (Desc) - When this option is selected, the deposit transactions are sorted by the amount of the deposit, from the largest to the smallest amount.

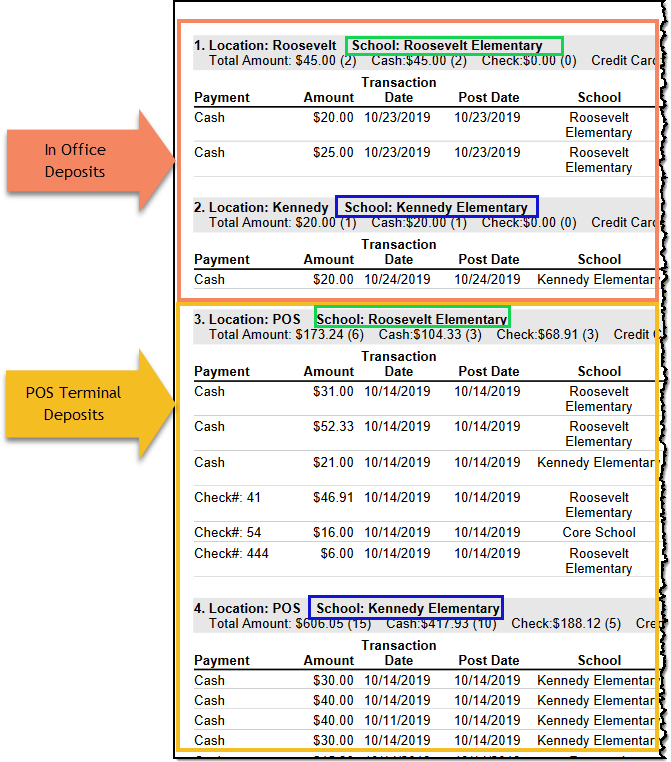

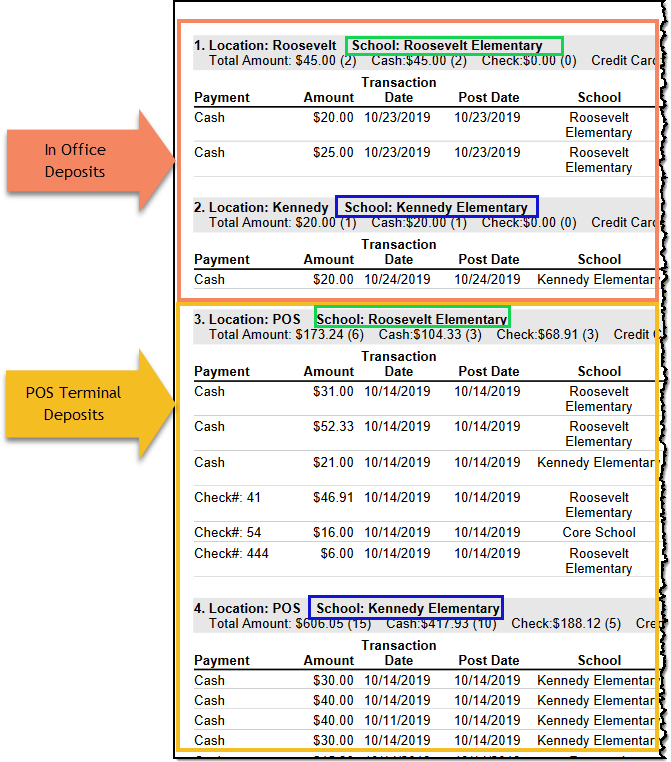

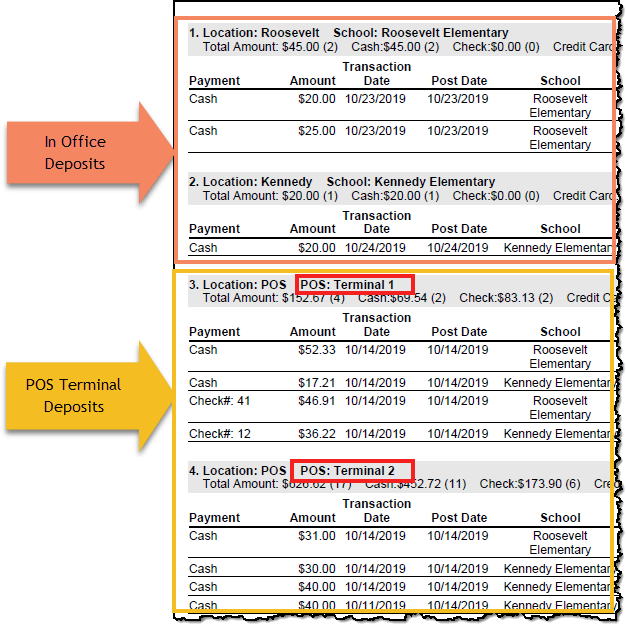

Site The option you select here determines how POS Terminal deposits are grouped beneath each Location. This option does NOT affect the report when it is grouped by Household.

In Office deposits are always grouped by deposit location.

When... Then... Example School is selected deposits are grouped by school.

Terminal is selected deposits are grouped by POS terminal.

If multiple schools are assigned to the same application and terminal, you can see all deposits made on the terminal you select regardless of where the students are enrolled by selecting District (All Schools) in the School dropdown list.

Payment Payment options allow you to specify the type of deposit transactions to be included in the report results.

Online - When this checkbox is marked, transactions made online, through the My Cart tool, are included in the report results. This only applies in districts where the Payments feature is enabled.

When you select this option, the Deposit Report includes Online Payments for ALL schools regardless of the School selected in the School field.

- In Office - When this checkbox is marked, transactions made at a location selected in the Select Deposit Locations area are included in the report results. The option to select Deposit Locations only displays when In Office is marked. Campus assigns the deposit location when you manually enter the deposit.

POS Deposit - When this checkbox is marked, cash or check deposits made at a Point of Sale terminal are included in the report results. The option to select terminals only displays when POS Deposit is marked.

Campus limits the POS terminals available for selection to the terminals that are available at the School selected on the report editor.

When multiple schools are assigned the same application, the same terminal will display under multiple schools. To see all deposits made on the terminal regardless of where the students are enrolled, select District (All Schools) in the School dropdown list and select the terminal under one of the schools with which it is associated.

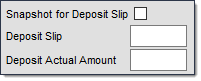

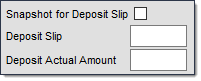

Deposit Slip Options

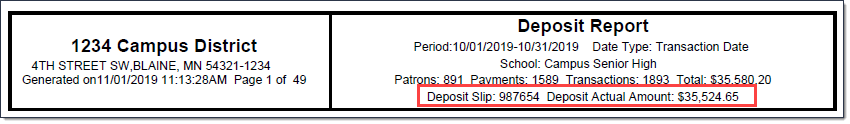

Deposit Slip Options allow you to associate a Deposit Slip number and dollar amount to the Deposit Report being generated. This information can be retrieved later in the Deposit Slip tool.

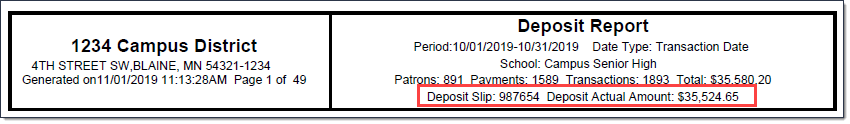

Field Description Snapshot for Deposit Slip When this checkbox is marked, Campus includes the Deposit Slip number and the Deposit Actual Amount in the header of the Deposit Report and saves the Deposit Report so that you can retrieve it later in the Deposit Slip tool.

A Deposit Slip number and Deposit Actual Amount are not required for the Deposit Slip snapshot.

If this checkbox is NOT marked, the Deposit Slip number and Deposit Actual Amount are included on the Deposit Report but a record is not saved for the Deposit Slip tool.

Deposit Slip The code for the Deposit Slip.

If your Deposit Slip is greater than 25 characters, it is best to use the CSV Report Format. If you choose the PDF format instead, the Deposit Slip and Deposit Actual Amount will not display correctly in the report header.

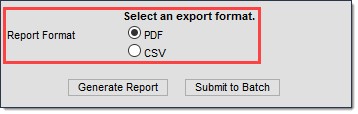

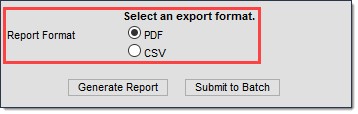

Deposit Actual Amount The actual deposit amount from the Deposit Slip. Report Format Options

Users have the option to generate the report as a PDF file or CSV file.

If your Deposit Slip is greater than 25 characters, it is best to use the CSV Report Format. If you choose the PDF format instead, the Deposit Slip and Deposit Actual Amount will not display correctly in the report header.

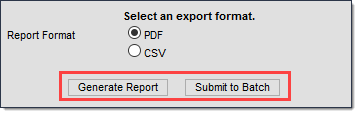

Generate or Submit to Batch

Users have the option of submitting a report request to the batch queue by clicking Submit to Batch instead of Generate Report. This process allows larger reports to generate in the background, without disrupting the use of Campus. For more information about submitting a report to the batch queue, see the Batch Queue article.

Analyzing Report Results

The following sections break down each column of each report in order to allow better analysis of results.

The Deposit Report always presents results in the following order:

- Online Payment Deposits

- In Office Deposits

- POS Terminal Deposits

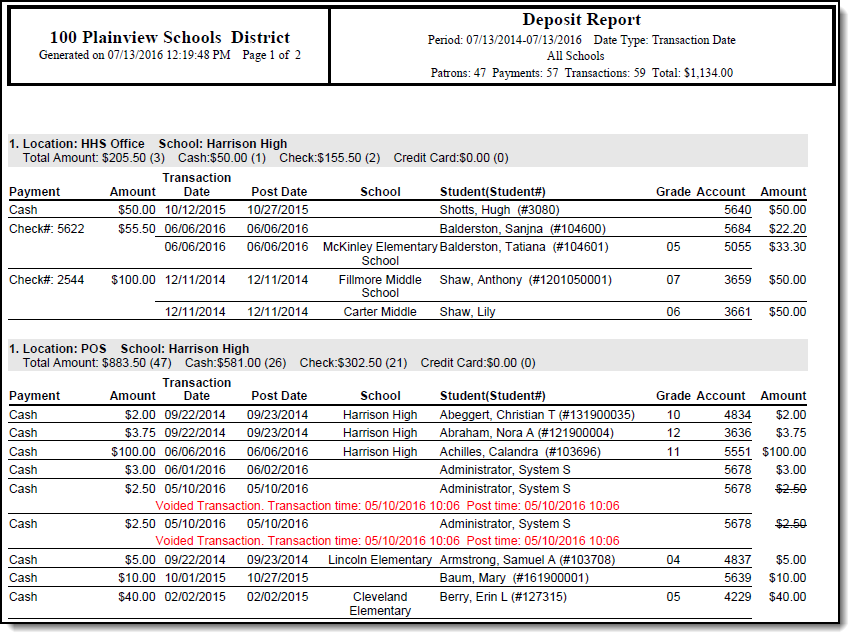

Grouped By Location

The Group By Location option generates a report listing each deposit transaction per location.

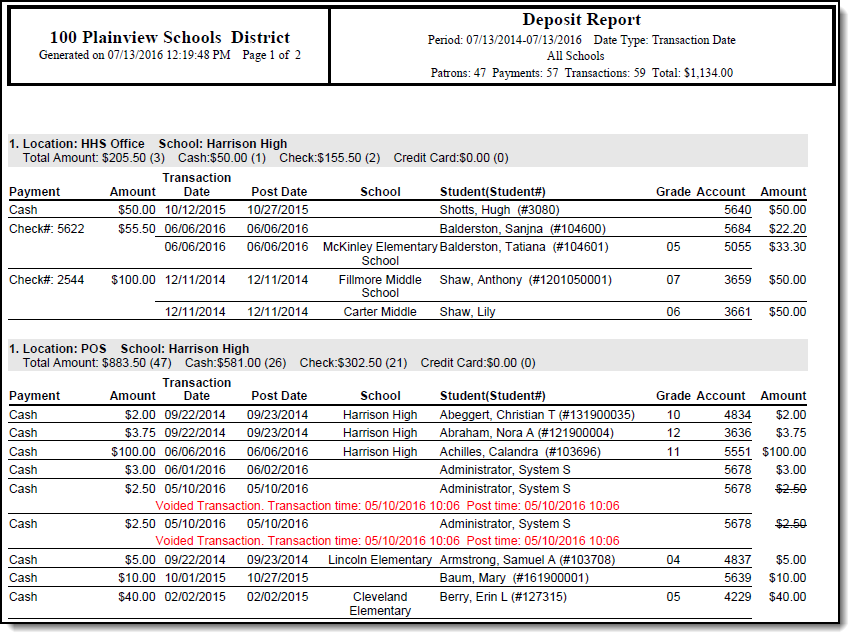

Deposit Report (grouped by Location)

Deposit Report (grouped by Location)

Column/Field

Description

Heading Fields

Location

The in office location in where the deposit was made. Locations for In Office payments are defined in the Payment Location tool.

Deposits made online via the Payments tool on the the Portal, always report a location of Online Payment. Deposits made at a POS Terminal always report as POS.

School

The school in which the deposit was made.

Core Report Fields Payment

The type of payment used for depositing money: Check, Cash or Savings (Account).

Amount

The amount of money deposited into the patron's account.

Transaction Date

The day on which the deposit was entered into the Point of Sale terminal.

Post Date

The day on which the deposited money was applied to the patron's account.

School The school in which the student is actively enrolled. The school only displays if the student has an active enrollment. The School may report blank if the deposit was manually entered on the FS Deposit tool or on the patron's Journal in Campus and the student did not have an active enrollment when the deposit was entered. Student (Student#)

The student (and corresponding Student ID) depositing money into their account.

Grade

The grade of the student having money deposited into their account.

Account

The account number of the account receiving the deposit.

Amount

The amount of money deposited into the patron's account. If the amount is crossed out, this indicates the deposit was voided and information about the date of the transaction void is listed below the Transaction Date, Post Date and Student (Student#) columns.

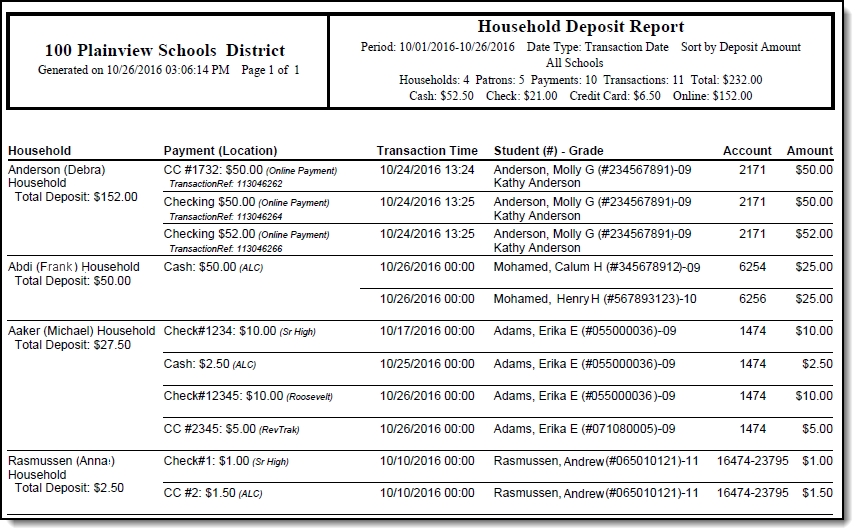

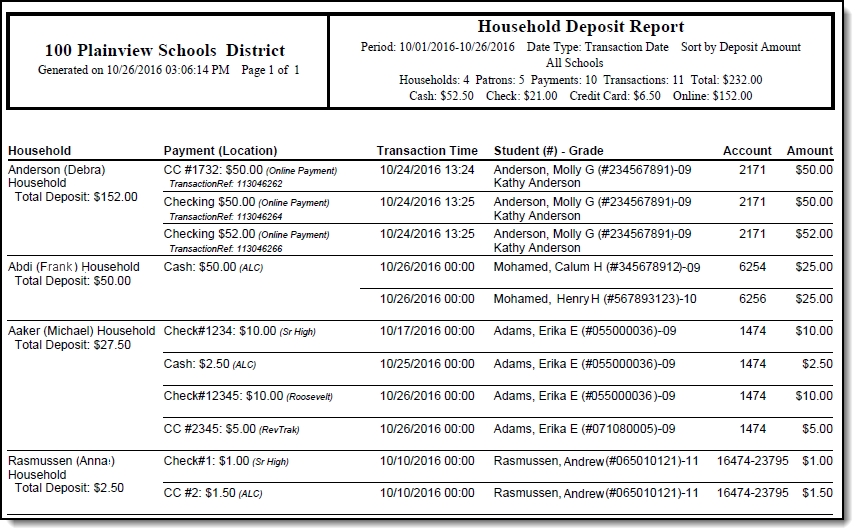

Grouped By Household

The Group By Household option generates a report listing all transactions per household.

Deposit Report (grouped by Household)

Deposit Report (grouped by Household)

Column/Field

Description

Household

The household account receiving deposited money.

Payment (Location)

The type of payment used for deposit (Cash, Check, Savings) and where the deposit was made.

Transaction Time

The day and time on which the deposit transaction was entered into the Point of Sale terminal.

Student (#) - Grade

The name, corresponding Student ID and grade level of the student depositing money into their family account.

Account

The account number of the account receiving deposited money.

Amount

The amount of money deposited into the patron's family account. If the amount is in red font, this indicates the deposit transaction was voided.

Save

Save

VideoThe Deposit Report generates a list of check, cash and credit card deposits made through the Household FS Deposit and Person FS Deposit tools used by school staff, as well as deposits made directly at a Point of Sale Terminal and online. The Deposit Report can also be saved as a snapshot so the history of the report will be saved.

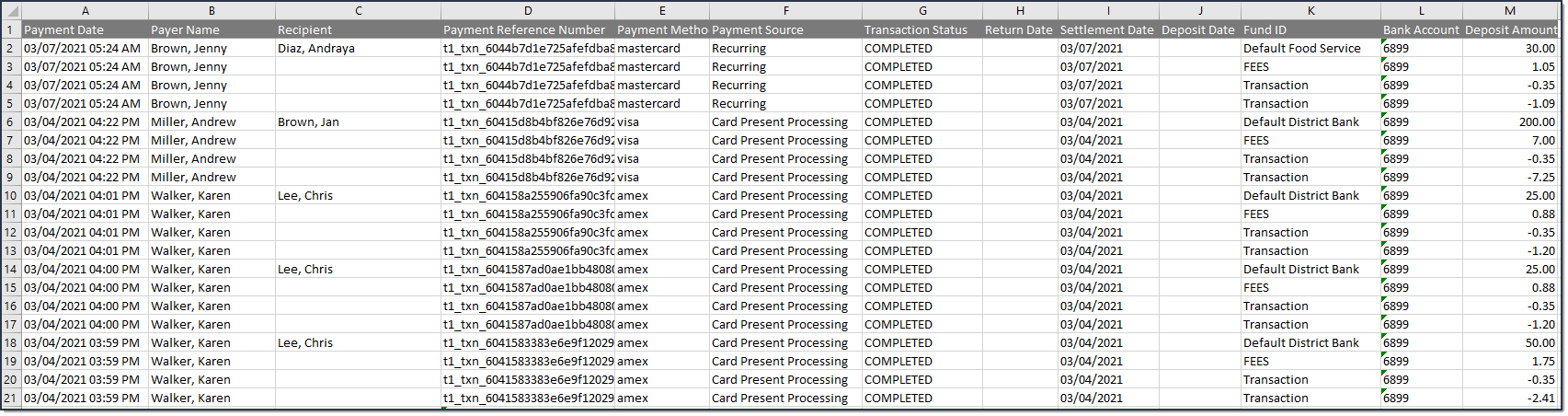

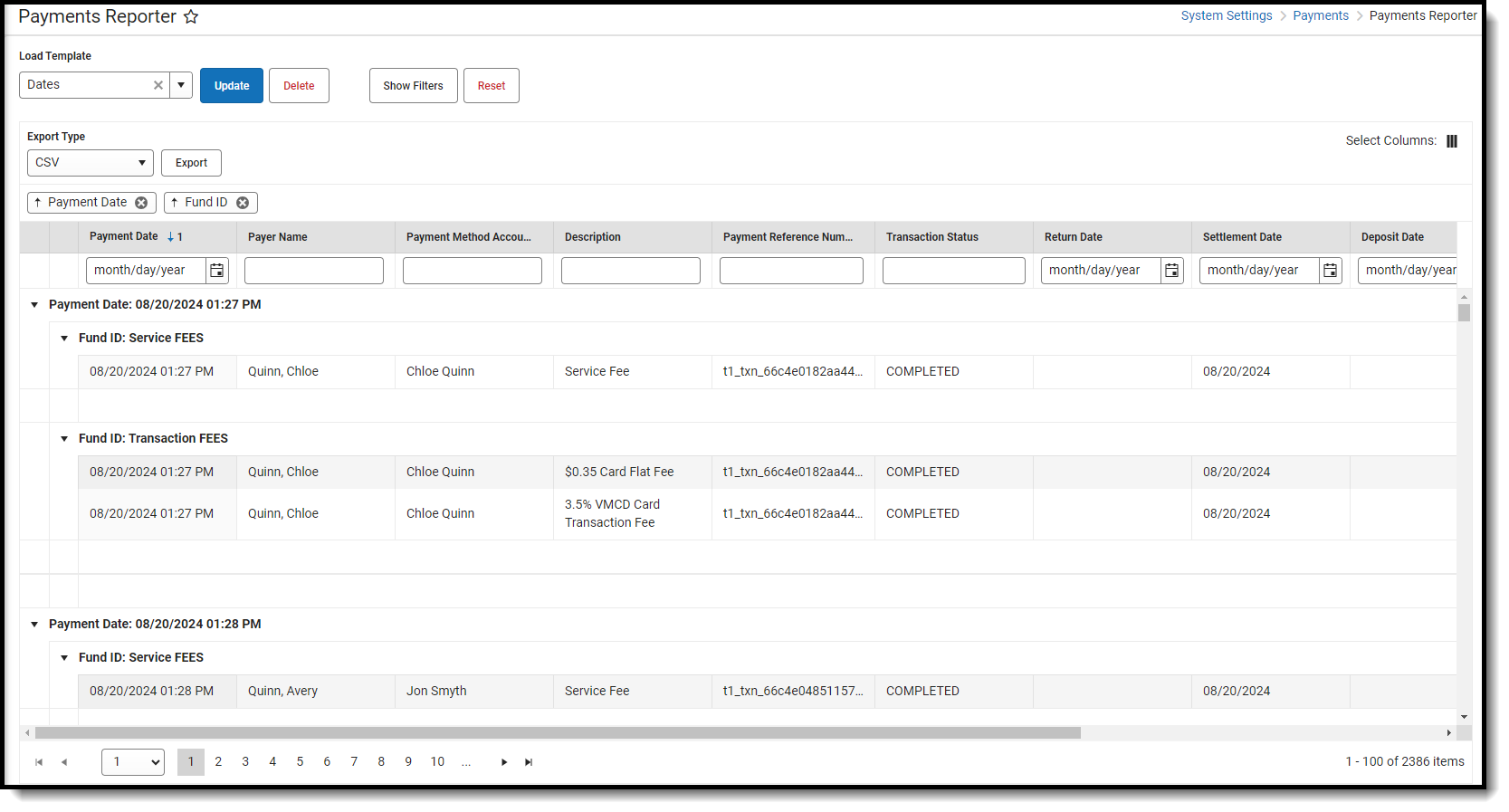

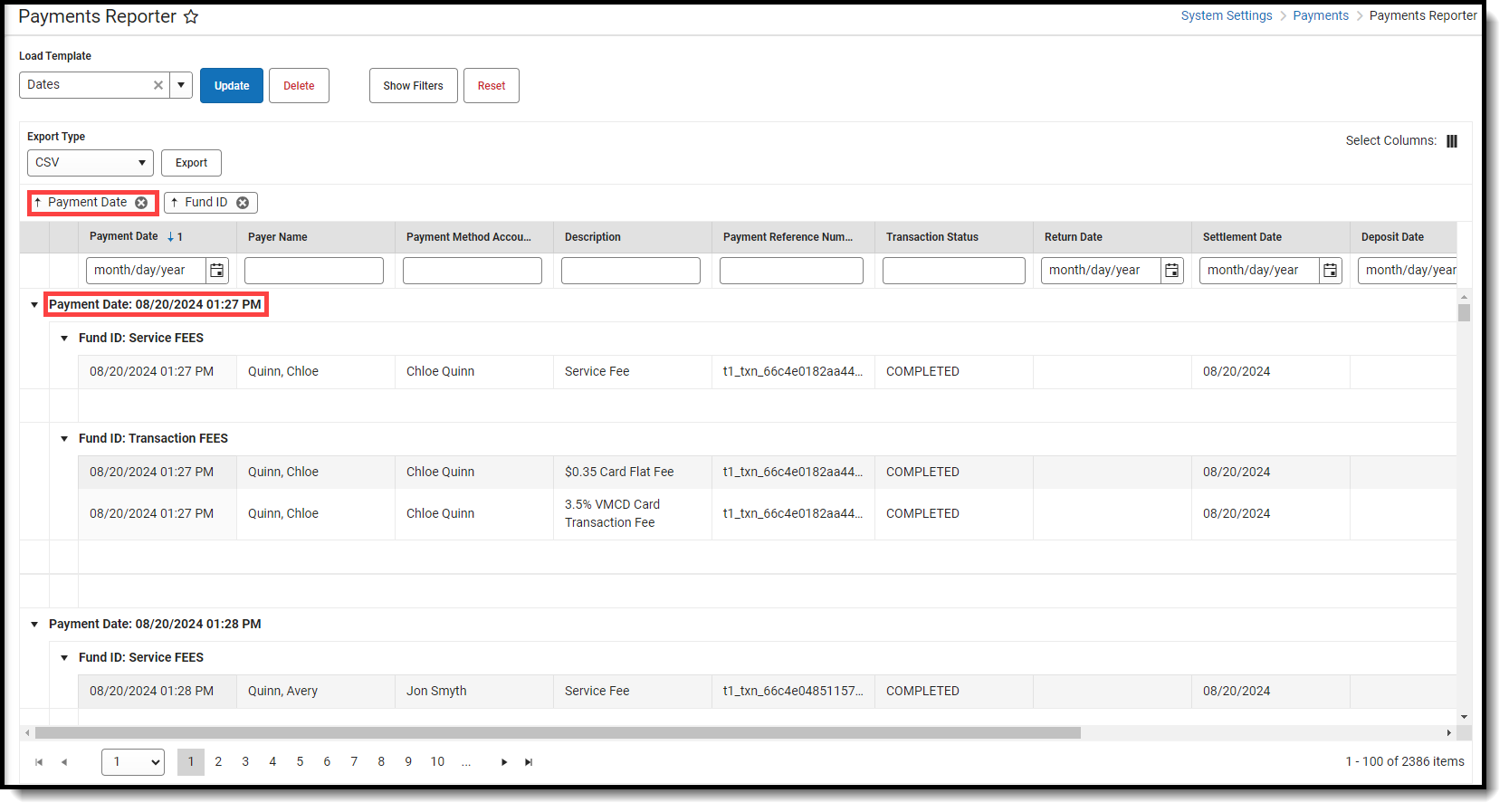

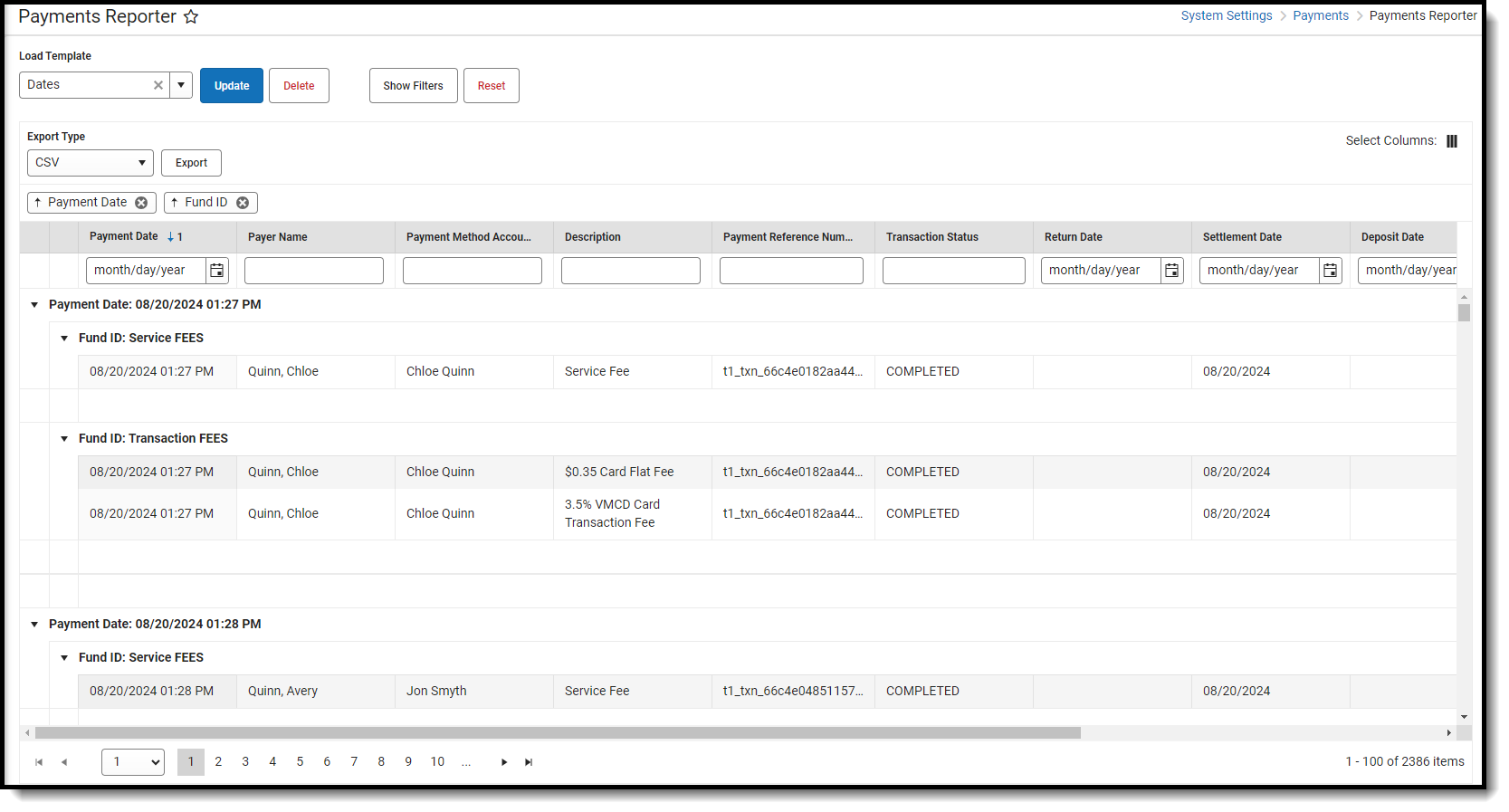

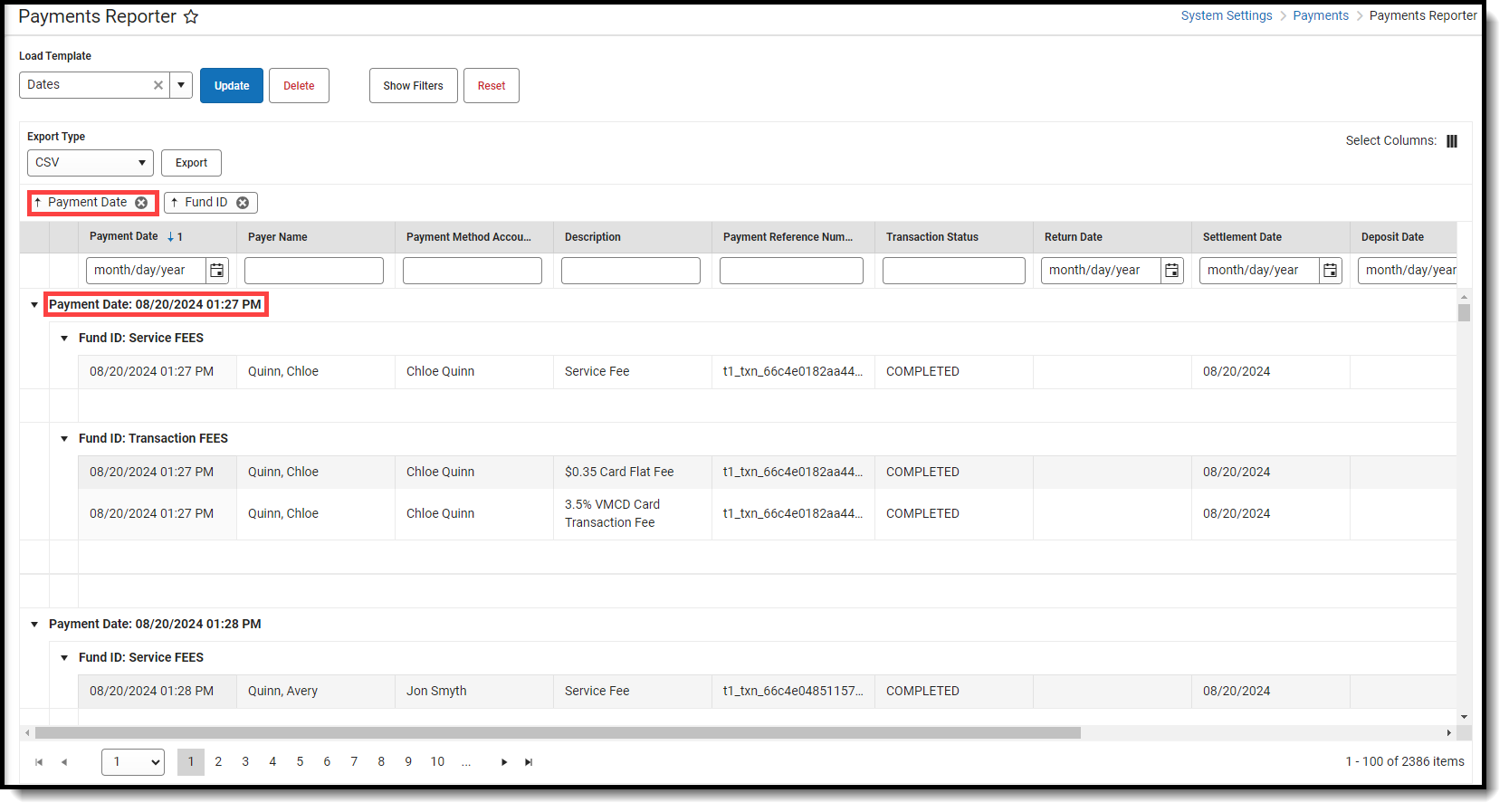

Payments Reporter

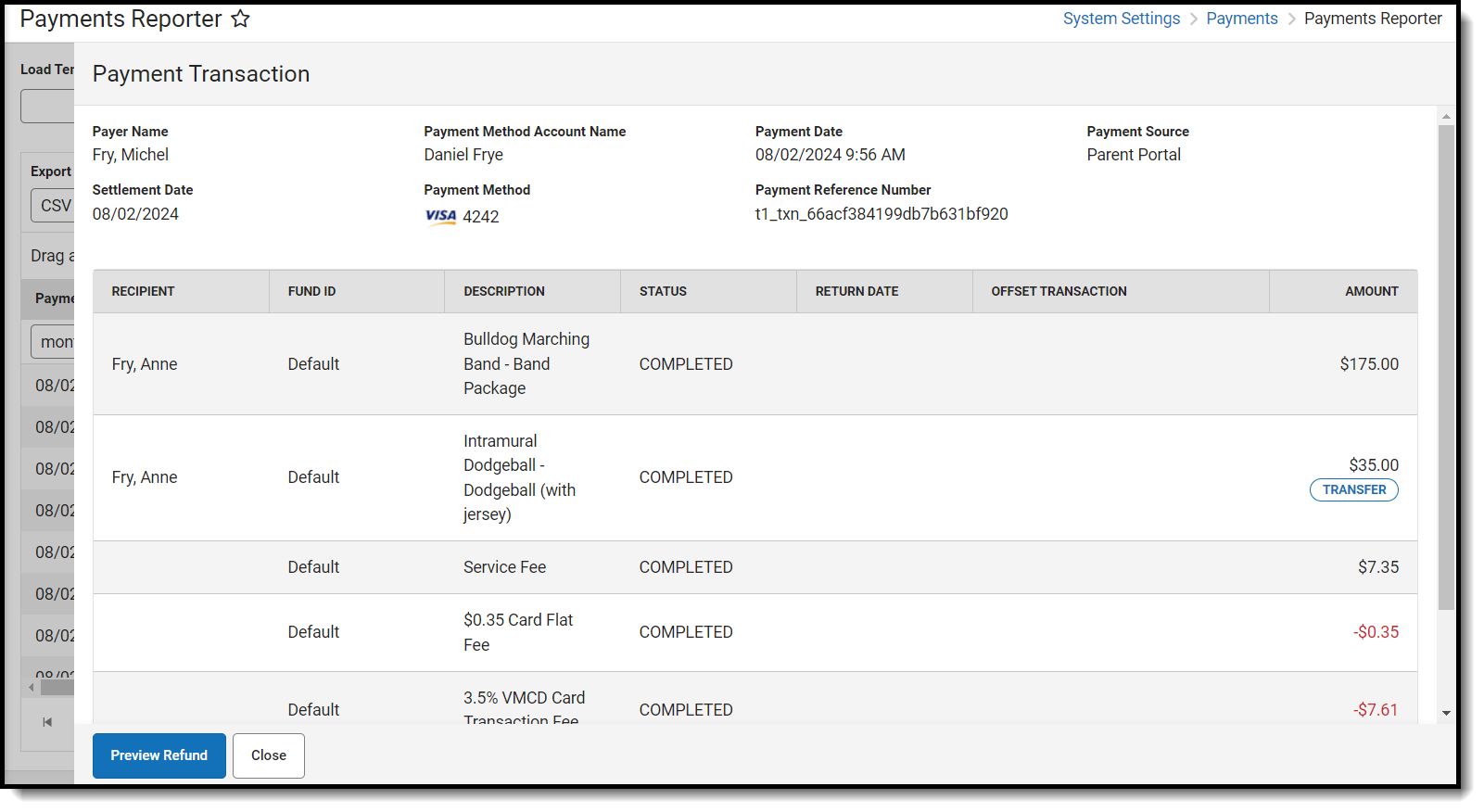

The Payments Reporter details all transactions that were completed through the online payment process. With this tool, you can check the status of a specific payment and issue refunds.

DocumentationTool Search: Payments Reporter

The Payments Reporter details all transactions that were completed through the online payment process. With this tool, you can check the status of a specific payment, issue refunds, and revoke transactions.

Important Information about this Tool

- Campus automatically voids all returned transactions. The original transaction appears with the Returned status and the correcting transaction appears with the Return Void status. Transactions may be returned if the account is not valid or has insufficient funds.

- Transaction fees are never refunded.

- Payments with the Transaction Status Resolved can only be refunded if the transaction was resolved by Campus Support. If you need to refund a payment that you manually resolved, contact Campus Support for assistance.

- When a payer makes a purchase for $0.00, Campus assigns a reference number but a Payment Method does not appear in the report. In addition, Service Fees are not applied when the total is $0.00.

- A Deposit Date does not display either unless the zero dollar purchase was purchased with other items for which the payer was charged and the transaction is processed.

- If an E-check fails, it can occur up to 10 business days after settling. If there is a failure, the amount of the E-check is automatically returned.

- Refunds (full or partial) for echecks are not allowed until there is a Settlement Date.

- Refunds for echecks are processed 12 days after the transaction's Payment Date. This ensures funds have cleared before the refund is processed.

- All refunds that are requested between 5:45 p.m. and 6:00 p.m. Eastern Time will not process until 12:00 a.m. the following day. For example, a refund requested at 5:45 p.m. on September 1st will be processed at 12:00 a.m. on September 2nd. This rule applies to all payment types except for echecks which cannot be processed until 12 days after their transaction's Payment Date.

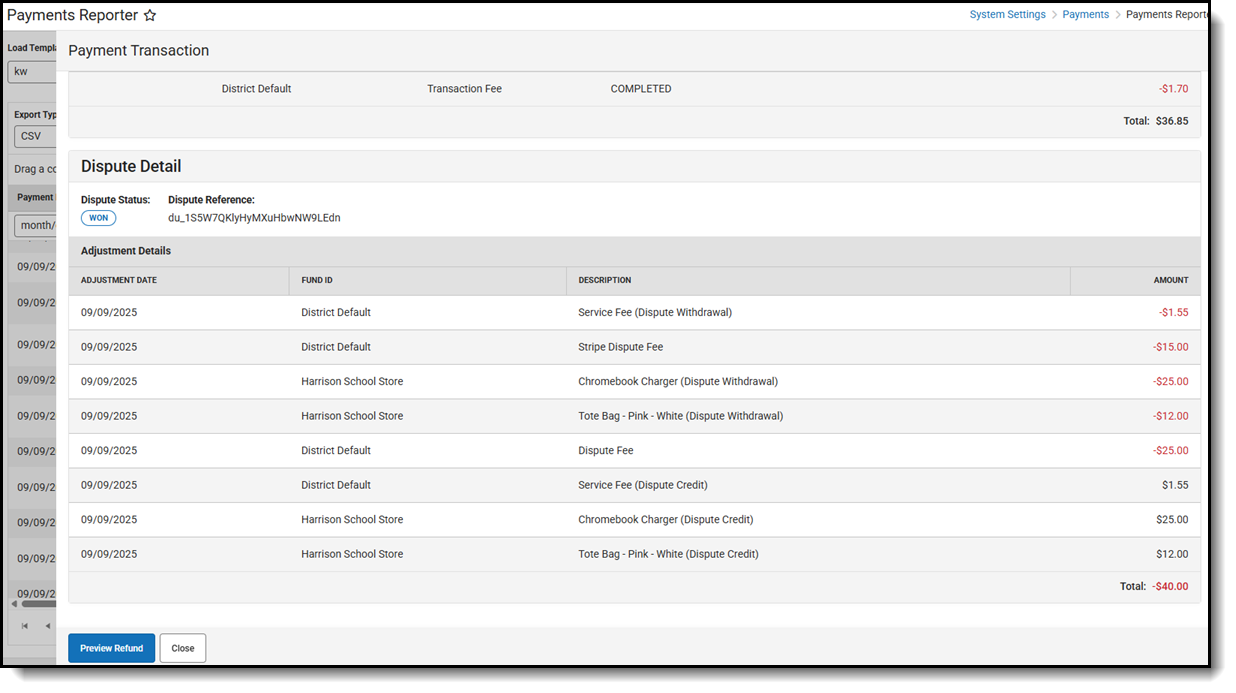

- If a transaction is disputed, a chargeback or dispute fee is assessed. These can be searched for in the Description column as ‘Chargeback’ or “Dispute.’ When clicked, the Payment Transaction history will appear showing all the fees associated with that transaction.

About the Deposit Process

Following a payment, the funds are typically deposited into your bank account within three to four business days. This timeframe includes the settlement of the payment, the request for the deposit, and the bank's processing duration. Please note that this period may vary slightly depending on the timing of the payment and Stripe’s processing schedule.

The deposit process runs daily before 5:45 PM Eastern Time (ET). The deposit job must complete by 6:00 PM Eastern Time (ET); otherwise, the payment platform moves the request date forward one day to ensure the deposit job has enough time to complete.

The deposit process does not run on weekends (Saturday, Sunday) or holidays.

Step Description 1 Campus determines your district's account balance. When your district is processing payments, any returns/refunds you process are subtracted from your account balance when they occur. At the end of each business day, Campus calculates the balance and then requests a deposit. If your district's account balance is negative, Campus issues a negative deposit. 2 After determining the balance, Campus combines transactions with the following statuses into a deposit. - Completed

- Resolved

- Returned

- Partial returned

- Returnvoid

- Transactions with a settled date

- Transaction Fees

3 If the deposit is... Then... Successful You will see a deposit in your district's bank account. Keep in mind, you may see different deposit dates for one payment reference number since the deposit payment separates transaction line items. Not Successful The deposit is canceled and recalculated the following day.

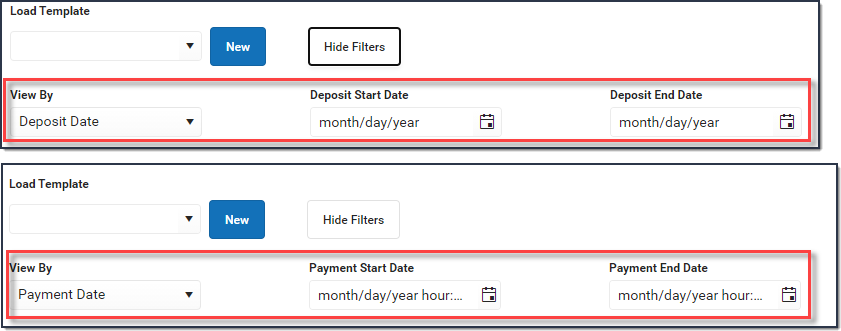

Tips for Searching

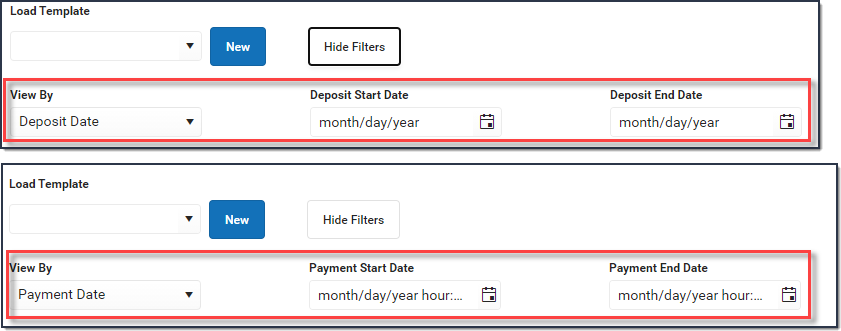

- You can search for transactions according to their Payment Date or Deposit Date. Click the Show Filters button, then select the option you want to use in the View By field and enter the appropriate start and end dates.

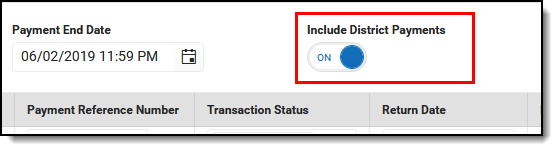

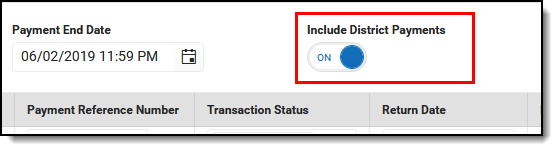

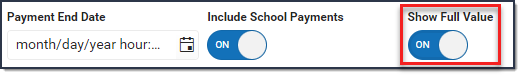

- To include district payments such as Service Fees in your search, click the Show Filters button then toggle Include District Payments to ON. If you want to see payments made to your school only, set the toggle to OFF.

This toggle is only available if your system administrator has assigned the appropriate tool rights.

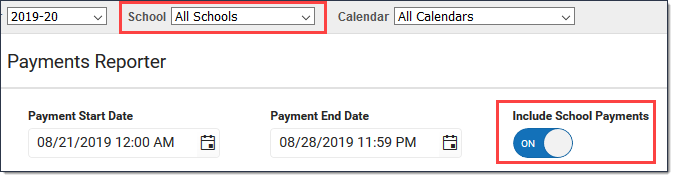

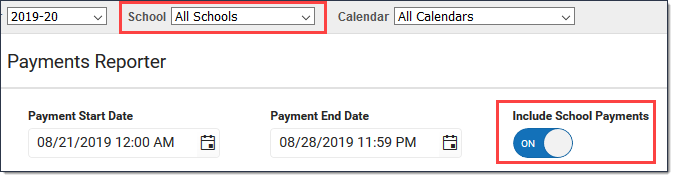

- If you select All Schools in the School dropdown list, only payments made to the district display. However, you can set the Include School Payments toggle to On to include payments from all schools in the district.

- Search results are grouped by Fund ID.

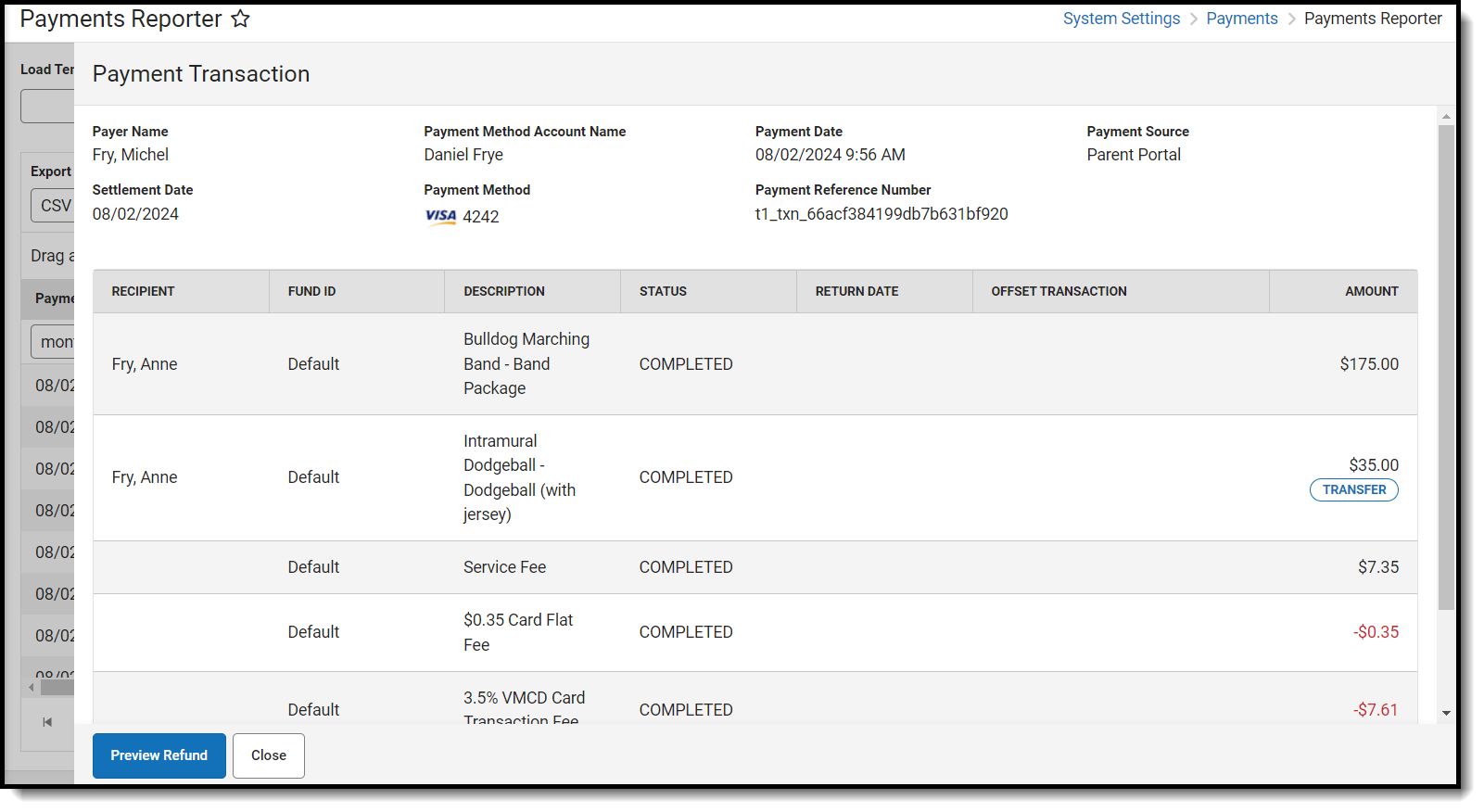

- Select an individual line to see the entire transaction in the Payment Transaction panel.

- Sort results by Deposit Date and Deposit Amount when trying to perform a bank reconciliation.

- You can sort the results by clicking a column heading. Each click changes the data in ascending or descending order.

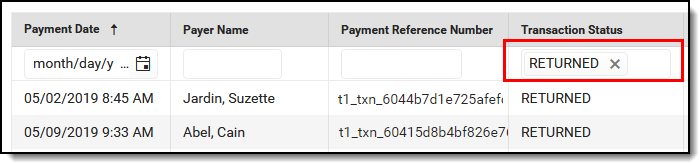

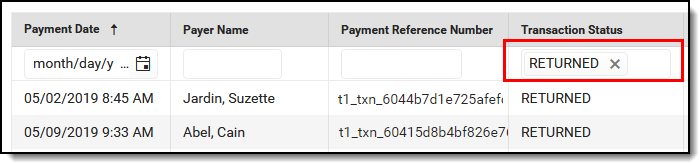

- You can add filters to narrow the report's results. For example, you can find payments that were made on a specific date or Transaction Status.

Transaction Status Descriptions

Transaction Status

Description

Completed A fully completed transaction. Canceled If a transaction displays this status, you can manually resolve the transaction or contact Campus Support. Exception The payment was processed by the payment vendor but not on Campus.

If a transaction displays this status, you can manually resolve the transaction or contact Campus Support.

Returned

and

Return Void

Campus automatically voids all returned transactions from the payment vendor. The original transaction appears with the Returned status and the correcting transaction appears with the Return Void status. Transactions may be returned if the account is not valid or has insufficient funds. Transactions also appear in these states if the district manually Refunds a Payment.

There could be a two to five-day delay in which Campus may have completed the transaction and the payment vendor may need to return it.

ResolvedTransactions may be manually resolved by Campus Support or by the district if the transaction was processed but still appears to be in an Exception, Canceled, or Pending Status in the Payments Reporter.

Revoked

Transactions can be manually revoked by the district if an interruption occurs between the district and the payment vendor where the payment was never processed.

This status displays transactions manually revoked by the district within the date range entered on the editor.

Pending

If a transaction displays this status, you can manually resolve the transaction or contact Campus Support.

Processing If a transaction displays this status, our payment processor is waiting for confirmation from the bank that the transaction has cleared. Once the confirmation is received, the deposit date could be in the past. For example, a fee or refund might show a deposit request date of 4/3 but will stay in pending status until 4/10 then once in completed status the deposit date would be 4/4. Negative deposits can take 5-7 business days before they have a Deposit State of Completed in Campus.

View Details for a Single Transaction

A transaction with the label Fee Surplus indicates an online payment was voided using the Fees tool. The payment amount is deposited into the surplus for that student. When you see this label, the payment can NOT be refunded in Payments Reporter.To view details for a single transaction, click the transaction you want to view. The Payment Transaction panel displays details for the transaction.

Since lines on the Payments Reporter are grouped by Fund ID, this is a good method for viewing the entire transaction.

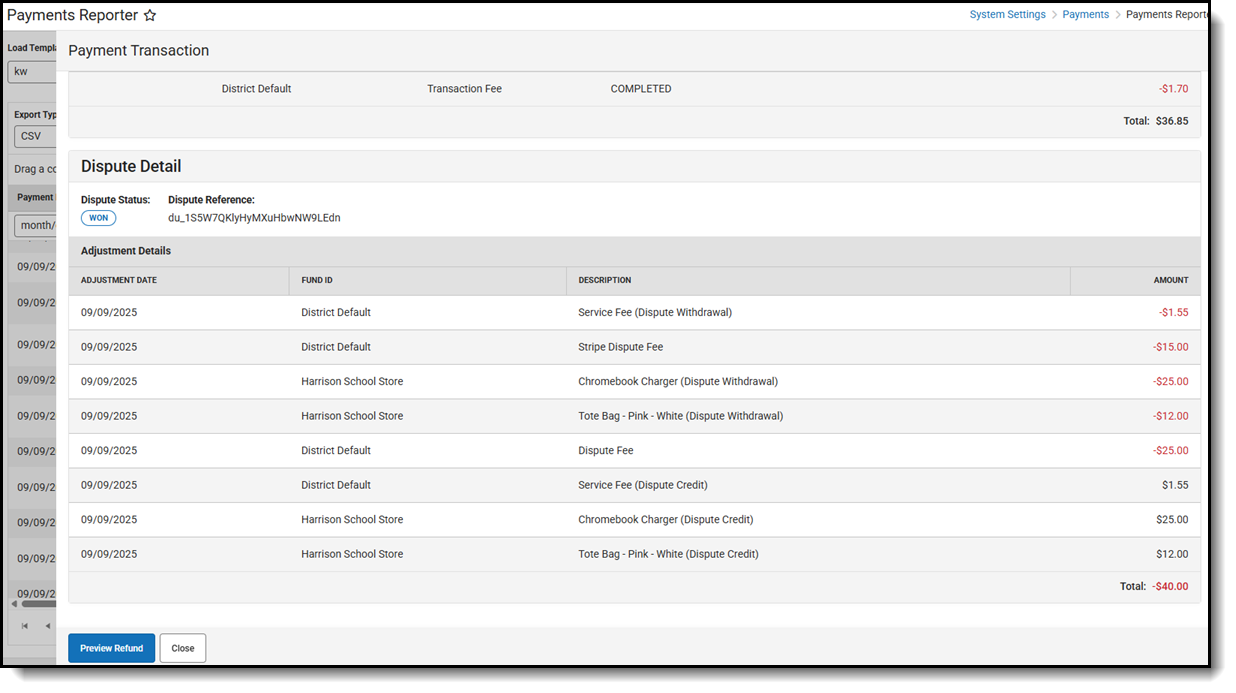

View Disputed Transaction Details in Payment Transaction Panel

When a user clicks on a transaction with a dispute, the information related to that dispute will display within the Dispute Detail.

For Stripe, disputes have been supported since version .2531, and for Payrix since version .2539. Any disputes before these updates will show fees in the Transaction Details section, while disputes after the updates appear in the Dispute Details section.

Issue a Full Refund

Tips

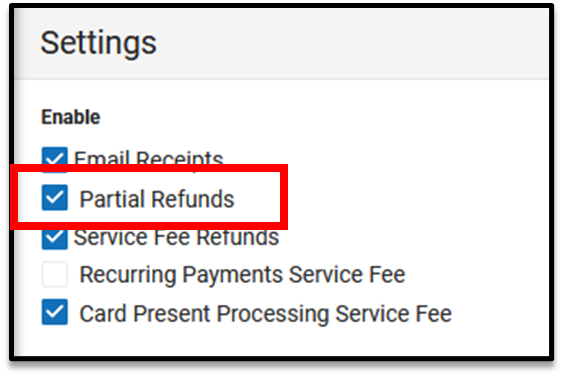

- This option is only available if your system administrator has assigned the appropriate tool rights.

- The Transaction Fee cannot be refunded.

- The Service Fee can only be returned if your District has enabled Service Fee refunds in the Payment setup.

- If you do NOT refund Service Fees, the Service Fee stays in a Completed status.

- Refunds for echecks are not allowed until there is a Settlement Date.

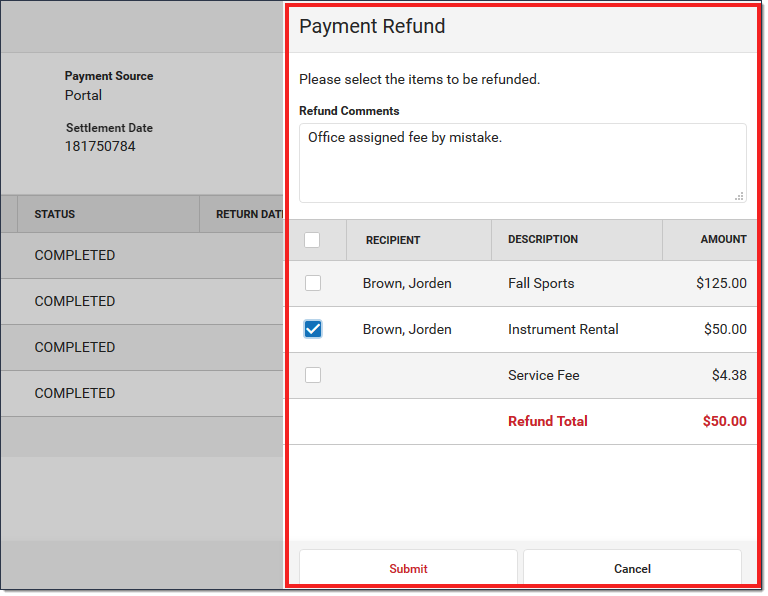

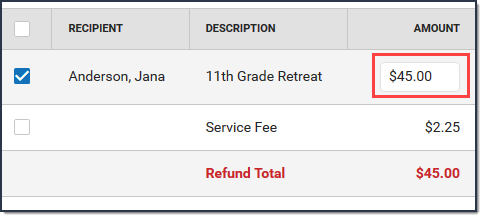

- Click the transaction you want to refund.

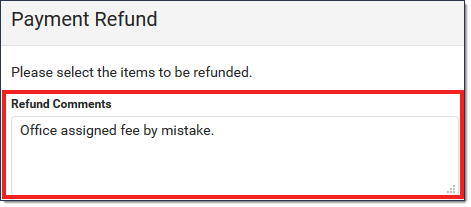

Result: The Payment Transaction panel displays. - Click the Preview Refund button.

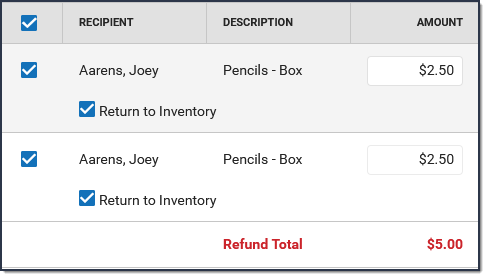

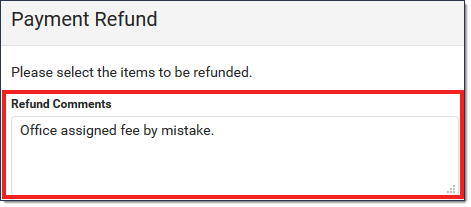

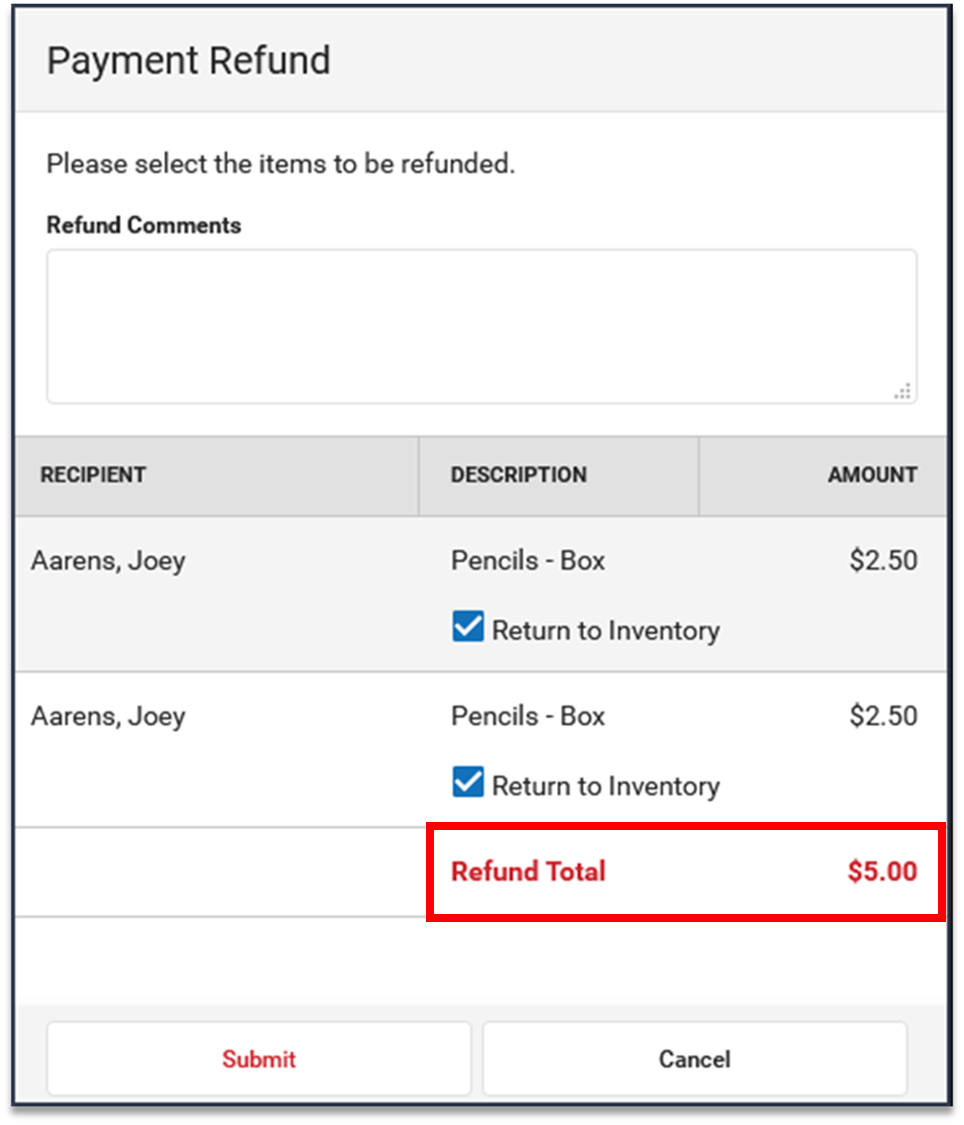

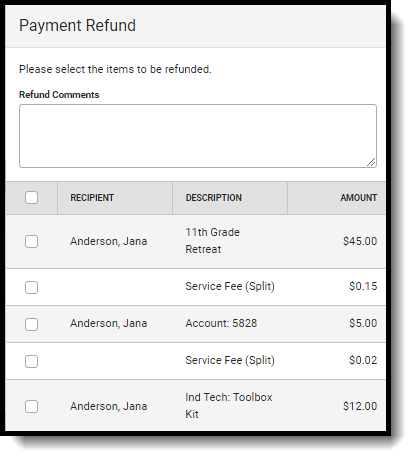

Result: The Payment Refund panel displays. -

Enter the reason for the refund in the Refund Comments field. (optional)

This comment will display on the offset transaction's details.

-

Complete one of the following options. Options that display depend on whether your district allows partial refunds.

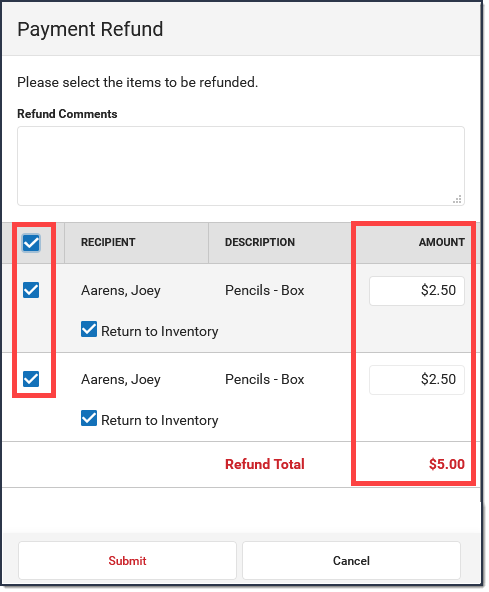

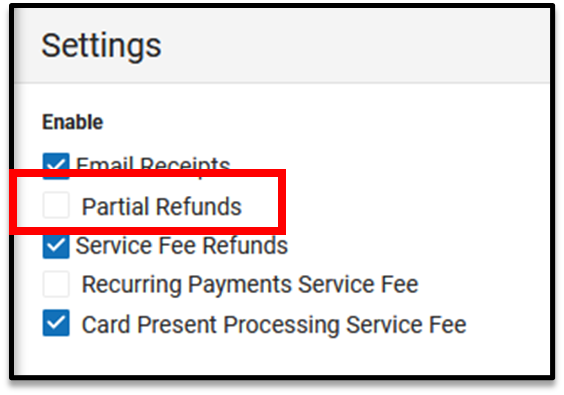

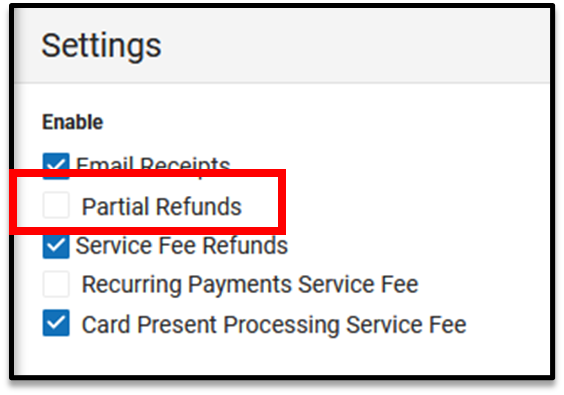

If Partial Refunds... Then... is enabled in Payments Setup (district settings)

- Mark all of the checkboxes.

- Verify the Amount you want to refund.

- If your district uses inventory tracking, verify the Return to Inventory checkbox is marked next to the item(s) you want to return (optional)

- Click Submit.

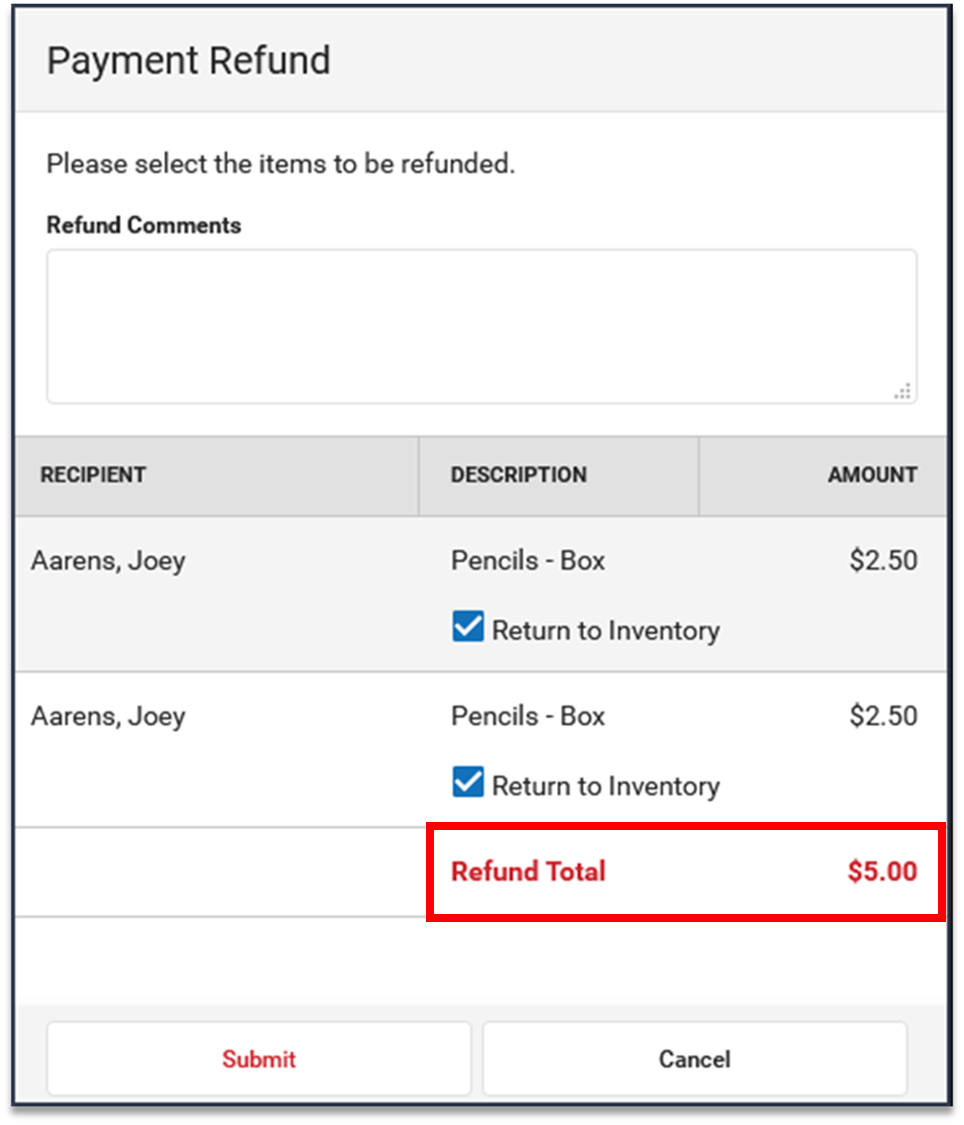

is not enabled in Payments Setup (district settings)

- The entire amount is refunded; you cannot give partial refunds.

- If your district uses inventory tracking, verify the Return to Inventory checkbox is marked next to the item(s) you want to return (optional)

- Click Submit

Result: A confirmation message displays. - Click OK.

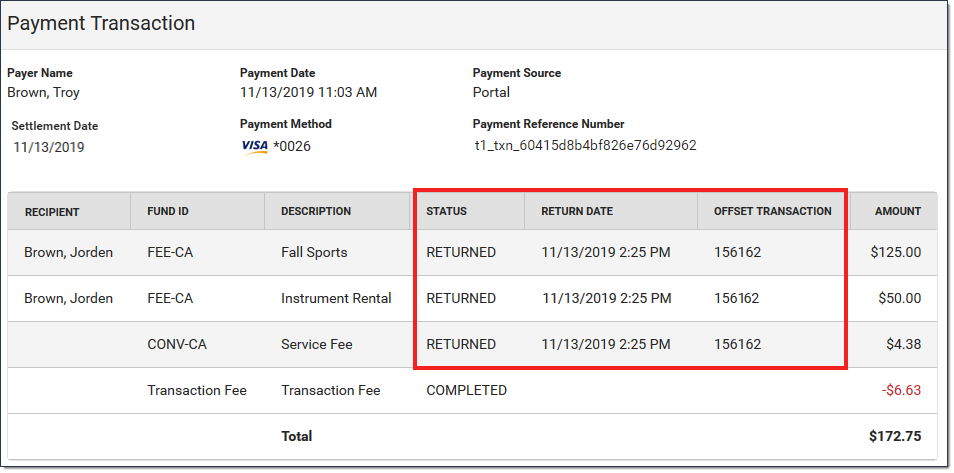

Result

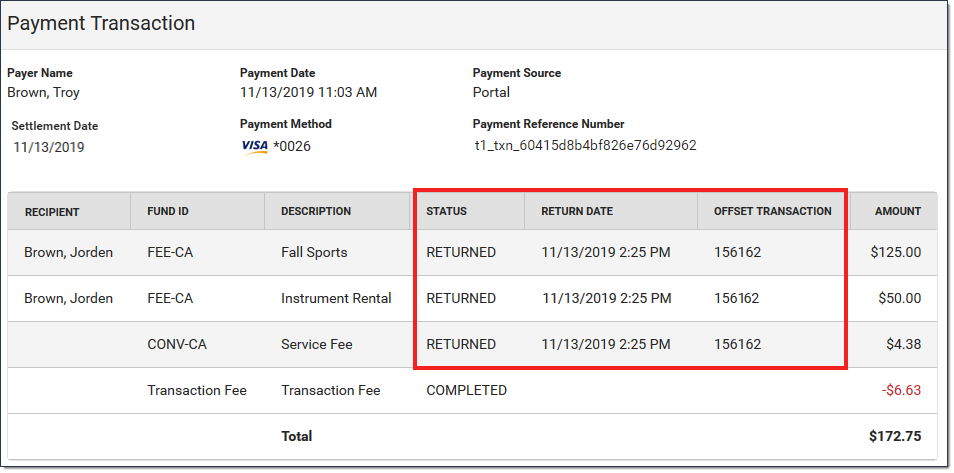

- The Payments Reporter screen displays. Campus updates the original Transaction Status to RETURNED and adds an offset entry with the Status RETURNEDVOID on the refunded lines.

- Campus also updates the original payment transaction's details. After a refund is made, the details include a Return Date and the Offset Transaction Reference Number.

- Refunds may incur an additional Transaction Fee based on your district's contract with the payment vendor.

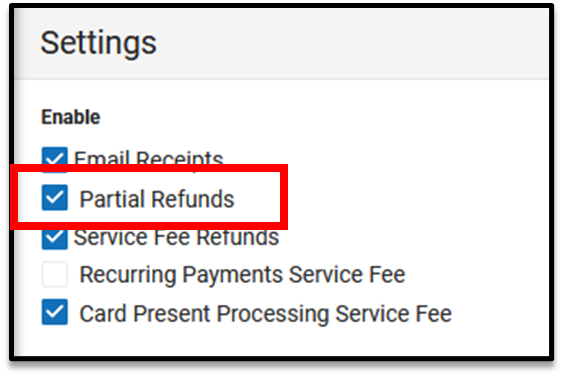

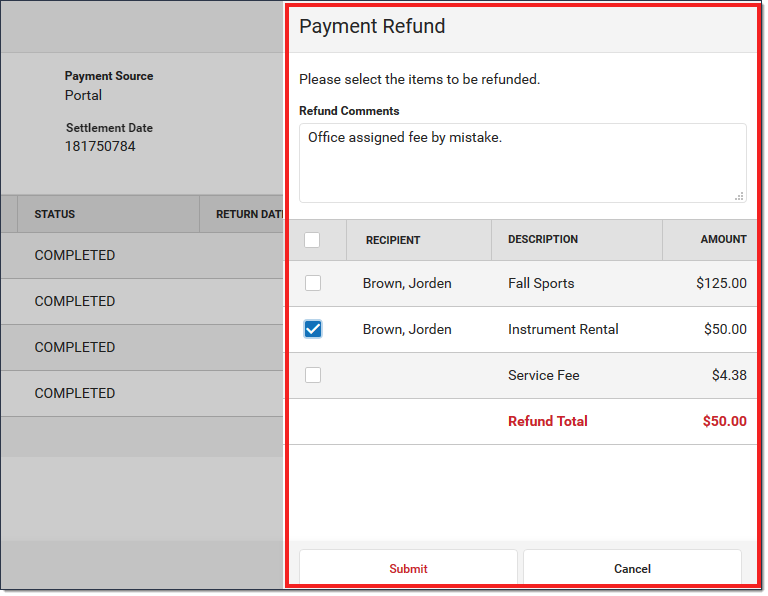

Issue a Partial Refund

Tips

- This option is only available if:

- Your system administrator has assigned the appropriate tool rights.

- Your district has enabled partial refunds in the Payment setup.

- The Transaction Fee cannot be refunded.

- Refunds may incur an additional Transaction Fee based on your district's contract with the payment vendor.

- The Service Fee can only be returned if your District has enabled Service Fee refunds.

- If an item is already partially returned, you cannot make additional refunds on the same item.

- Partial refunds appear in the Payments Reporter with a status of Partial Return and an offset transaction number.

- Refunds for echecks are not allowed until there is a Settlement Date.

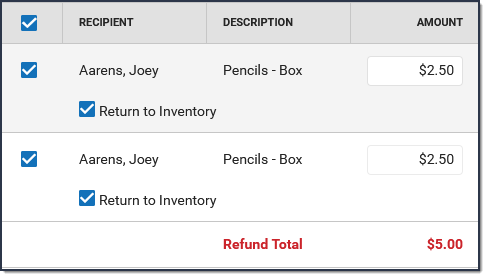

- If split fees is enabled, districts may opt to refund only the service fee related to the specific product being returned, rather than the entire service fee if a full refund option is enabled.

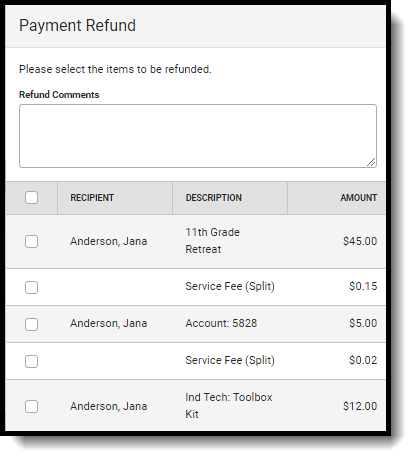

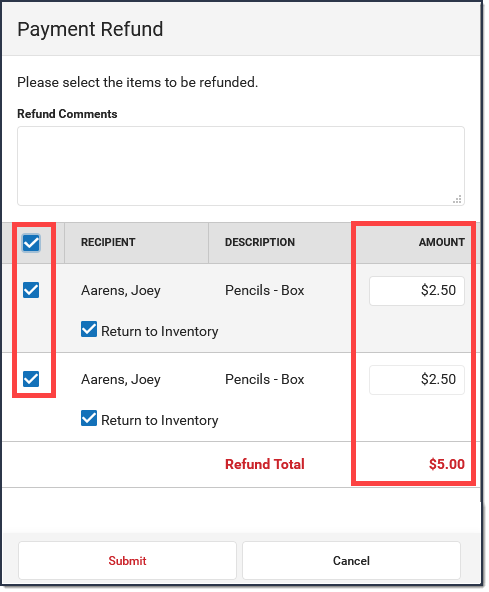

- Click the transaction you want to refund.

Result The Payment Transaction panel displays. - Click the Preview Refund button.

Result The Payment Refund panel displays. Only items eligible for a refund displayed on the screen.

-

Enter the reason for the refund in the Refund Comments field. (optional)

This comment will display on the offset transaction's details.

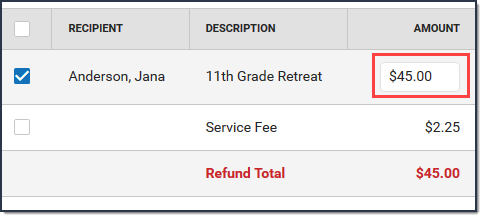

- Mark the checkbox(es) next to the item(s) you want to return.

-

Verify the Amount(s) you to refund.

You can change the amount to be less than the amount that was paid.

- Verify the Return to Inventory checkbox is marked next to the item(s) you want to return to inventory. (optional)

This checkbox only displays if you use inventory tracking and is automatically selected. If you do not want to return an item to inventory, make sure the checkbox is cleared.

- Click Submit.

Result: A confirmation message displays. - Click OK.

Results- The Payments Reporter screen displays. Campus updates the Transaction Status to RETURNED and adds an offset entry with the Status RETURNEDVOID on the refunded lines.

- Campus also updates the payment transaction's details. After a refund is made, the details include a Return Date and the Offset Transaction Reference Number.

- Refunds may incur an additional Transaction Fee based on your district's contract with the payment vendor.

Revoke a Transaction

You can revoke transactions that did not process. Only transactions that are in a Pending, Exception, or Canceled status can be revoked. When revoked, Campus updates the Transaction Status for all lines in the transaction to Revoked and line item balances do not change.- Select the transaction you want to revoke. The Payment Transaction panel displays.

- Click the Revoke button. A confirmation message displays.

- Click OK. The Payments Reporter screen displays. Campus updates the Transaction Status to Revoked and line item balances do not change.

Resolve a Transaction

If the transaction was processed but still appears to be in an Exception, Canceled, or Pending Status in the Payments Reporter, you can manually resolve the transaction. Please note that Resolved transactions may not display a Deposit Date in the Payments Reporter tool.Before you Begin

To manually resolve a transaction in Campus Payments, you must contact Campus Support to get the Payment Reference Number.

- Select the transaction you want to resolve. The Payment Transaction panel displays.

- Enter the Payment Reference Number in the Payment Reference Number field.

- Click the Resolve button. A confirmation message displays.

- Click OK. The Payments Reporter screen displays. Campus updates the Transaction Status to Resolved and payments are posted to the Food Service and Fee Accounts.

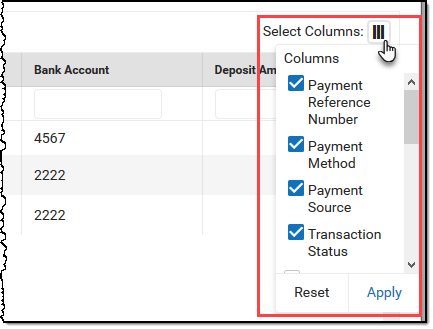

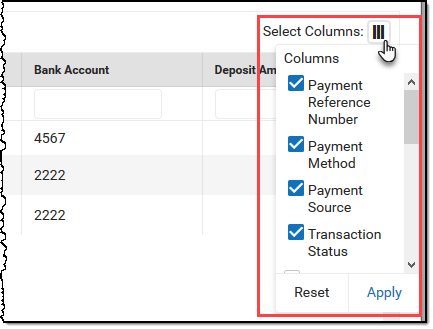

Select Columns to Display

The column selector allows you to choose which columns to hide or display. Click the Select Columns button and mark the checkbox next to the columns you want to display. Clear the checkbox next to the columns you want to hide.

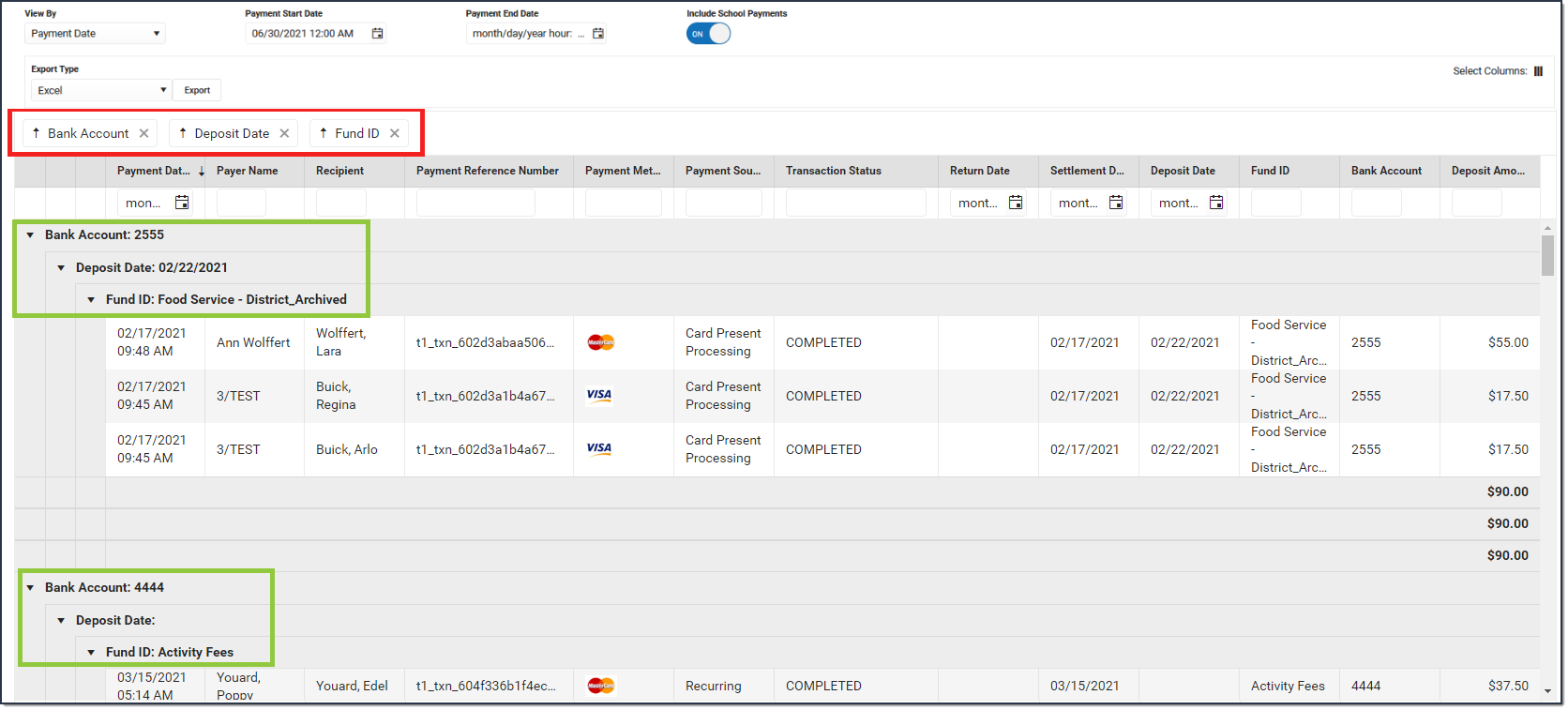

Group Report by Specific Columns (Grouping Options)

The report displays differently based on the grouping options you select. Select the column(s) you want to group together and drag the column(s) to the area above the table. You can select multiple columns and further group the report results.

Payments Reporter Column Descriptions

The following columns are available on the Payments Reporter. These columns are available via the column selector and can be grouped, filtered, and saved as templates.

TIP

You can sort the Payments Report by clicking a column heading. Each click changes the data in ascending or descending order. When grouping specific columns, be sure to also sort the column headings to ensure you are viewing the report results in an organized manner.

Column Description Payment Date The date on which the payment was made. Payer Name The name of the person who made the payment. This column will only show a name if the payer is a logged-in Infinite Campus user. Payment Method Account Name If a name is entered in a payment method, it will be displayed in this field. Recipient The person receiving items purchased in the School Store or the student who was registered for an activity.

If an item was purchased and paid through the Campus Mobile Payments app, the student's name appears IF the student number was entered at the time of the purchase.Description A description of the fee. If the 'Split Transaction and Service Fees' checkbox has been enabled within the Payments Setup Settings, any transaction or service fee involving a split will be designated with '(Split)' in its description.Payment Reference Number This number is automatically generated by the payments platform and is a unique identifier for a specific transaction. Payment Method Indicates what was used to make the payment; e.g., type of credit card or eCheck. If eCheck is used, it will indicate if it was from checking or savings. Card Entry Type Shows whether a credit/debit card payment was typed in manually, swiped, or processed through the Campus Mobile Payments app using a chip insert or tap (EMV). If the payment method was not a credit or debit card, this column will appear blank. Payment Source Identifies where the transaction occurred. - Portal

- Parent Portal

- Student Portal

- Employee Self Service

- Card Present Processing

- Public Store

- Recurring

- Refund

- Reversal

- Failed Transaction

- Campus Payments App

- Activity Roster

- Fees

- Food Service

- POS Terminal

Transaction Status The current state of the transaction. See the Transaction Status topic for more information. - Completed

- Exception

- Canceled

- Pending

- Returned

- Return Void

- Revoked

- Resolved

Dispute Status Displays the status for any payment currently or previously involved in a dispute. - Closed - The dispute has been closed and could have been won or lost.

- Inquiry - An inquiry has been opened by the cardholder. The district must take action to prevent it from going into a full dispute.

- In Review - The dispute is under review. Nothing can be submitted or done in this status.

- Lost - The district has lost the dispute.

- Open - The transaction is currently in dispute.

- Won - The district has won the dispute.

If you have any questions regarding a Dispute Status, please contact Support.

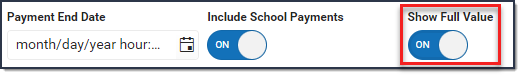

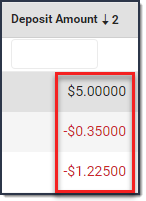

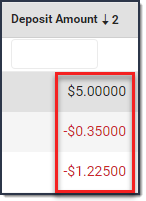

Return Date After a refund is made, the details include this Return Date and the Offset Transaction Reference Number. Settlement Date The date on which the payment is finalized and eligible to be deposited. Deposit Date The date when the payment platform deposits the money into the bank accounts. Deposit Request Date The date when Campus requested payments to be disbursed to the bank accounts. Deposit Request Reference The ID the payment platform sends to Campus when Campus requests a disbursement. Fund ID The unique identifier for the Fund Account. Fund ID is unique and the same Fund ID cannot be used at different schools. Fund Description A description of the Fund Account. Bank Account The bank account associated with the Fund ID. Deposit Amount The specific amount of money that constitutes the deposit. Tip: Turn the Show Full Value toggle to ON to see the Deposit Amount go to 5 decimal places.

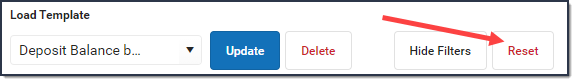

Create and Manage Templates

Templates allow you to save a custom view of the Payments Reporter and use it again later. You can choose specific columns to display, group them in a useful way, filter data in each column, and save your selections as a template. You can create multiple templates as well as update or delete templates at any time.

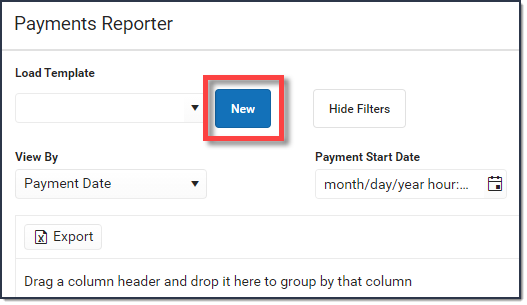

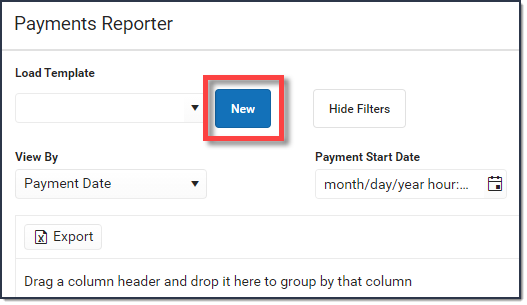

Create a New Template

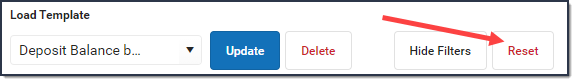

If there are existing templates, click the Reset button before you begin.

- Use the Select Columns tool to choose the column(s) you want to display then drag the column(s) you want to group together to the area above the table.

- Click the Show Filters button and enter any filter data you want to use. (Optional)

- Further narrow down report results by using the filters in each column. (Optional)

- Click the New button (next to the Load Template dropdown list).

Result: The Create Template panel displays.

Result: The Create Template panel displays. - Enter the Template Name then click Save.

Result: The new template displays in the Load Template dropdown list.

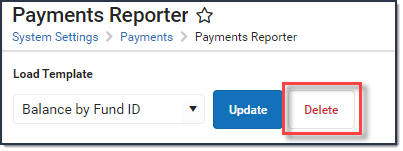

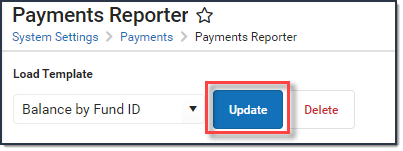

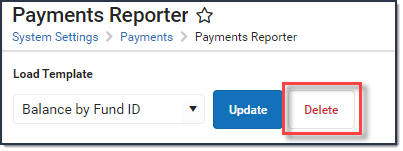

Delete a Template

To delete a template, select the template you want to delete in the Load Template dropdown list then click the Delete button.

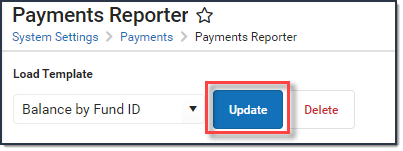

Update a Template

To update a template, select the template you want to update in the Load Template dropdown list. Make any necessary changes then click the Update button to save your changes.

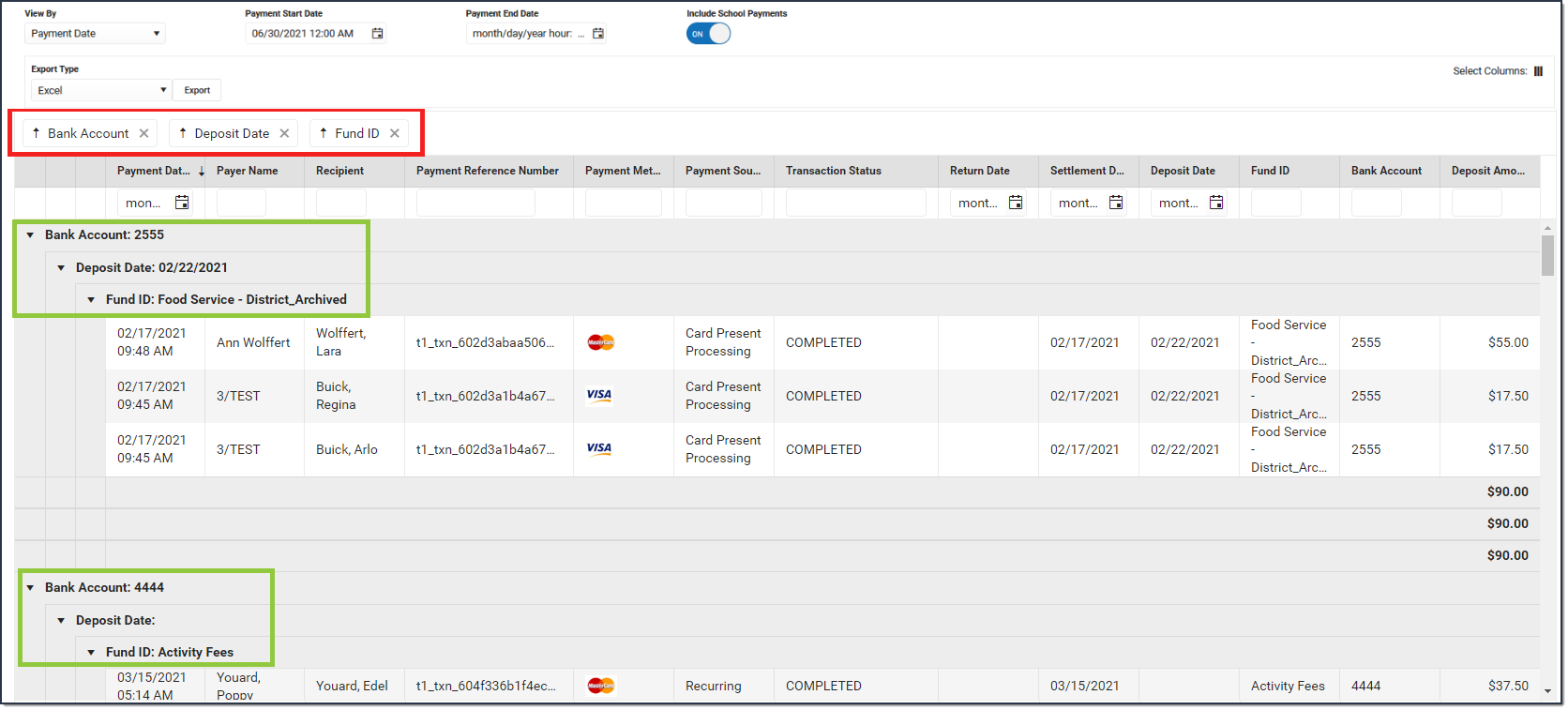

Identify Deposit Balance by Fund ID

The report displays differently based on the grouping options you select. Select the column(s) you want to group together and drag the column(s) to the area above the table. To identify the balance by Fund ID, group columns in the following order:

- Bank Account

- Deposit Date

- Fund ID

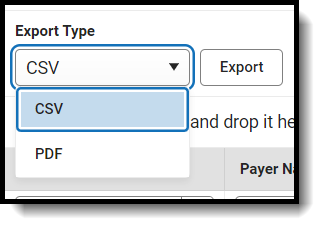

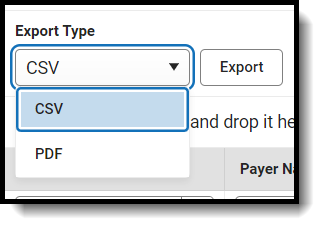

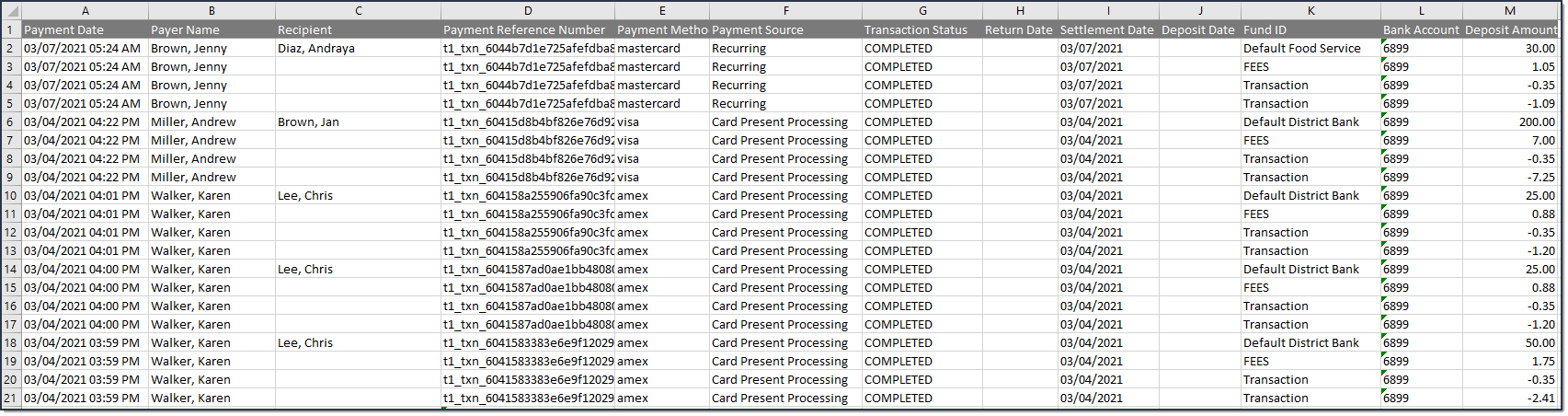

Export the Report

You can export the report to CSV or PDF format. To export the report, select the format you want from the Export Type dropdown list then click the Export button.

If you do not limit the report results using the Payment Start Date and/or the Payment End Date, the export will be limited to the last 60 days.

Previous Version

Payments Reporter [.2435 - .2527]

Payments Reporter [.2347-.2431]

Video - Click the Process button. The Card Present Processing window displays.

Related Articles

Thank you!

Result: The Create Template panel displays.

Result: The Create Template panel displays.